Frank’s GM

It’s FOMC day (Federal Open Markets Committee) and all eyes are on the dot plots.

Why? Well it’s unanimous that the Fed will leave interest rates unchanged today and they will likely copy/paste large swaths of their previous statements.

What’s still unknown is how voting members are feeling about the future.

Sentiment is revealed via their forward-looking interest rate projections, as voting members provide their best guesses as to where they will move interest rates over the next three years.

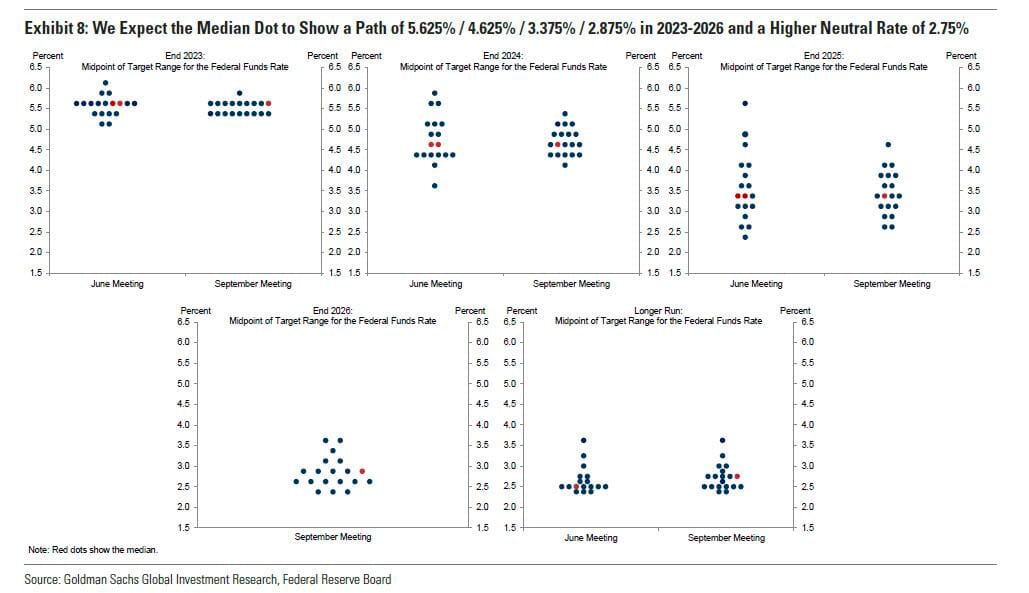

For those interested, here’s the most recent dot plot charts:

I tend to believe that interest rates will fall far faster than the Fed officials are leading on because of continued banking system stress and unsustainable spending and interest on the debt.

Elsewhere, we’re following a story focused on the Apple & Goldman Sachs relationship.

It’s being reported that in 2020, the pair had initially planned to offer stock trading natively built into the iPhone core feature set, as part of the Apple Pay product.

But because market conditions soured in 2022, they pulled the investing feature and instead offered a savings account product that yields over 4%.

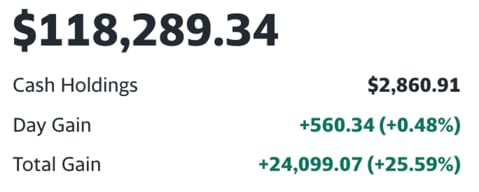

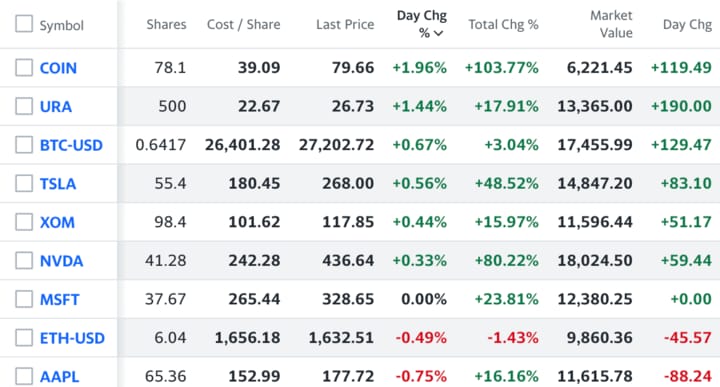

As a reminder, for just $2/month or $12.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+25.6% since inception in March) and watchlist as a premium subscriber.

