GM and BRRR.

Regional banks are selling off again today, on the heels of yesterday’s bounce. The bankers are fearful and have continued their pleas for bailouts and backstops, which they’ll inevitably get in some form.

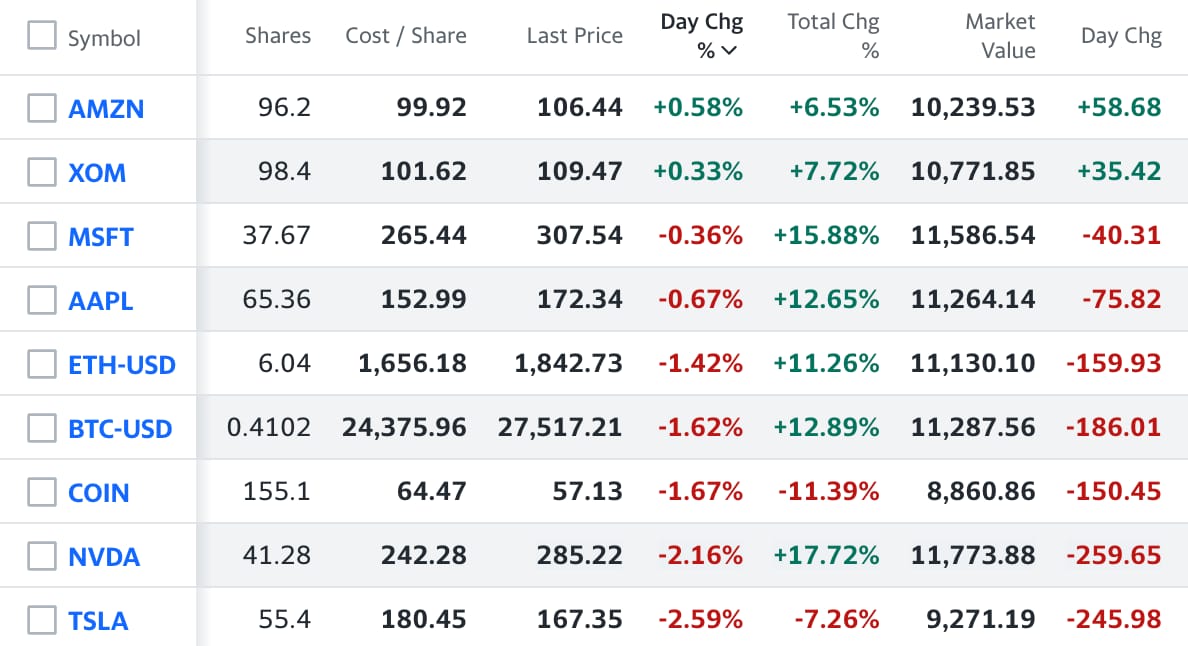

We also covered BRRR Portfolio company Coinbase today, as their CEO Brian Armstrong embarks on a tour of the UAE as he cozies up to a friendlier regulatory environment. The US has been outright hostile to crypto organizations of any kind - whether you’re playing by the rules like Coinbase does or not.

The Coinbase stock has seen a bit of weakness after doubling over the first two months of the year, as investors weigh the likelihood of continued strength and activity across the crypto economy.

Here’s what we brrr’d today:

Bankers Plea for Backstops and Safety Nets

Coinbase to US Regulators: “We’re Just Not That Into You”

Will the NASDAQ end the year higher than today's price of $12,200?

Bankers Plea for Backstops and Safety Nets

Regional banks experience sell-off: PacWest Bancorp, a Los Angeles-based lender, saw a 6.5% drop in early trading Tuesday, after an announced dividend cut failed to alleviate concerns about its stability.

Fed survey shows less demand for credit: A recent Federal Reserve survey released on Monday (SLOOS Report), showed 46.0% of banks tightened terms of credit on business loans for medium and large businesses, which indicates tightening credit conditions for US businesses and households in the first quarter.

Wall Street calls for more protection for bank deposits: Recently, many Wall Street executives and analysts have argued that only an intervention could stop the crisis, again asking the government to socialize their losses after years of privatizing the gains.

Fed Never Considered Hikes: The bank stress is due to the relationship between deposit and loan growth, faster deposit outflows, and 14 years of stress tests where the Fed never contemplated higher interest rates.

Reuters

Coinbase Explores New Hub in UAE

Coinbase executives in UAE: United States-based crypto exchange Coinbase’s CEO Brian Armstrong and executive team are meeting with industry leaders and policymakers in the UAE to discuss the potential for the region as a strategic hub for the company.

Expansion and regulatory discussions: Coinbase is working with regulators in the Abu Dhabi Global Market and Dubai’s Virtual Assets Regulatory Authority to potentially expand into the region, seeing the UAE as an exciting international hub that could serve the Middle East, parts of Africa, and other countries in Asia.

UAE’s growing web3 ecosystem: The UAE has been opening up opportunities for crypto firms and has established a legal framework for cryptocurrencies, making it an attractive location for investment and development of a web3 ecosystem.

US regulatory challenges for Coinbase: While CEO Brian Armstrong has criticized the lack of regulatory clarity in the US, he affirmed in a Q1 earnings call that there are no plans to move operations outside the country. Coinbase has previously engaged with US policymakers, including more than 30 meetings with SEC representatives over nine months, seeking feedback on its proposals.

AI ART OF THE DAY

Please like, comment or retweet!

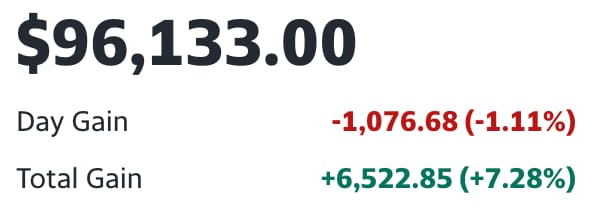

The BRRR’s Portfolio

Keeping our eyes on crypto

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.