TheBRRR’s Thoughts

GM.

Despite the dollar index (DXY) climbing back to multi-month highs, risk assets have drifted mildly higher in a moderate bounce off of the lows.

Apple continues to outperform and is holding onto its gains after breaking above $200 to $212+ for the first time.

We’re covering bitcoin in depth today as two one-off events are driving recent sell pressure.

We’re also covering Apple - as they recently announced a delay to their AI features in Europe, citing regulatory and compliance burden.

Still looking at a sideways week overall with volatility expected to pick up after the July 4th holiday. That’ll mark the final leg of the election year as we move towards November’s consequential US presidential election.

Bitcoin Under Pressure From Germany Sales & Mt Gox Unlocks

WHAT HAPPENED

Bitcoin Market Movements: Bitcoin saw a 5% rebound, currently trading at $61,485, as concerns over Mt. Gox creditors liquidating their holdings were downplayed. Concurrently, the German government has been selling off its seized Bitcoin, significantly impacting the market.

Mt. Gox Developments: Mt. Gox creditors are set to receive reimbursements starting next week, but analysts argue that immediate sell-offs are unlikely. Off the Chain Capital and Galaxy Research suggest most creditors will hold their Bitcoin given its maturity and historical performance (Decrypt) (Benzinga) (Nairametrics).

German Government Sales:

Recent Sales: Germany sold $325 million worth of Bitcoin in two days, adding to a total of $195 million sold recently. The government still holds around $3.05 billion in Bitcoin from previous seizures (Benzinga) (TheGWW.com) (Nairametrics).

Impact: These sales have added to market volatility, with Bitcoin's price dropping by 3.5% following the large sell-offs.

WHY IT MATTERS

Market Sentiment: The combination of German Bitcoin sales and the looming Mt. Gox reimbursements has created a complex market environment. While German sales have pressured prices, the reassurance regarding Mt. Gox reduces fear of a massive dump, helping stabilize Bitcoin prices.

Institutional Confidence: Positive net inflows in U.S. Bitcoin ETFs indicate renewed confidence among institutional investors, offsetting some of the negative impacts from Germany’s sales and Mt. Gox-related uncertainties (Decrypt) (Nairametrics).

Long-Term Outlook: Analysts emphasize the importance of long-term strategies. While Germany's immediate financial gains are notable, the ongoing sales could undermine its position in the crypto market. Conversely, Mt. Gox creditors are likely to hold their assets, supporting Bitcoin’s long-term value appreciation.

BIG PICTURE

The dual narrative of Mt. Gox reimbursements and German Bitcoin sales highlights the intricate dynamics at play in the cryptocurrency market. Germany's actions illustrate the significant influence large holders have on market liquidity and sentiment, while the measured response from Mt. Gox creditors underscores Bitcoin's maturation as a long-term asset. Keep an eye on institutional behavior and government actions for future market shifts.

