GM and BRRR.

FOMC Day! At 2pm, we learn what a handful of unelected officials believe the cost of money should be.

Yesterday, elected Democratic lawmakers opined a letter to the Fed, begging not to raise rates amid its “potential to throw millions of Americans out of work”, arguing additional hikes to be unnecessary. They might have a point.

The market prices in over an 80% chance that the committee raises rates by 0.25% - and that this is the final rate hike before they pause to evaluate the damage they’ve done to banks and the broader economy.

Here’s what we brrr’d today:

Fed Officials Facing Disastrous Decision: To Hike or Not to Hike?

Insolvency Crisis: Over 2,315 US Banks Sitting on Assets Worth Less Than Their Liabilities

Prediction Contest Update

FOMC meeting here soon, where do you think it lands?

On May 3rd, the FOMC will announce the following

Fed Faces Disastrous Decision: To Hike or Not to Hike?

Economic Outlook and Risks: The Federal Reserve officials are set to raise interest rates for the 10th time amid turmoil in the banking sector and political battles over the US government's borrowing limit, either of which could weaken the economy.

Fed Officials Divided: The range of potential outcomes could provoke divisions among Fed officials, even as they are expected to raise their benchmark rate to 5.1%. Some Fed officials warn against overdoing rate hikes and derailing the economy, while others want the central bank to lift its key rate to at least 5.4%.

Uncertainty Looms: Turmoil has re-erupted in US banking after regulators seized and sold off First Republic Bank, causing investor anxieties, while Treasury Secretary Janet Yellen warned of the nation’s default on its debt as soon as June 1. Goldman Sachs estimates that a pullback in bank lending could cut US growth by 0.4 percentage points this year.

Inflation Persists: Although overall inflation has tumbled as the cost of gas and many goods has eased, "core" inflation - which excludes volatile food and energy costs - remains high. According to the Fed, core prices rose 4.6% in March from a year earlier, the same as in December. Other major central banks, such as the ECB, also are tightening credit as consumer prices continue to rise.

US Banks Underwater: Half of America’s Banks May Be Insolvent

US Banking System Faces Insolvency: $9T in uninsured deposits in US banks may disappear rapidly due to the collision of twin crashes in the US commercial real estate and bond market.

FRC Collapse Signals Warnings: The second and third largest bank failures in US history occurred in quick succession, casting doubt on Treasury and Federal Reserve claims that they are "idiosyncratic."

More Than 2,300 US Banks Potentially Insolvent: Almost half of America's 4,800 banks are burning through their capital buffers and are potentially insolvent, according to Hoover Institute Report.

Commercial Property Loans Pose Threat: US commercial real estate is facing a refinancing cliff-edge over the next six quarters, with an estimated $4-5T debt, of which about $1T is maturing in the next 12 to 18 months.

US Authorities in Denial as Solvency Crisis Looms: The US banking system may not be able to safely deflate the excess leverage induced by extreme monetary stimulus seen during the pandemic.

YahooFinance

AI ART OF THE DAY

Jerome Powell between a rock and a hard place

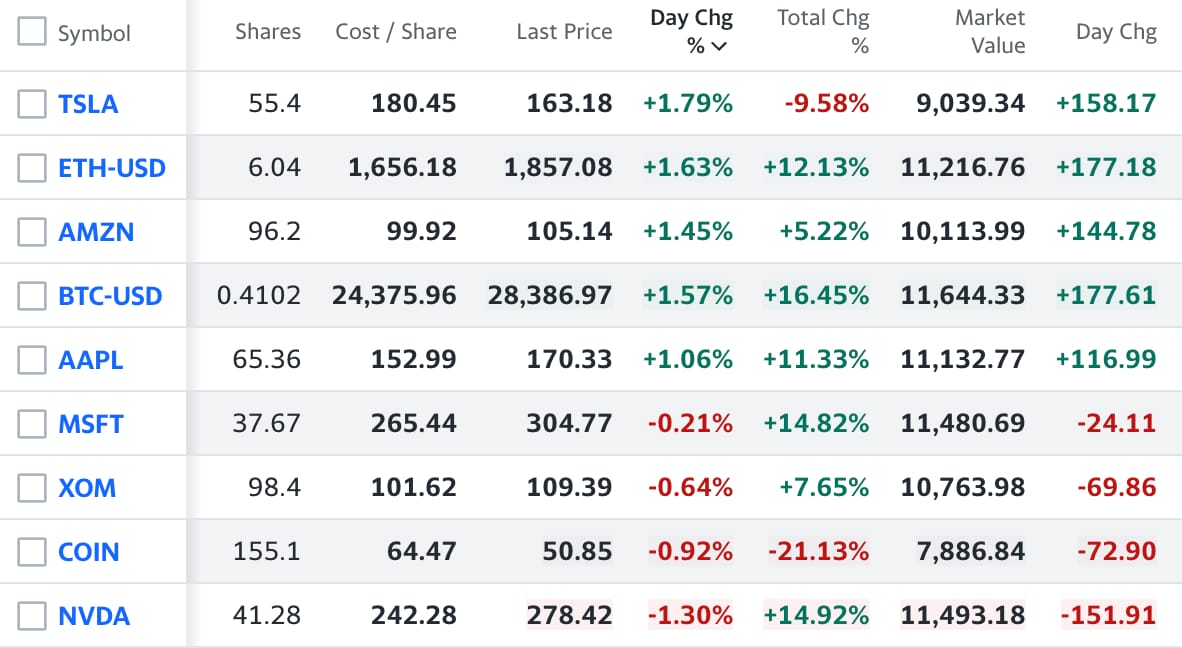

The BRRR’s Portfolio

Wavering and waiting, but resilience shown by crypto and Big Tech yesterday…

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.