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

iPhone Maker Shelved Equity Trading Feature (for Now)

As meme stocks like GameStop and AMC soared in popularity during 2020, Apple explored launching an iPhone feature in partnership with Goldman Sachs that would allow users to easily buy and sell stocks directly on their devices. One potential use case envisioned was letting users invest spare cash directly into Apple stock.

However, as the markets began to decline in 2022 amid rising inflation and interest rates, Apple grew concerned over launching a trading feature at a time when consumers could potentially lose money in the market using an Apple-enabled product. This led the iPhone maker to hit pause on the stock trading rollout.

The infrastructure for stock trading is said to be largely ready and could still launch in the future if Apple decides to resurrect the plans.

Partnership with Goldman Sachs: Apple planned to partner with Goldman Sachs to power the stock trading feature. The two companies already collaborate on Apple Card, Apple Pay Later, and high-yield savings accounts.

Infrastructure Largely in Place: Despite pausing the stock trading rollout, Apple has built much of the backend infrastructure needed to enable equity investing through iOS. The capability could launch in the future.

Capitalize on Retail Investing Trend: The planned feature was partly intended to capitalize on the surge in retail investing driven by zero-fee brokers like Robinhood during the pandemic. Apple wanted a piece of the trading frenzy.

Global Macro News

FOMC Preview: Rates Unchanged

The FOMC is anticipated to maintain rates between 5.25%-5.50% with market speculation divided on the possibility of another rate hike in November. While several notable economists predict that there won't be any further rate hikes this year, traders are closely watching the upcoming FOMC guidance and economic projections. Market sentiment is leaning toward the possibility of three rate cuts in 2024, despite Fed officials' dismissals of such talks.

Both Goldman Sachs and JPMorgan have provided insights on the FOMC's probable moves, with varying takes on the rate decisions, inflation, GDP growth, and forward guidance. Both banks emphasize the need for caution in the FOMC's approach to ensure market stability.

Parsing the Data Flow: Growth has rebounded more than expected with Q3 GDP tracking above 3% but inflation has also moderated. The FOMC may revise up 2023 GDP growth forecasts to 2% or higher while lowering 2023 core PCE inflation to around 3.5%. This complicates the dots and rate cut timing.

Interpreting the Dots: Money markets see a terminal rate around 5.25% but the June dots forecast 5.625%. Views are split on whether there will be another hike or if July was the final move. The median 2023 dot may stay at 5.625% but risks skewing dovish. Messaging the balance will be key.

Walking the Tightrope: Powell will likely emphasize upside inflation risks and data dependence, but could face intense questioning on the potential timing of rate cuts in 2024. Markets are pricing cuts starting in H2 2023. The overall tone may lean hawkish to counteract dovish dots.

Today’s Reader Poll

Our position in $URA, a Uranium ETF is up 19% since we bought it. From 1-5, how interested are you in Uranium and nuclear energy?

Shoutout to a longtime BRRR subscriber named Edward for his comment to our Uranium poll.

“I have always thought that Nuclear would be our best way to curb CO2 emissions as renewables have yet to prove viable for our consumption patters. Uranium obviously plays a very large part of that. There are other options as well, like Thorium in molten salt reactors.”

-Edward

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

We added Flutter Entertainment (PDYPY) to the Watchlist on Wednesday on the strength of its US betting operation. We think it commands a higher premium than it currently does over #1 competitor, $DKNG and are monitoring when and if we will initiate a position in either company.

We initiated a position in $URA two weeks ago - it’s an ETF that tracks the price of Uranium. We believe the Nuclear Energy narrative is gaining steam very quickly.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

$DKNG: Sports betting revenue may beat expectations this quarter

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.