our reaction to Tesla range issues

GM and BRRR.

Markets are bouncing back this morning after yesterday’s afternoon selloff. Overnight we learned more about The Bank of Japan’s monetary policy and it was more dovish than expected.

In other news, Reuters reports Tesla's been inflating its EV range estimates, leading to a surge in customer complaints. Tesla's solution? A "Diversion Team" to cancel range-related appointments, arguing no repairs needed. This, coupled with optimistic in-dash range meters, raises questions about Tesla's transparency.

In the crypto sphere, the House Financial Services Committee advances two key crypto bills, despite concerns over consumer protections and the CFTC's increased power. The Senate adds anti-money laundering provisions for the crypto industry to a defense bill.

Critics are vocal, but supporters argue it's necessary to keep the U.S. competitive in crypto regulation. A handful of democrats defected to join the republicans that are championing the bill.

Turning to the broader economy, the Federal Reserve's favored inflation gauge showed signs of cooling in June.

The market seems to be buying into the narrative that inflation is cooling and economic growth is chugging along. However, the central bank's insistence that inflation is still too high, despite the recent positive trends, leaves one wondering if they're waiting for a mirage of multiple months of solid data before changing course.

Today’s email is brought to you by the TLDR Newsletter. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report: Leverage AI for productivity. Leverage AI for creativity. Leverage AI so the robots don’t replace you. This newsletter brings the best AI Tools to your inbox. Here’s your link to subscribe for free.

AI & The Future

The Real Range of Tesla: Expectations vs Reality

In a recent Reuters special report, Tesla has been accused of exaggerating the driving range of its electric vehicles, leading to a surge in customer complaints and service appointments. In response, the company created a "Diversion Team" to cancel as many range-related appointments as possible, arguing that the vehicles did not need repair. The issue has not been previously reported and raises questions about Tesla's transparency and customer service.

Inflated Range Estimates: Tesla's decision to inflate its vehicles' potential driving range dates back about a decade when the company decided to program its range meter to show optimistic projections for marketing purposes. This practice has led to a significant discrepancy between the advertised and actual driving range, especially in cold weather conditions. For instance, a study found that three Tesla models averaged 26% below their advertised ranges.

Diversion Team and Service Cancellations: To manage the surge in service appointments related to range complaints, Tesla created a "Diversion Team" in Las Vegas. The team's primary goal was to cancel as many range-related appointments as possible, arguing that the vehicles did not need repair. The team often closed hundreds of cases a week, and employees were tracked based on their average number of diverted appointments per day.

Regulatory and Legal Challenges: Tesla's practice of inflating range estimates has attracted regulatory scrutiny and legal challenges. The company was fined by South Korean regulators for delivering cars that achieved as little as half their advertised range in cold weather. In the U.S., the Environmental Protection Agency (EPA) has required Tesla to reduce the range estimates it wanted to advertise for six of its vehicles by an average of 3%.

Our take: Automotive enthusiasts and journalists alike have known about this for years, and also discussed as much. While certainly a real issue, it is not unique only to Tesla’s EVs. Dieselgate, anyone? The market shrugged off the report so far - with Tesla green on the day.

Cryptocurrency News

Crypto Bills Advance: Charting the Course to Regulatory Clarity

The House Financial Services Committee has advanced two key crypto bills, H.R. 4763, the Financial Innovation and Technology for the 21st Century Act, and H.R. 1747, the Blockchain Regulatory Certainty Act, despite concerns over the fallout from crypto exchange FTX. The bills aim to establish a unified legal framework for cryptocurrencies and address blockchain-related issues. However, they faced criticism from committee members who were concerned over consumer protections and the power granted to the Commodity Futures Trading Commission (CFTC). Meanwhile, the Senate added anti-money laundering provisions for the crypto industry to a must-pass defense bill.

Criticism of the Bills: Many committee members, including both Republicans and Democrats, criticized the proposed market structure bill, particularly a clause that would grant more power to the CFTC. They expressed concerns that the bill could weaken consumer protections and leave U.S. investors more vulnerable to fraud. Rep. Stephen Lynch (D-Mass.) described it as the worst piece of legislation presented for markup in his 20 years on the committee.

Support for the Bills: The committee's chair, Rep. Patrick McHenry (R-N.C.), praised the legislation, stating it was necessary to prevent the U.S. from falling behind other countries in regulating crypto. Republicans supporting the bill also argued that an additional $120 million in funding recently approved by the Agriculture Committee would provide the CFTC with the resources to regulate the digital assets space more effectively.

Senate's Anti-Money Laundering Provisions: As the House committee advanced the crypto bills, the Senate added anti-money laundering provisions for the crypto industry to a must-pass defense bill. The amendment, proposed by Senators Cynthia Lummis (R-Wyo.), Kirsten Gillibrand (D-N.Y.), Elizabeth Warren (D-Mass.) and Roger Marshall (R-Kansas), would require various regulators to create a risk-focused examination and review process for financial institutions to assess certain crypto-related risks. It would also require the Treasury Department to analyze the role of mixers and privacy-enhancing technologies used in connection with crypto assets.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will interest rates go any higher this year, or is the Fed done hiking?

AI Art of The Day

Jerome Powell still not sure if he should put away his hiking boots….hmmm, any cushion left?

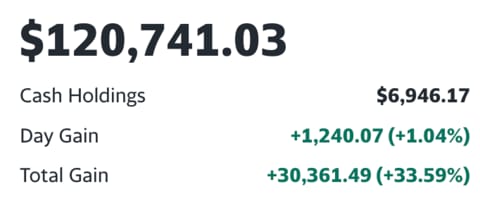

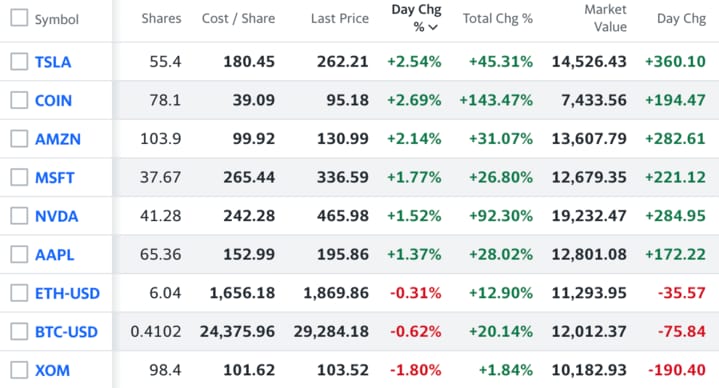

The BRRR’s Portfolio Update

Tech stocks propel Wall Street to new heights with Microsoft and Apple leading the charge, up 1.8% and 1.5% respectively. A robust economy and strong economic data, including a surge in consumer confidence and new home sales, fuel the rally, dispelling recession fears.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.