TheBRRR’s Thoughts

GM.

We’ve got a surprisingly busy week of economic data despite the Independence Day holiday on Thursday.

We expect the trend of cooling m/m and y/y price inflation + worsening job market to continue to rear its head, lending a helpful hand to JPowell and the Federal Reserve in their mission to pump the economy without igniting another round of inflation.

The major stock indexes have continued to chop sideways since mid June while bitcoin has continued to trade within its multi-month range between $60k and $70k.

Risk asset markets are awaiting the next liquidity injection from the US Treasury Department and/or the Federal Reserve to move higher, and we continue to expect to see it ahead of the November election.

We’ve got fairly broad world coverage today previewing the economic week ahead, providing an update on the French election and the country’s conservative shift, and also digging into an emerging narrative of Big Tech seeking partnership with low-cost energy producers - this time in the nuclear space - as they look to power AI data centers as efficiently as possible.

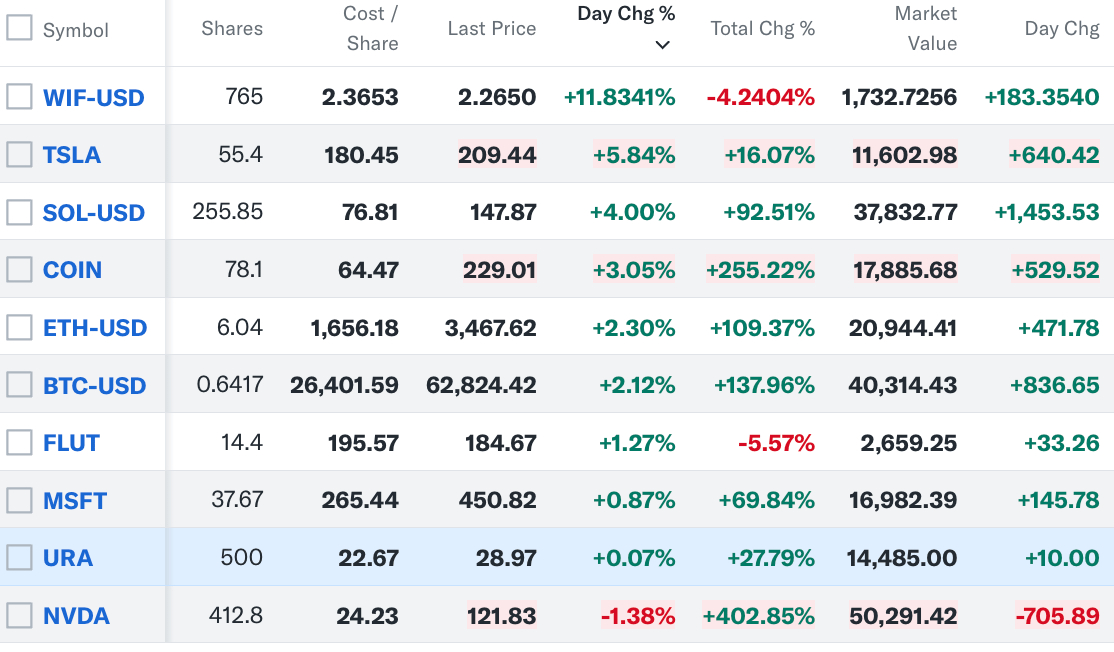

Crypto, AI, and nuclear energy are the key investing opportunities we see in the months and years ahead and we express this in our portfolio construction.

The Holiday-Shortened Week Ahead

This week promises significant economic activity despite the July 4th holiday. Here's a detailed breakdown of the key events and additional context to keep an eye on.

Key Economic Events:

Monday:

US ISM Manufacturing Index: The latest reading fell to 48.5, down from 48.7, indicating continued contraction in the manufacturing sector. This marks the 18th contraction in the last 19 months, reflecting ongoing challenges in demand and output stability (Investing.com) (Advisor Perspectives).

German CPI: This will provide insight into inflation trends within Europe's largest economy.

Tuesday:

US JOLTS Report: Job openings are expected to drop to 7.75 million, signaling a potential cooling in the labor market.

Powell and Lagarde Speak: Both central bank heads will be at the ECB's Sintra conference, likely offering insights into future monetary policy directions.

Wednesday:

US Services ISM: This will offer a snapshot of the non-manufacturing sector's health.

FOMC Minutes: Investors will parse these for clues on the Fed's future rate path, especially after the hawkish surprises from the last meeting (Advisor Perspectives).

China's Caixin Services PMI and Eurozone PPI: Additional data points to gauge global economic momentum.

Thursday:

UK Election: Political shifts here could impact markets, particularly in the context of Brexit-related economic adjustments.