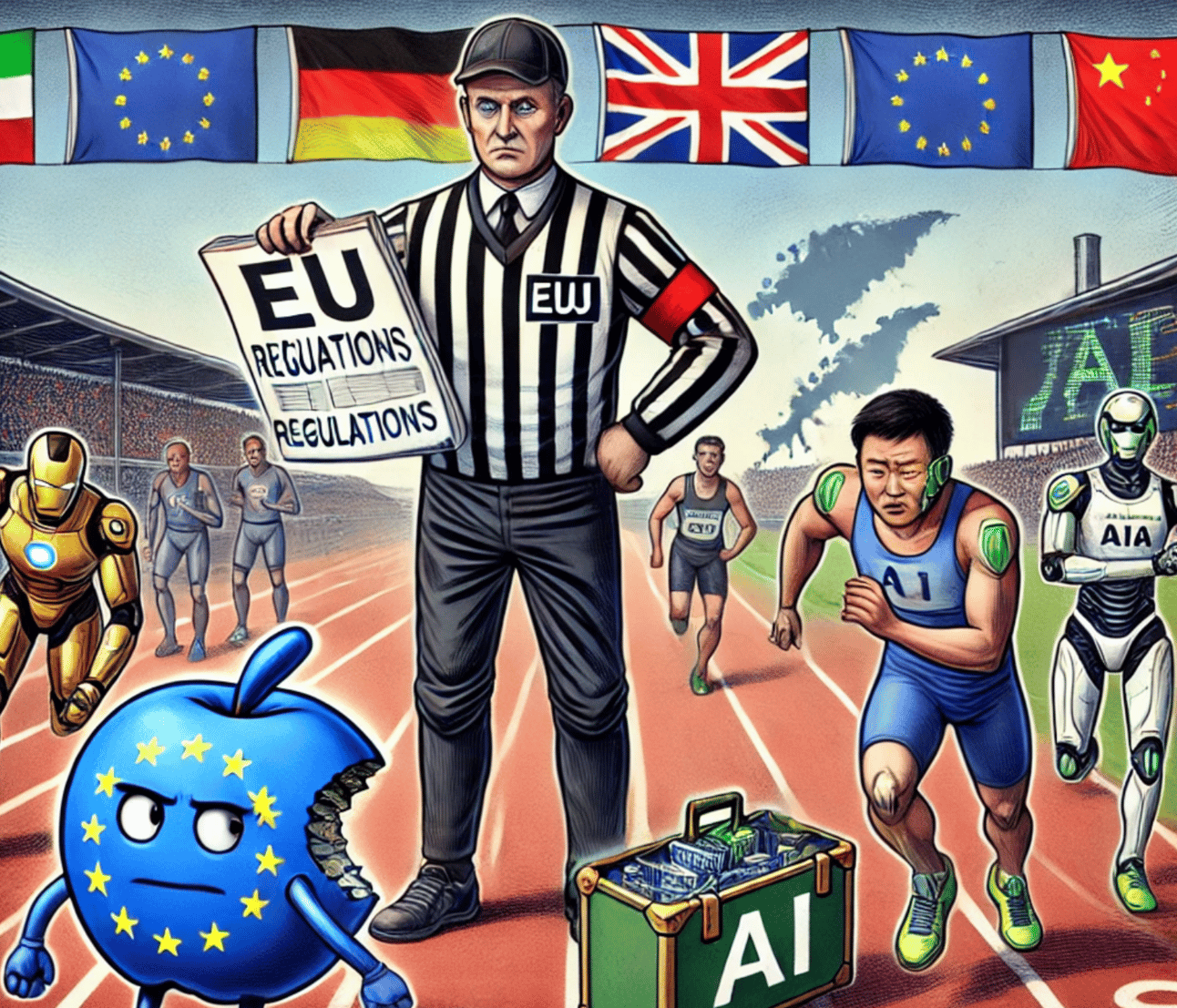

Eurozone Regulations Pushing Apple Away

WHAT HAPPENED:

WHY IT MATTERS:

Regulatory Hurdles: The DMA aims to ensure fair competition but poses significant compliance challenges for big tech companies like Apple. The Act's strict scrutiny for high-impact, general-purpose AI models could force companies to compromise on product integrity and user privacy (Engadget) (DW).

Key Data Points:

AI Features on Hold: Apple Intelligence, which includes AI-driven email summaries, custom emojis, iPhone Mirroring, and SharePlay Screen Sharing, will not be available in the EU this year (The Europe Today) (Malay Mail ).

Implications:

Innovation Slowdown: Europe's focus on regulation could stifle AI innovation, leaving it as a consumer rather than a producer of advanced AI technologies.

Conclusion: Apple's decision to delay AI features in Europe, coupled with warnings from industry leaders like Prince Constantijn, highlights the significant impact of stringent regulations on innovation. As Europe grapples with these challenges, it risks falling behind more adaptive markets, underscoring the importance of balancing regulation with the need to foster technological advancements.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll