May the 4th be with you. Washington needs it.

GM and BRRR.

Things are unfolding quickly. Yesterday the FOMC announced yet another 0.25% interest rate hike. After the release, Fed Chair Jay Powell took the podium to answer questions from the media.

Before reading his standard prepared remarks, Powell made a point to assure the public that the banking sector remained “sound and resilient”. Hours later, another sizable bank announced it was seeking a sale as it was in the midst of an insolvency crisis.

Imagine if Powell said anything less.

The only way to stem the crisis and prevent further contagion and banking insolvencies is to dramatically reverse course and begin cutting interest rates - and the market is keen to this, as it expects the Fed to cut back multiple times before the end of the year - firmly in opposition to the Fed’s stated stance of keeping interest rates “higher for longer”.

It’s a game of chicken for the Fed and we all know how this ends. Money printer go brrr.

Here’s what we brrr’d today:

FOMC Announces Rate Hike Followed By Another Bank Blow-up

Productivity Drops & Labor Costs Rise In First Quarter - A Perfect Storm of Inefficiency

FOMC Announces 0.25% Rate Hike As Another Bank Blows Up

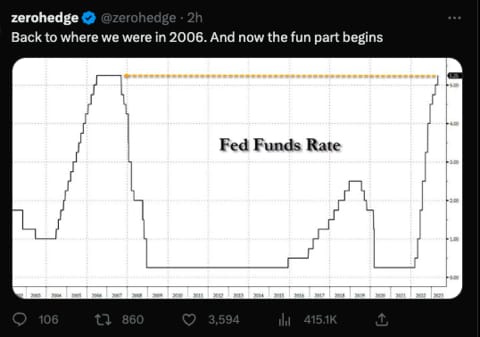

Fed Raises Rates: FOMC Announces Rate Hike of 0.25%, highest since 2006 at 5.25%. Fed Chair Jerome Powell indicated no decision on pause, commitment to monitoring data through “ongoing assessment.”

Another Bank Announces Failure: PacWest, a bank with ~$50B in assets, announced it seeks a distressed sale, hinting at further contagion. Hours earlier, Powell claimed banking sector remained “sound and resilient.”

Surpassing global crisis: A staggering half a trillion dollars in bank failures over the past few weeks, dwarfing the global financial crisis, only adds to the cynicism surrounding the unstable banking system.

Q1 Productivity Takes A Dive While Labor Market Cools Down

Productivity Down, Labor Costs Rise: The US worker productivity declined by 2.7% in the first quarter, according to a Thursday morning report. Additionally, labor costs increased by 6.3% compared to a rise of 3.3% in the previous period. The increase in labor costs came despite output almost stagnating, and the decline in productivity is likely to keep inflationary pressures high.

Re-investment to offset Inflation: Investment in technology and equipment can improve worker efficiency and help offset the inflationary impact of higher wages and other costs. However, some businesses are pulling back on investment due to mounting economic headwinds.

Other Factors Remain: Adjusted for inflation, hourly compensation fell by 0.3% in the first quarter. Hours worked increased by 3%, and nonfarm business output grew just 0.2%, accounting for about three-quarters of GDP in 2022. Recent data also shows that labor-cost pressures remain firm, while GDP moderated to an annualized 1.1% pace in part due to an inventory drawdown.

AI ART OF THE DAY

Jerome Powell says “sound and resilient”

TWEET of the Day

Pretty clear where we’re headed…

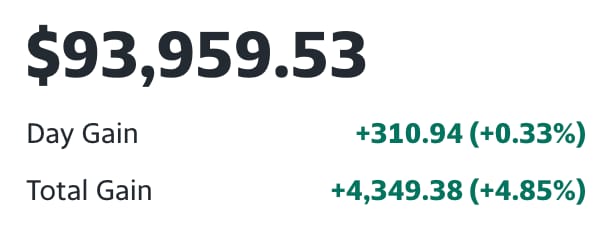

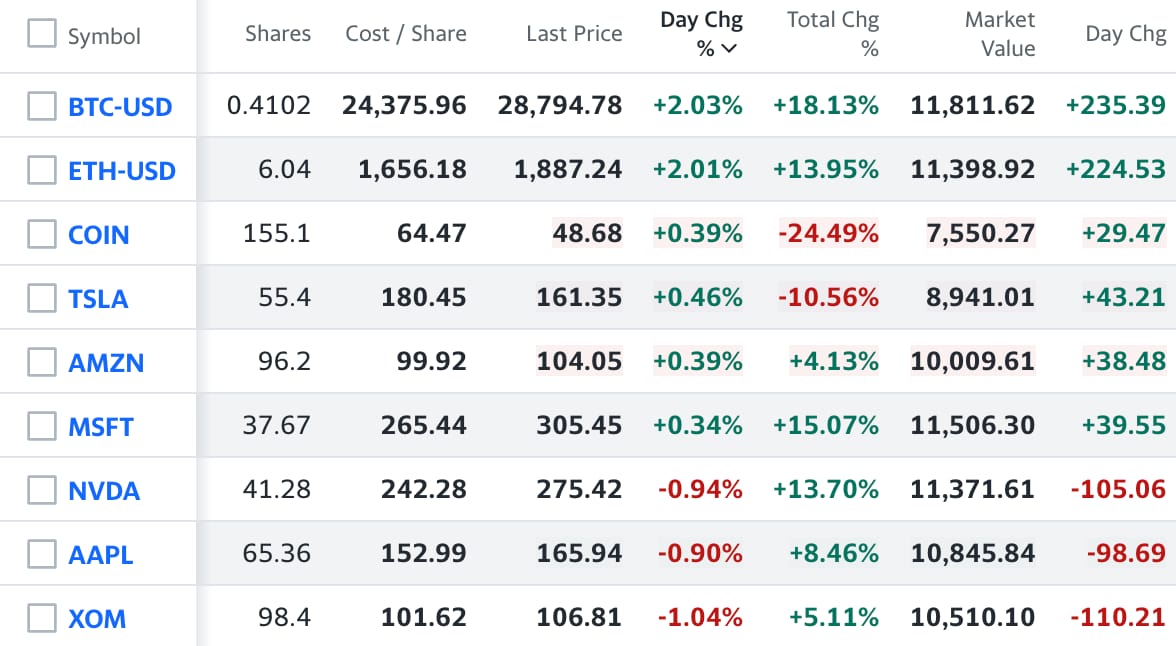

The BRRR’s Portfolio

Crypto bounces back, along with Big Tech for now…

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.