Friday:

US Employment Report: Expected payrolls growth is 225k, with unemployment likely holding steady at 4%. This data is critical for assessing the labor market's strength and potential Fed responses (Advisor Perspectives).

European Political Context:

French Elections:

The French legislative election's first round, held on June 30, saw the far-right National Rally (RN) leading with 33.15% of the vote. This performance, though strong, slightly underperformed some expectations. The left-wing New Popular Front (NFP) garnered 28.14%, while President Macron’s Ensemble coalition received 21.27%. Les Républicains (LR) and other right-wing candidates captured 10.22% of the vote. The high turnout and fragmented vote have led to an unprecedented number of three-way runoffs expected in the second round on July 7 (Wikipedia) (2024 European election results) (POLITICO).

Key Points:

RN Dominance: Led by Marine Le Pen, the RN has solidified its position as a major political force, leveraging discontent with Macron’s administration.

NFP and Ensemble: The left-wing coalition slightly outperformed expectations, indicating robust grassroots support. Macron’s party, while still significant, shows declining influence.

Contextual Insights:

Macron’s Gamble: The snap election was a high-risk move by Macron following poor results in the European Parliament elections, where RN secured 31.5% of the vote, more than doubling the support for Macron's Renaissance party (POLITICO).

Potential Outcomes: The fragmented nature of the vote could lead to a hung parliament, potentially causing political instability and forcing another snap election within a year if no bloc secures a majority (Wikipedia) (2024 European election results).

Additional Market Insights:

Q2 Performance Review: The S&P 500 continued to reach new highs, driven by significant tech stock gains, despite broader market challenges. Sovereign bonds faced headwinds as slower rate cuts were priced in. The ECB’s recent rate cut added a dovish tone to European rate expectations (Advisor Perspectives).

Market Implications:

US Employment Data: With expectations of payrolls increasing by 225k, this week's JOLTS data will provide a more immediate gauge of labor market tightness. Investors should closely monitor these reports for signs of economic resilience or further slowdown (Investing.com) (Advisor Perspectives).

This week is crucial for understanding both macroeconomic trends and market sentiment, given the mix of critical data releases and high-profile speeches. Stay tuned for updates as these events unfold.

Big Tech Partnering With Nuclear Power For AI Data Centers

Big tech companies like Amazon and Microsoft are actively pursuing deals with nuclear power providers to fuel their data centers, especially those needed for artificial intelligence (AI) workloads. This shift towards nuclear energy aims to meet the surging power demands of AI while aligning with carbon reduction goals.

Current Developments

Amazon Web Services (AWS) and Constellation Energy:

AWS is negotiating with Constellation Energy, the largest owner of nuclear power plants in the US, to supply clean energy to its East Coast data center. This isn't AWS's first foray into nuclear energy. Previously, AWS acquired Talen Energy's data center campus next to a 2.5 GW nuclear plant in Pennsylvania (E&E News by POLITICO) (Data Center Knowledge).

Microsoft's Nuclear Ambitions:

Microsoft plans to build nuclear-powered data centers and has already partnered with Helion Energy, a company specializing in nuclear fusion. This deal includes the future purchase of electricity from Helion’s fusion plants. Additionally, Microsoft is hiring nuclear technology experts to advance these initiatives (GeekWire) (TechPowerUp).

Small Modular Reactors (SMRs):

SMRs are emerging as a practical solution for powering data centers due to their smaller size and modular nature, which allows for easier and faster deployment compared to traditional large reactors. Companies like NuScale Power and Oklo are leading the development of these reactors, which can provide scalable and clean energy solutions (Data Center Knowledge).

Implications and Challenges

Energy Demand and Grid Stability:

The integration of nuclear power for data centers could divert existing electricity resources, potentially raising utility prices and impacting grid reliability. The increased demand from AI and data centers is expected to drive a significant rise in electricity consumption, with estimates predicting growth from 2.6% to 4.7% over the next five years (E&E News by POLITICO) (GeekWire).

Environmental and Economic Impact:

While nuclear energy offers a clean alternative to fossil fuels, the rapid uptake by tech firms could strain the current infrastructure. This scenario necessitates the construction of new nuclear plants to maintain balance and prevent price hikes for consumers. SMRs and advancements in nuclear fusion are seen as pivotal in meeting these future demands (Data Center Knowledge) (TechPowerUp).

Future Prospects

The push towards nuclear-powered AI data centers highlights a broader trend of tech companies seeking sustainable and reliable energy sources to support their growing computational needs. This collaboration between tech giants and nuclear power providers is not only pivotal for the AI boom but also crucial for achieving long-term climate goals. As the technology and infrastructure for nuclear energy continue to evolve, it will play an increasingly significant role in the energy landscape of the future.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll