Frank’s GM

Stocks are mixed at the open today, as markets continue to digest last week’s FOMC meeting.

Because the Fed surprised the world with higher-than-expected GDP estimates and lower-than-expected unemployment projections, they expressed a belief that they will be able to maintain high interest rates for longer-than-expected.

With high rates comes high opportunity cost in alternate investments, so on the margin, money will move into money market accounts and bonds and away from growth stocks and risk assets.

Despite these structural changes, investor appetite for market-beating returns remains high as inflation continues to erode purchasing power, and big tech has steadfastly committed to massive, multi-year share buyback programs, providing a strong tailwind to stock performance.

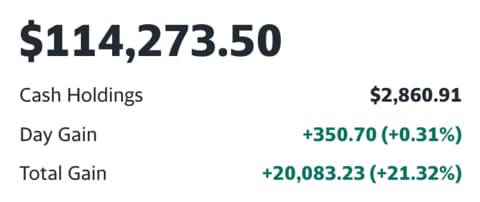

As a reminder, for just $3/month or $14.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+21.3% since inception in late March).

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Amazon Invests In Anthropic

Amazon announced a strategic partnership and $4 billion investment in Anthropic, maker of Claude, an AI chatbot rivaling ChatGPT and Google’s Bard. The deal gives Amazon minority ownership in Anthropic and secures cloud infrastructure collaboration to strengthen its presence in the generative AI race.

Bezos Bets on AI: The $4 billion investment provides significant funding for Anthropic to scale its large language model development and underscores Amazon’s intent to be a leading player across all layers of generative AI.

Faster Chips for AI Models: Anthropic will leverage AWS’s Trainium chips and Inferentia for compute power to build and deploy future Claude models, benefitting from AWS’s performance and scale.

Alexa Welcomes Claude: Per the agreement, Anthropic will make Claude available to AWS customers via Amazon Bedrock, its platform for accessing major foundation models. This expands Amazon’s generative AI service offerings.

Unleashing New AI: The partnership connects Amazon to a top chatbot able to compete with OpenAI’s ChatGPT and Google’s Bard, allowing it to diversify its AI investments and offerings across the tech stack.

Macro News

Markets Drop as Yields, Dollar Rise

Global markets started the week lower as Treasury yields resumed their climb, the dollar hit its highest level since March, and investors worried central banks will maintain high interest rates to curb inflation.

Yields Above 4.5%: The 10-year Treasury yield rose above 4.5% and the dollar index hit its highest level since March, indicating concerns about aggressive rate hikes continuing.

Dollar at 7-Month High: U.S. stock futures and European indexes declined, extending last week’s selloff that was the worst since March amid hawkish Fed signals.

Stocks Extend Selloff: Oil prices rallied again as hedge funds bet on tightening supplies, further worrying traders about inflation being fanned. China property woes also weighed on Asian markets.

Today’s Reader Poll

The budget is due by October 1st, and if Congress can’t come to terms and agree, the Federal Government will partially “shut down”. “Essential” elements of the government will continue, like the post office , air traffic control and the social security office, but nearly 2m employees will be furloughed until the budget is finalized.

The budget is objectively out of control as our deficit has widened each year since 2001, but there is no political will to reverse course.

Here’s a piece from Reason about the theatrics.

Will Congress agree to a deal, or will the federal government go into shutdown on October 1st?

Here are the results from Friday’s poll asking if the Nasdaq will finish the year higher or lower than $13,330. Looks like readers are slightly bullish.

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

We added Flutter Entertainment (PDYPY) to the Watchlist on Wednesday of last week and it’s fallen by 5%. We think it has a little further to go, but would take no issue with a buy in the $86 range.

We initiated a position in $URA in August - it’s an ETF that tracks the price of Uranium. We believe the Nuclear Energy narrative is gaining steam very quickly and that the asset class will continue to outperform.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

$DKNG: Sports betting revenue may beat expectations this quarter

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.