TheBRRR’s Thoughts.

Quick scheduling note - we're moving Monday’s email to Tuesdays as it’s more comprehensive for macro data, earnings and price action.

GM.

This Wednesday’s FOMC meeting will mark the first interest rate cut from the Federal Reserve since April 2020. That rate cut took rates to near zero in a panicked attempt to stimulate growth during the COVID lockdowns.

Rates remained near zero until inflation (inevitably) spiked up in February of 2022.

Despite initial dismissals from Fed officials that the price spike was “transitory”, inflation proved incredibly problematic and the Fed was forced to embark on 18 months of interest rate hikes up to 5.25% by September 2023, blowing up a few regional banks in the process.

Rates remained at 5.25% for a full year and will finally start to come back down at tomorrow’s FOMC meeting.

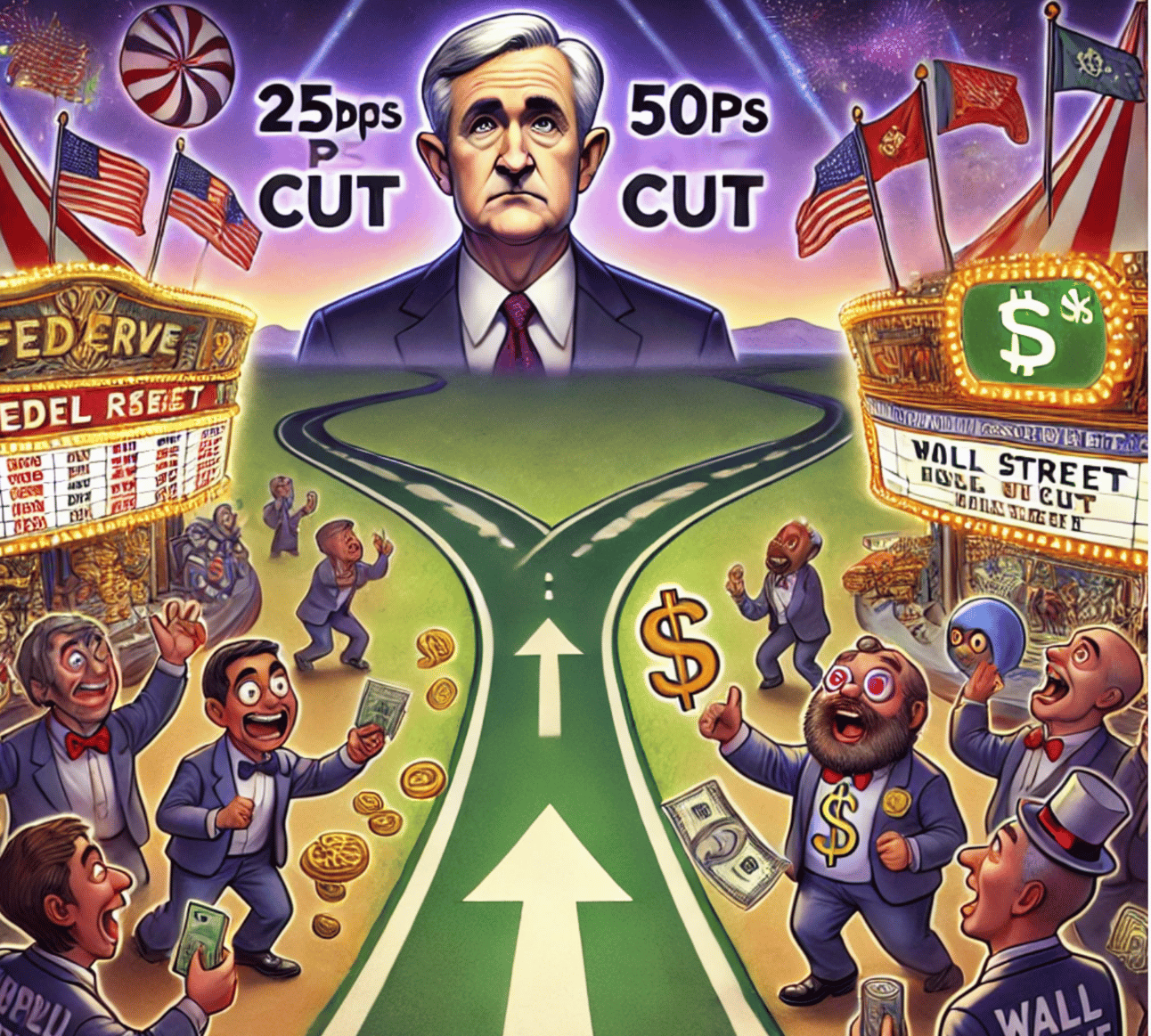

Markets are unsure if rates will be lowered by a half point or a quarter point, but the direction of the move has been telegraphed for months, as markets now expect rates to be at least one full point lower by the end of the year.

Regardless of the size of this first cut, we think Powell will be very dovish in his prepared remarks and during the Q&A.

The dovish commentary could come from a change in the Fed’s quantitative tightening plans. The Fed could also dovishly revise their expectations for interest rate levels well into 2025.

Should the Fed grant the jumbo cut and/or include exceedingly dovish posturing and commentary, our long tech & long crypto portfolio construction should pay off to close the calendar year.

The newsletter’s portfolio is up 30% YTD and 67% over the last 12 months.

Our benchmark, the Nasdaq, is up 17% YTD and 28% over the last 12 months.

What Happens If the Fed Cuts 50bps… and what if it doesn’t?

The Fed is expected to cut rates on Wednesday, but the key question is by how much—25 or 50 basis points (bps)? For weeks, the narrative was that a 50bps cut could signal panic, but now markets seem to desire the bigger cut. Media chatter, including pieces from WSJ and Bloomberg, has raised the possibility of a "jumbo cut." As a result, bond yields dropped, and markets have moved their bets away from 25bps and towards a 50bps cut.

Goldman Sachs: Leans toward 25bps, saying there’s no strong case for 50bps with inflation data still hawkish.

Robert Kaplan, former president of the Dallas Federal Reserve, is advocating for a 50-basis-point (bps) interest rate cut at this week's Fed meeting. In an interview on CNBC’s Squawk Box, Kaplan emphasized that a larger cut would better prepare the Fed for the economic challenges heading into late 2024.

Kaplan's Rationale: He believes the Fed might be a meeting or two late in starting its rate cuts, and a more aggressive move would signal decisive action.

Key Data: Recent labor market cooling and mixed inflation data add uncertainty.

Market Pricing: The odds of a 50 bps cut surged to 63% today, up from 34% just one week ago.

WHY IT MATTERS:

The market has partially priced in 50bps—anything less could trigger a sell-off. The Fed’s mixed messaging and media leaks have created a paradox: if they cut only 25bps, we could see deleveraging and asset sell-offs.

If the Fed cuts 50bps: Stocks, bonds, and gold would rally as markets get the stimulus they crave.

If the Fed cuts 25bps: Markets may see it as a disappointment, leading to downside in risk assets. CTA and futures positions would unwind, driving volatility.

THE BIG PICTURE:

With elections around the corner, the Fed’s decision isn’t just about monetary policy—it’s also about politics. The central bank could face accusations of playing a political hand with a jumbo cut. But if they go too soft with just 25bps, markets may punish them.

Either way, there’s a huge gap between market expectations and the Fed’s dot plot for 2025, suggesting something’s got to give.

This week’s rate decision isn’t just about today—it’s setting the stage for whether the U.S. economy skates by without a recession, or if we’re headed for a storm.

Bottom Line: Buckle up. A 25bps cut might spook markets, while 50bps could trigger a violent move to the upside.

Keep an eye on gold and U.S. Treasuries as safe havens if the Fed fails to deliver. Watch big tech and crypto soar should the Fed comply and initiate the jumbo cut.

Trump-Backed World Liberty Financial Eyes a Simpler DeFi Experience

WHAT HAPPENED:

World Liberty Financial (WLF), a crypto project spearheaded by the Trump family, confirmed during a live stream that they’re rolling out a DeFi platform along with a governance token, WLFI. The platform, built on Ethereum, will focus on borrowing and lending services, offering users decentralized access to crypto liquidity.

The live stream was President Trump’s first interview since the latest attempt on his life. He provides his first-hand take on the event, his experience with NFTs, and anecdotes about how his three sons convinced him to embrace bitcoin and crypto.

WLFI Token: The governance token will be non-transferable, giving holders the power to vote on protocol decisions without offering any economic return. The token will be available only to accredited investors under SEC Regulation D exemptions.

Borrowing and Lending: Similar to popular DeFi protocols like Aave and Compound, users will be able to collateralize crypto assets (like Ethereum) and borrow against them. The platform is expected to focus on stablecoins, aiming to maintain U.S. dollar supremacy in the DeFi ecosystem.

PLATFORM DETAILS:

Governance: Holders of WLFI tokens will have the ability to vote on decisions affecting the platform's future. Governance could include choosing which assets to support for lending, adjusting interest rates, or determining the platform's fees. 63% of WLFI tokens will be sold to the public, with 17% reserved for user rewards and 20% allocated to the founding team (including the Trumps).

User-Friendly Focus: Eric Trump highlighted the challenges of using current DeFi platforms, mentioning his own struggles with looping Ethereum on Aave. The WLF platform aims to simplify DeFi, making it accessible for users who are not tech-savvy.

Stablecoin-Driven: The platform will leverage stablecoins, pegged to the U.S. dollar, to provide liquidity in a familiar currency. This move supports their mission to keep the U.S. dollar central in global finance while participating in the decentralized revolution.

WHY IT MATTERS:

The Trump family’s entrance into crypto isn’t just about the token—it’s a push for mainstream DeFi adoption. By simplifying the experience and focusing on governance, World Liberty Financial is targeting a broader audience who may have found existing DeFi platforms too technical or intimidating.

Regulation D Exemption: By only offering WLFI to accredited investors, the project is navigating the U.S.’s regulatory tightrope. This strategic move could protect the project from immediate SEC scrutiny, but it limits the audience to high-net-worth individuals, excluding retail investors.

Political Connections: With Donald Trump Jr. positioning DeFi as the financial system the Founding Fathers envisioned, the project adds a political narrative to the already heated debates around decentralized finance. Trump’s 2024 election run complicates things further, with potential conflicts of interest arising from his involvement in the venture.

BIG PICTURE:

World Liberty Financial promises to make DeFi simpler and more accessible, while also pushing for U.S. dollar dominance in the crypto space via stablecoins.

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll