TheBRRR’s Thoughts

GM.

We’ve gotten some revealing data this week and big swings in markets.

CPI came in soft yesterday, indicating slowing inflation, which lead to a repricing of small-cap stocks higher and large-cap stocks lower. The Russell 2000 (includes long tail of stocks) soared 3% yesterday while the Nasdaq (big tech heavy) fell 2%.

This was mostly a function of a direct rotation from large to small, as small-caps are disproportionally suppressed by high inflation and high interest rates because they have less robust balance sheets.

We then got a slightly hot headline PPI report this morning, indicating sticky inflation, but the market mostly shrugged at the datapoint so far and all indexes have marched higher.

The odds of an interest rate cut in September have surged from 77% to 96% according to Fed Watch pricing.

Crypto has bounced around with low correlation to stocks, with bitcoin sitting roughly flat over the last 24 hours and for the week at $58k, after nuking below support last week.

Ether has outperformed bitcoin as traders position ahead of its ETF launch later this month.

Learn AI in 5 Minutes a Day

AI Tool Report is one of the fastest-growing and most respected newsletters in the world, with over 550,000 readers from companies like OpenAI, Nvidia, Meta, Microsoft, and more.

Our research team spends hundreds of hours a week summarizing the latest news, and finding you the best opportunities to save time and earn more using AI.

US CPI 3.0% Y/Y, -0.1% M/M, Beating Expectations

soft

WHAT HAPPENED

Consumer Price Index (CPI): Fell 0.1% MoM in June, pulling the YoY rate to 3%, the lowest in over three years.

Core CPI: Increased 0.1% MoM and 3.3% YoY, the smallest annual increase since April 2021.

Energy Prices: Gasoline prices dropped 3.8%, significantly impacting overall inflation.

Food and Shelter Costs: Both increased by 0.2% MoM.

Used Vehicle Prices: Decreased 1.5% MoM and 10.1% YoY.

Labor Market: Weekly jobless claims fell to 222,000, the lowest since June 1.

WHY IT MATTERS

Fed Rate Cuts: The decline in inflation strengthens the case for potential rate cuts, possibly as early as September.

Economic Indicators: The soft inflation report boosts stock market futures and lowers Treasury yields, reflecting market optimism.

Earnings Impact: Real average hourly earnings for workers increased 0.4% MoM, indicating improved purchasing power despite modest YoY gains.

Policy Implications: Traders are increasingly betting on multiple rate cuts this year, with rising probabilities for a September cut.

KEY TAKEAWAYS

Inflation Trends: Headline and core inflation rates indicate a cooling trend, providing the Fed with "ammunition" to consider rate cuts.

Market Reactions: Positive stock market futures and falling Treasury yields signal market confidence in a potential Fed policy shift.

Economic Sentiment: The reduction in inflation and jobless claims supports a positive economic outlook, reducing recession fears.

Data Source: Bureau of Labor Statistics, CME Group’s FedWatch tracker

CONCLUSION

June's CPI report reveals a notable decline in inflation, reinforcing the possibility of Fed rate cuts later this year. This shift could provide relief to markets and consumers alike, as economic indicators point towards a cooling inflation environment. The upcoming months will be critical in determining the Fed's response and the broader economic trajectory.

US PPI Seen At 2.6% in Mixed Signal Report

WHAT HAPPENED

Stocks edged up after a tech selloff, buoyed by mixed inflation data and the start of earnings season.

Producer Price Index (PPI) rose slightly more than expected, but key components feeding into the Fed's preferred measure, the Personal Consumption Expenditures (PCE) index, were stable.

PCE Inflation Details: Factors affecting PCE inflation were soft, largely due to medical services.

WHY IT MATTERS

PPI Insights: The headline PPI increase suggests rising producer costs, but crucial components for the PCE index remained stable. This indicates inflation at the consumer level may not be as severe, bolstering hopes for a rate cut in September.

Paul Ashworth (Capital Economics): "PPI was actually a lot better than it looks."

Citi’s Core PCE Prediction: Now expected to rise by 0.17% month-over-month in June, down 4 basis points from post-CPI estimates.

Inflation Insight: The higher PPI indicates rising producer costs, but the soft PCE components suggest consumer-level inflation remains controlled, easing immediate concerns over aggressive rate hikes.

Fed Policy Implications: Stable PCE data strengthens the case for a potential rate cut in September, providing relief to markets.

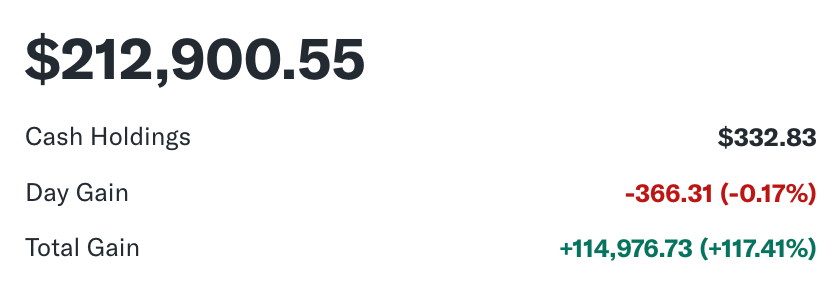

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll