GM and BRRR.

Let me help you wake up with a head of steam on this glorious Monday morning with a smattering of important headlines.

Summer is over and markets are heating up.

Chinese equities are falling to annual lows, and the US consumer has over $1T in outstanding credit card balances for the first time.

After falling for 12 consecutive months, y/y CPI has risen in each of the last two months. Sharply rising oil may be the culprit.

Perhaps more alarmingly, Costco’s CFO says the company is selling more canned chicken than ever, as cash-strapped consumers shy away from more expensive meat.

Fortunately, and perhaps relatedly, the Fed is expected to leave interest rates unchanged at its Wednesday meeting.

Despite the challenging conditions, big tech has largely remained resilient. Massive stock buyback programs are likely supporting the action, so we continue to feel especially cozy in names like AAPL, NVDA, AMZN and MSFT in our portfolio.

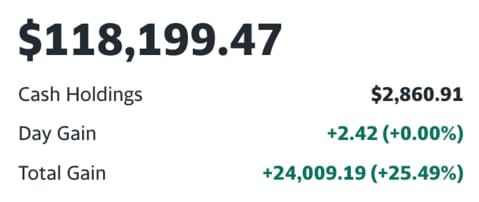

As a reminder, for just $2/month or $12.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+25.6% since inception in March) and watchlist as a premium subscriber.

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Tesla's Next Factory: Turkey, Saudi, or Surprise?

Turkish President Tayyip Erdogan spoke with Tesla CEO Elon Musk yesterday to establish a Tesla factory in Turkey, highlighting the existing collaboration between Turkish suppliers and Tesla. The meeting took place at the Turkish House in New York, where Erdogan also spoke to potential collaboration with Musk's Starlink and AI.

Also announced this morning, Saudi Arabia is in preliminary discussions with Tesla about setting up a manufacturing facility, even offering their own set of production incentives. This comes as Tesla aims to expand its global presence, with shares surging 123% this year and a recent milestone of producing its 5 millionth car.

Tesla's Global Expansion: Elon Musk has been in discussions with multiple countries regarding the expansion of Tesla factories. This aligns with Tesla's growth strategy, as evidenced by their current six factories, an ongoing project in Mexico, and plans to decide on a new factory location by year's end.

Starlink and AI Collaboration: Not just focused on automobiles, Erdogan showed interest in Musk's Starlink satellite internet venture and AI. Musk expressed SpaceX's desire to collaborate with Turkish authorities to secure the necessary licenses for Starlink services in Turkey, indicating a potential expansion of Musk's footprint in the country.

SA's Strategic Move: The kingdom's sovereign wealth fund is a majority investor in Lucid Group (a competitor to Tesla), but appear to be looking to diversify. Saudi Arabia is considering financing options for the Mutoshi project in Congo to supply essential materials for a Tesla factory, showing their intent to position itself as a significant player in the electric vehicle industry.

Global Macro News

FOMC Preview

The Federal Open Market Committee (FOMC) meeting this week is expected to keep interest rates unchanged, with all eyes on the economic projections to be released. Despite Chair Jerome Powell's "higher for longer" mantra, experts anticipate fewer rate cuts in 2024.

Meanwhile, concerns persist about the Federal Reserve's timing in reacting to economic conditions, with uncertainties like the recent auto workers' strike and potential government shutdown complicating the economic outlook.

Rate Projections: The June 2023 SEP reflected a federal funds rate median projection of 5.5% by the end of 2023 and 4.6% by the end of 2024. The current rate hovers between 5.25%-5.50%. Traders project a 97% chance of no change in the upcoming meeting and a 61.1% likelihood of the rate remaining steady in the Dec. 12-13 meeting.

Economic Predictions: The FOMC's June 2023 projections show an anticipated median change in real GDP of 1.0% for 2023, edging up to 1.1% in 2024, while PCE inflation is expected to decrease from 3.2% in 2023 to 2.5% in 2024. This indicates expectations of moderate growth paired with a cooling inflationary environment.

External Factors Impacting the Economy: A potential government shutdown could hinder data releases from agencies. Added to this, the September jobs report is due on Oct. 6. External factors such as the recent UAW strike and the recommencement of student loan repayments might also slightly depress GDP.

Today’s Reader Poll

Our position in $URA, a Uranium ETF is up 19% since we bought it. From 1-5, how interested are you in Uranium and nuclear energy?

Here are the results to the last poll about sports betting:

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

We added Flutter Entertainment (PDYPY) to the Watchlist on Wednesday on the strength of its US betting operation. We think it commands a higher premium than it currently does over #1 competitor, $DKNG and are monitoring when and if we will initiate a position in either company.

We initiated a position in $URA two weeks ago - it’s an ETF that tracks the price of Uranium. We believe the Nuclear Energy narrative is gaining steam very quickly.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

$DKNG: Sports betting revenue may beat expectations this quarter

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.