GM and BRRR. We got a traffic bump yesterday as our meme went to #1 on r/wallstreetbets.

We’re watching a few things at the open today as markets have inched higher on no obvious catalyst.

1) Will crypto continue higher, setting new YTD highs?

2) Will the long-tail of AI stocks with concentrated AI exposure catch up to NVDA with Q2 earning guidance?

3) Will commercial real estate and regional banks continue to sell off due to “higher for longer” interest rates?

To the last question, we have some takeaway from a paywalled ZeroHedge article released this morning:

Private Real Estate Market Risks: Deutsche Bank's Luke Templeman predicts that low-quality real estate will face severe refinancing stress in 2023 and 2024, while high-quality real estate will remain relatively safe.

Potential Catalysts for Repricing: Templeman identifies tighter credit conditions, a higher cost of capital, and lower occupancy rates in office buildings as triggers.

Comparisons to 2008 Financial Crisis: Templeman draws parallels between the current situation and the conditions before the 2008 financial crisis. He highlights that private property valuations remain high despite low transaction volumes and very strong construction activity.

Ideas:

-Short Real Estate Investment Trusts

-Short Regional Banks and related ETFs

So we ask…👇

Will the Commercial Real Estate market crash over the next 6 months?

AI: The Money Robots

Investing in AMD: Betting on Second Place, Hoping for First

Nvidia's stock rallies, while AMD lags behind: Nvidia Corporation's stock has experienced a significant rally, while Advanced Micro Devices, Inc. (AMD) has not received the same level of investor attention and growth this year.

Conservative guidance impacts AMD's investor sentiment: Despite maintaining a net cash balance sheet and solid profitability, AMD's conservative guidance has spooked investors, potentially indicating a winner-takes-most market in generative AI, where Nvidia holds a stronger position.

AMD aims to catch up rapidly in the AI market: Although currently behind Nvidia in the AI market, AMD expects to release competitive MI300x accelerators later this year, positioning itself to catch up quickly and benefit from the enormous generative AI market opportunity.

Generative AI market potential favors multiple winners, including AMD: The generative AI market is expected to grow significantly, and AMD is among the companies likely to benefit. Management believes the data center AI accelerator market could reach over $150 billion by 2027, indicating substantial opportunities for AMD.

Valuation disparity between Nvidia and AMD: Nvidia trades at a higher valuation than AMD, with Nvidia trading at well over 20x sales while AMD trades at a fraction of that at well under 10x sales. However, there is potential for AMD's valuation to expand and for the stock to see upside as it strengthens its AI offerings and catches up with Nvidia.

Public companies mentioned: AMD, NVDA

Our take: Long AMD and NVDA as they will both win

Crypto: Digital Gold Rush

HSBC's New Strategy: If You Can't Beat 'Em, Trade 'Em

HSBC introduces cryptocurrency services for Bitcoin and Ether: HSBC, the largest bank in Hong Kong, enters the cryptocurrency market by offering local cryptocurrency services. Customers can now trade Bitcoin and Ether through HSBC's platform, expanding their access to digital assets within the region.

Access to cryptocurrency ETFs listed on the Hong Kong Stock Exchange: HSBC provides customers with the opportunity to invest in cryptocurrency exchange-traded funds (ETFs) listed on the Stock Exchange of Hong Kong. The available ETFs include CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF, giving investors a range of options to diversify their portfolios.

HSBC establishes Virtual Asset Investor Education Center: In an effort to protect investors from cryptocurrency-related risks, HSBC establishes the Virtual Asset Investor Education Center. This initiative aims to educate and inform investors about the potential risks and rewards associated with cryptocurrencies. Customers must review educational materials and risk disclosures before engaging in cryptocurrency investments.

AI ART OF THE DAY

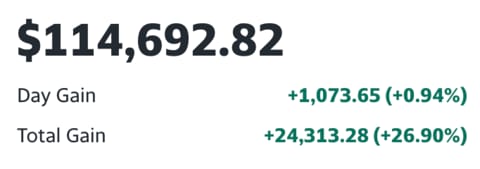

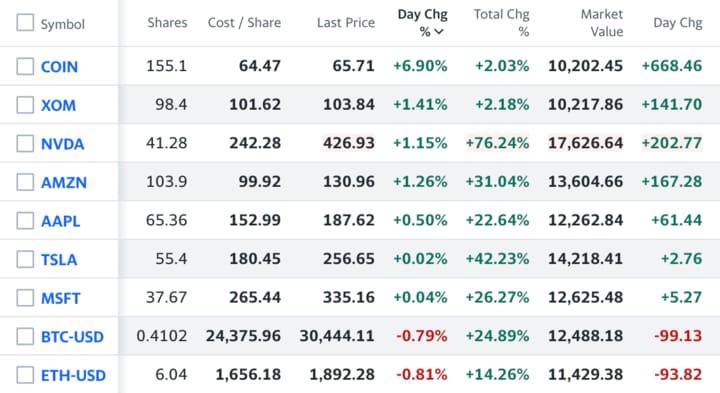

The BRRR’s Portfolio

Looking good with Coinbase playing catch up.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: AI Supply Chain

$AI: Enterprise AI software

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.