GM and BRRR.

The story this week continues to focus on Q1 earnings and the subsequent conference calls. On the heels of Tesla and Netflix’s underwhelming reports last week, Amazon, Microsoft, Alphabet and Meta are all set to share results over the next 4 days.

We’ve also prepared a summary of the 5 biggest economic disasters on the horizon. We’re not doomsdayers here, but it’s worth monitoring these situations because should they spiral out of control, the Fed will do the only thing it knows how to do - make the printer go brrr, inject liquidity, and pray for deflationary forces to counteract their massively inflationary actions.

Here’s what we brrr’d today:

Show Me The Money - Big Earnings Ahead

5 Impending Economic Disasters

Prediction Contest #5

Make sure to get your prediction in before Tuesday’s announcement!

Microsoft reports earnings on Tuesday, April 25. How will they do?

Show Me The Money: Big Earnings Ahead

Tech Giants to Report Results: The week ahead will provide investors with quarterly earnings reports from tech giants such as Amazon, Microsoft, Alphabet, and Meta. Expectations for tech sector earnings are low, with consistent layoffs during the quarter as a sign of weakening.

Markets on Edge: Investors will closely watch Thursday's release of the first estimate of Q1 GDP, which is expected to show 2% annualized growth for the first three months of the year. The major averages closed slightly lower last week, with earnings reactions proving mixed. Data from FactSet shows that S&P 500 earnings are expected to decline 6.2% in Q1, which would mark the largest earnings decline since Q2 2020.

Coming Up Short: Investors expect this earnings season to bring a second straight quarter of decline in profits earned by US corporates. Companies are reporting earnings that are 5.8% above estimates, which is below the 5-year average of 8.4% and the 10-year average of 6.4%.

The High Mark: The first quarter is expected to be the year's high water mark for economic growth, but mixed survey evidence points to a further slowdown at the start of Q2. Reports from regional banks show that billions of dollars of deposits have left these institutions and the cost of keeping deposits has skyrocketed.

5 Economic Disasters: Predicted & Happening

Not-so-positive outlook: Long-term problems are becoming short-term problems, and the economic outlook for the remainder of 2023 is extremely bleak. We were warned about severe consequences for foolish economic decisions made by our leaders, and now those consequences are playing out.

5 economic disasters that we were warned about in advance are happening right now:

A great commercial real estate crisis is here, with high-profile defaults such as Brookfield defaulting on a $161.4 million mortgage for twelve office buildings in Washington, DC.

Widespread layoffs are happening, with Ernst & Young announcing that they will be laying off roughly 3,000 jobs from their US workforce.

The largest corporate debt bubble in the history of the world is bursting, with companies around the world defaulting on their debts at an alarming rate.

We are witnessing a dramatic surge in bankruptcies in 2023, with bankruptcy filings across the United States rising for the third straight month in March in all major industries.

The rest of the world is rejecting the US dollar at a stunning pace, with the dollar losing its reserve status at a faster pace than generally accepted.

Felt at all levels: Americans have never been more negative about the economy than they are now, according to a CNBC survey.

AI ART OF THE DAY

Jay Powell prays AI drives a massive productivity surge and heavy deflation

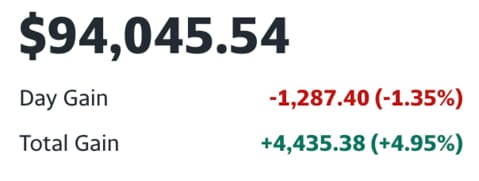

The BRRR’s Portfolio

HODL' on

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.