GM and BRRR.

Let’s kick off one of the lowest volume trading weeks of the year with some China and central banking coverage.

This morning the Chinese government continued its asset-pumping campaign with a policy change that amounts to a tax cut on stock trading. The 0.1% levy on trading activity was cut to 0.05% and the mainland China stock index rallied by as much as 5% in reaction.

In addition to pressuring corporations into doing stock buybacks and coercing hedge funds out of shorting markets, the CCP has a full-court press inplace to support asset prices as their sluggish economic recovery continues in the post-covid world.

Domestically, analysts are reacting and commenting on Jerome Powell’s annual speech he gave from Jackson Hole, Wyoming on Friday.

Ultimately Powell reiterated the same rhetoric that he has parroted throughout 2023 - interest rates will remain higher for longer than the markets think because he is embarrassed and humbled by the out-of-control inflation he accidentally created.

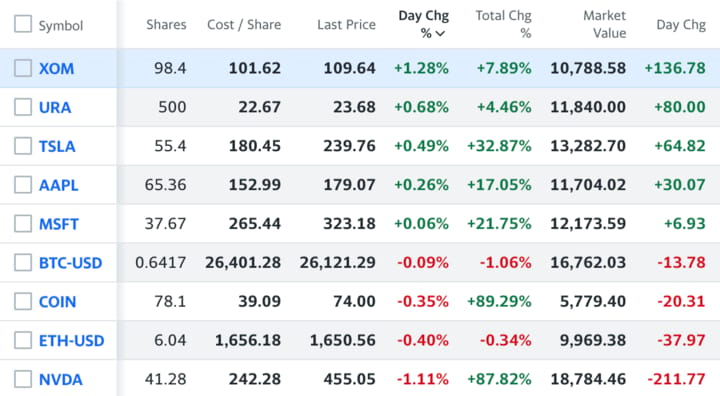

No portfolio moves today - but subscribing to the BRRR ($2/month or $10/yr) unlocks trade notifications and a full view of our actively managed portfolio (+21% since inception in March).

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Beijing Goes for Broke to Prop Up Stocks

Chinese stocks rallied strongly on Monday after authorities announced several measures aimed at boosting investor confidence and attracting capital back into the market.

The CSI 300 Index jumped over 5%, the most in 3 years, led by brokerage stocks. Regulators also said they would slow down the pace of IPOs, restrict share sales by major stakeholders in companies whose prices have fallen, and lower margin trading ratios.

Analysts said the force and scale of the new policies exceeded expectations and could lift market sentiment in the near-term. However, some questions remain on the durability of any rally, as authorities have struggled to reverse the ongoing slump amid a weak property market and consumer spending. Foreigners have sold mainland stocks for 13 straight sessions, the longest on record.

Stamp Duty Cut: The stamp duty cut is the first since April 2008, when China reduced it to 0.1% from 0.3% to stabilize markets after a plunge, leading to a bull run in 2009. This new reduction to 0.05% is estimated to bring in the equivalent of $103 billion in new funds per year.

Slowing IPOs: Regulators did not provide specifics on how they will slow IPOs after previously aiming to approve them at a faster pace. The vague pledge comes amid a slumping market and weak appetite for new offerings.

Curbing Insider Sales: Authorities restricted major shareholders from selling stock in companies trading below IPO prices or net asset value. This move could lock up around $36 billion in insider funds from exiting positions.

Macro News

Traders Betting on Coin Flip for Fall Fed Move

Federal Reserve Chair Jerome Powell's speech at the Jackson Hole economic symposium indicated the Fed may take a patient approach to further interest rate hikes for now, according to reactions from economists.

Powell emphasized proceeding "carefully" and said the Fed would balance the risks of tightening too much or too little. Economists said this signaled a high bar for additional hikes, with some expecting the Fed to stay on hold for upcoming meetings.

However, Powell noted the Fed could respond if inflation surprises to the upside or the labor market does not continue softening. The upcoming August jobs report will provide an important test of the Fed's patience.

Fed chair's cautious tone: Powell said the Fed would "proceed carefully" on rate hikes and balance tightening risks, with economists saying this sets a high bar for additional hikes. JPMorgan economist sees Fed on hold for several meetings based on Powell's tone.

Jobs report is key data point: Powell explicitly stated labor market not softening further could require a policy response. Jobs data has averaged 375,000 per month in 2022 but economists forecast just 165,000 jobs added in August. An upside surprise could push expectations of further tightening.

Markets see under 50% odds of September hike: Fed fund futures show only 36% odds of a September hike, though odds rise to 56% for November. Markets took Powell's speech as a dovish sign with 10-year Treasury yields ending last week just above 4.2%.

Today’s Reader Poll

In our Wednesday poll, we asked for your predictions for NVDA’s earnings report. Not a single person predicted a “Big Beat”, so no one gets the free month. 😬

Is Powell's cough indicative of a lie about his inflation target intentions?

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Trades

We opened a position in $URA last week - it’s an ETF that tracks the price of Uranium. We’ll publish our longer thesis on the reason soon, but as we wrote last week, we believe the Nuclear Energy narrative is gaining steam very quickly.

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Wednesday 8/9/23 9am: BUY 0.2315 $BTC @ $29,990

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.