TheBRRR’s Thoughts

GM, crazy short week before Thanksgiving.

Interesting developments at OpenAI have unfolded, with Sam Altman's unexpected return as CEO contingent on significant board changes.

OpenAI had been firing on all cylinders under Altman’s leadership, so it’s a win for the AI space to have continuity at the top.

NVDA crushed their earnings report yesterday. This further solidifies their leadership position amidst the ever-growing AI and tech landscape in need of their processors.

On the crypto front, the US DOJ's landmark settlement with Binance and CZ marks a pivotal moment in crypto regulation and market stability. Tearing up the podium, Janet Yellen said Binance committed “consistent and egregious violations” of US law that “allowed illicit actors to transact freely.”

It’s quite the stretch, as law enforcement agents universally agree that blockchain-based money laundering is much easier to sniff out and seize given the open and transparent nature of the public ledger.

In power(ful) news, Uranium's price surge to over $80 per pound, a level unseen since 2008, and a 173% increase since 2020, highlights its growing importance in the clean energy sector. This reinforces our position in our portfolio, as it is now up 25% so far.

Editor’s Note: We’ve released V1 of our technical analysis chatbot. Premium subscribers can see the link in the premium section at the bottom of the email. I released a preview of what it can do in this post, where I ask it to analyze the daily and hourly bitcoin charts.

AI News

Reinstated: Altman's OpenAI Odyssey

credit: Devesh @theywayshhh on X

WHAT HAPPENED:

Dramatic Reinstatement: Sam Altman is back as CEO of OpenAI after a whirlwind of events, including his unexpected dismissal and a frenetic five-day negotiation.

Board Restructuring: OpenAI is revamping its board, dismissing several members who faced scrutiny over their decision to oust Altman.

New Board Composition: The new board includes Bret Taylor (former Salesforce co-chief executive), Larry Summers (former U.S. Secretary of the Treasury), and Adam D’Angelo (Quora founder), with Taylor as the chair.

Microsoft's Reaction: Microsoft, 50% equity owner of OpenAI, quickly offered Altman a leadership role in a new AI group following his dismissal. The company was surprised by OpenAI’s initial decision but supports the latest developments.

WHY IT MATTERS:

Stabilizing OpenAI's Leadership: Altman's return brings stability to OpenAI, a company considered a key player in the AI industry.

Enhanced Microsoft Partnership: Analysts anticipate a stronger and more integrated partnership between OpenAI and Microsoft, with Microsoft likely to play a more significant role moving forward.

Strategic and Operational Impact: Altman's leadership style and vision are expected to significantly influence OpenAI's future direction, with a focus on maintaining the startup culture beneficial for AI development.

Unconventional Structure: OpenAI's original nonprofit setup and its transition to a for-profit model under a nonprofit's control have led to complexities in governance, sparking debates around its mission and commercial success.

TechCrunch, Reuters, TechXplore

NVIDIA Shatters Expectations with Stellar Q3 Earnings

WHAT HAPPENED:

Record Revenues: NVIDIA reported a record $18.12 billion in revenue for Q3 2023, a 206% increase from the previous year and a 34% rise from the previous quarter.

Earnings Per Share Surge: The company's GAAP earnings per diluted share were $3.71, a significant jump from $0.27 a year ago. Non-GAAP earnings were $4.02 per share, exceeding the consensus estimate of $3.36.

Data Center Dominance: A major highlight was the record Data Center revenue of $14.51 billion, marking a 279% increase year-over-year.

Favorable Forecasts: NVIDIA's outlook for Q4 2024 includes expected revenue of $20.00 billion and improved gross margins.

Stock Performance: Post-earnings announcement, NVIDIA shares saw a 1.1% rise, reflecting positive investor response despite initial concerns over U.S. export curbs impacting sales in China.

WHY IT MATTERS:

Market Leadership: NVIDIA's impressive earnings underscore its dominant position in the tech sector, especially in data center and AI technologies.

Investor Confidence: The significant earnings beat and stock rise demonstrate strong investor confidence in NVIDIA's growth trajectory.

Forward-Looking Outlook: The company's positive forecast for the upcoming quarter signals continued growth momentum despite potential geopolitical challenges.

Impact on Tech Stocks: NVIDIA's performance is a bellwether for the broader tech sector, indicating robust demand for high-performance computing and AI technologies.

Crypto News

CZ and Binance Settle With US Law Enforcement in $4B+ Deal

WHAT HAPPENED:

Dramatic Announcement: In a high-profile press conference, the US Department of Justice announced a historic settlement with Binance and founder Changpeng Zhao, known as "CZ", with fines exceeding $4.3 billion.

Settlement Details: The settlement includes CZ's guilty plea to violations of U.S. anti-money laundering laws. CZ has agreed to step down from the company and may face jail time, pending the judge’s discretion.

CEO Succession Talks: Amidst the fallout, Richard Teng emerges as the successor to helm the world's largest crypto exchange.

WHY IT MATTERS:

Bullish for Crypto: The settlement removes uncertainties and dispels rumors of Binance's insolvency. This could be seen as a positive development, fostering confidence in the industry.

Proving Solvency: Despite over $950 million in net outflows following the announcement, Binance's ability to process these withdrawals efficiently demonstrates its financial robustness. This contrasts sharply with the FTX situation, where customer withdrawals were halted due to misuse of funds.

Market Stability: Binance's stability in handling the outflows and its substantial reserves, valued at over $67 billion, help in maintaining overall market confidence, reducing the risk of a wider industry contagion.

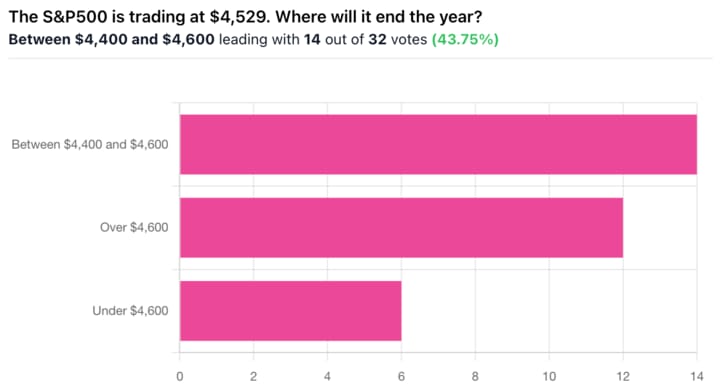

Today’s Reader Poll

We asked for your predictions on S&P500 annual performance this past Monday as a continuing gauge for sentiment. Opinions seem to be in flux (like the markets):

Subscriber “jackie”, voting the over, had some great input:

“The momentum of the market. Also, historically, January - October is a good market, but November - January has been +10% over ~ 37 out of 38 years."

AI Art of the Day

Premium Subscriber Section

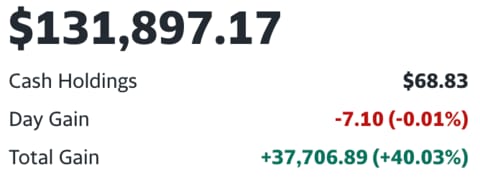

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Notes

Wednesday 11/15/23: We think our allocation remains strong so we haven’t actively traded much. Sometimes there is benefit to doing nothing and letting your winners run.

Latest Trades

Friday 10/13/23 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.