GM and BRRR.

Markets are selling off in early trading today, in another edition of “good news is bad news” for stocks.

This morning’s jobs report from ADP revealed an unexpected surge in new hires, causing interest rate expectations to move higher, leading to a selloff in stocks.

While an impressive 497k new hires were added in June, the Leisure and Hospitality industry lead the way with 232k new hires of the 497k. Waiters and bartenders have plenty of optionality right now as Americans continue to travel and eat out.

Typically leisure and hospitality jobs aren’t the highest quality or economic growth nor are they high-earning, so the market reaction was fairly muted, with the Nasdaq down just over 1%.

However more impressively, construction industry new hires came in as the 2nd biggest contributor at 97k for the month.

As we zoomed into specific AI and crypto stories today, we want to highlight a story about Google’s adventure into AI chip production not going as well as they had hoped, and the ongoing legal battle between Gemini vs Genesis case.

Will The Fed cut Interest Rates at least once before the end of 2023?

AI: The Money Robots

Google's Custom Chips: Faster, Stronger, and Fashionably Late

Google's highly anticipated custom processor for Pixel smartphones has been delayed by at least a year, surprising industry insiders. Rather than rushing into the market, Google has decided to extend its partnership with Samsung and continue using their processors until 2025, before introducing its own chip.

Google's custom processor release postponed: Google had originally intended to launch its customized processor for Pixel smartphones in 2024, with the aim of replacing Samsung processors. Directly aimed at NVDA after previous comparisons, Google boasted of its custom chips performance as they positioned in the AI marketplace.

Advancements in custom-built processors: Google has been actively working on developing its custom-built processors, and in April, it highlighted the capabilities of these chips for creating AI models. Google's TPUs are 1.2 to 1.7 times faster and up to 1.9 times more power efficient than Nvidia's A100 chips. Google did not directly compare its fourth-generation to Nvidia's H100NVL chips, as those were released after Google's custom chips and utilize newer technology.

Pixel smartphone unit as a competitive player: Google has been intensifying its efforts in the Pixel smartphone unit as it competes with industry giants like Apple and Samsung in the lucrative smartphone market. The company has engaged in discussions with Indian companies to explore manufacturing Pixel phones in the country, signaling its intent to expand its market presence. Additionally, Google confirmed the introduction of its first foldable smartphone, the Pixel Fold, in May, showcasing its determination to innovate and capture consumer interest.

Our take: Google’s ChatGPT competitor, Bard, was also late to market and is objectively worse than ChatGPT. Google’s having a bit of an existential crisis in our opinion, as gen-AI poses a serious threat to its two-decade long domination of internet advertising.

Crypto: Digital Gold Rush

Gemini Vs DCG Legal Battle Heats Up

Gemini president, Cameron Winklevoss, is escalating his legal fight against Barry Silbert, the founder of Digital Currency Group (DCG), over alleged accounting fraud and the failure to recover over $1 billion in customer funds. Winklevoss has threatened further legal action against Silbert, whose company, Genesis Global Capital, filed for bankruptcy following a series of bad loans, leaving major creditors, including Gemini, out of pocket. Winklevoss has demanded a near $1.5 billion settlement for Gemini Earn customers and threatened to sue Silbert personally if DCG does not agree.

Fraud Allegations: Winklevoss reemphasized the allegations of fraud he first raised in January, accusing Silbert of acting recklessly and creating financial chaos for his customers. Silbert's lending arm, Genesis Global Capital, had partnered with Gemini on its Gemini Earn program which lent out customers' crypto to generate yield, but filed for bankruptcy after bad loans, owing more than $3.5 billion to its largest creditors.

Demand for Settlement: Winklevoss is pressuring Silbert to settle with creditors by the end of the week, putting forth a "Final Offer" of nearly $1.5 billion to Gemini Earn customers. He has threatened personal legal action against Silbert if this is not met and has pledged to file a turnover motion, forcing DCG to distribute its assets to a third party.

Further Legal Complications: Adding to the complexity of the situation, bankrupt crypto exchange FTX is also suing Genesis, seeking to reclaim about $3.9 billion in cash and crypto assets. FTX lawyers allege that Genesis was instrumental to its fraudulent business model, a claim that Genesis denies and is contesting.

AI Art of The Day

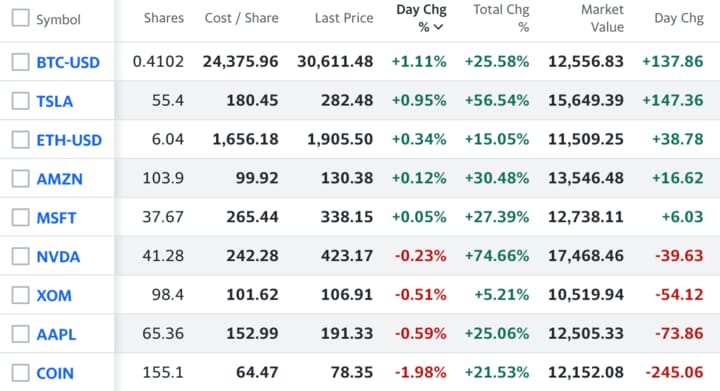

The BRRR’s Portfolio Update

Cooling today as profit-taking ensues. We are considering shifting half of our COIN exposure to AAPL after the recent run-up.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.