still The Sunshine State

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR.

Happy Friday, everyone. Interesting news stories today, as we continue to witness more drama unfolding in the crypto world via Binance and their SEC admirers, and Tesla may now supercharge your General Motors product (eventually).

As regulatory pressure mounts, Binance.US announced that its banking partners will pause their relationship with the exchange starting next week. This comes after the Securities and Exchange Commission (SEC) filed 13 charges against Binance and its owner, Changpeng Zhao, citing violations of U.S. securities laws. This move has significant implications for Binance.US customers, who will no longer be able to use U.S. dollars to buy cryptocurrencies on the platform.

Elsewhere, the automotive industry is witnessing a shocking collaboration that would make even the most seasoned car enthusiasts do a double take. Tesla, the trailblazing EV pioneer, has opened its Supercharger network to rival General Motors. With this partnership, Tesla has come a long way, demonstrating that even the most formidable rivals can come together in the pursuit of advancement. Although, we would be remiss to not include a great article on EVs by the renowned Rowan Atkinson (Mr. Bean to many of us), just for your consideration.

Here’s what we’ve BRRR’d:

Binance's Banking Breakup: SEC Throws Shade on Crypto Party

GM Teams Up with Tesla, Prepares for Shocking 'E-Volution'

Binance's Banking Breakup: SEC Throws Shade on Crypto Party

Binance banking fallout: Binance.US announced that its banking partners will pause their relationship with the exchange starting June 13, impacting its ability to conduct business in the US. This move comes amidst intense scrutiny from the SEC, which recently filed 13 charges against Binance and its owner.

SEC complaint targets banking: The SEC has filed a civil complaint against Binance and its founder, Changpeng Zhao, alleging violations of US securities laws. The complaint specifically focuses on Binance's offshore holding companies and their movement of billions of dollars in assets.

Binance.US disables USD transactions: Binance.US has disabled customers' ability to buy and deposit US dollars due to the SEC's claims. The exchange made this decision preemptively, and customers can still convert their funds to stablecoins and withdraw them.

Banks say Binance “too risky”: Binance's banking partners, including Axos Bank, Cross River Bank, and others, have signaled their intent to pause their relationships with the exchange. Suggests that partners consider Binance to be a risky client and highlights the impact of SEC charges.

Uncertainty over remaining partners: It is unclear which banking partners Binance has retained after several partners have already stopped serving the exchange. The disclosed partners had processed billions of dollars in transactions for Binance.US, as per documents provided to the SEC.

GM Teams Up with Tesla, Prepares for Shocking 'E-Volution'

Tesla's stock rallies: Tesla's stock is experiencing a notable surge, rising by 27.4% over the past 10 trading days. Stock is poised for its longest winning streak since January 2021, reflecting strong investor confidence.

Tesla-GM charging agreement: GM vehicle owners gain access to Tesla's Supercharger network in North America, similar to the Tesla-Ford agreement. Predicts that this collaboration could contribute $3 billion to Tesla's EV charging revenue in the coming years.

Analyst sets Tesla's price target at $300: Wedbush analyst Daniel Ives raises Tesla's price target from $215 to $300. Added to Wedbush's "best ideas list," highlighting its potential for growth.

GM-Tesla partnership strategy: Ives lauds GM's collaboration with Tesla, describing it as a strategic move. The partnership showcases GM's commitment to the EV market and willingness to collaborate for mutual benefit.

Positive outlook for Tesla: Tesla is on track to meet its delivery target of 1.8 million units this year, indicating strong demand with anticipated margin improvements in the next 1-2 quarters for a positive outlook for Tesla's profitability. The upcoming Cybertruck launch is expected to drive further growth for Tesla in the electric vehicle market.

AI ART OF THE DAY

Today’s AI Art of the Day features a Tesla Corvette. Maybe a Plaid version?

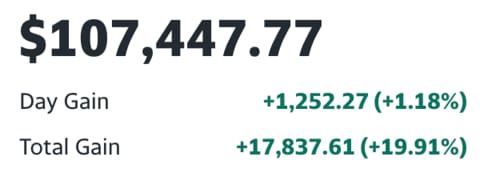

The BRRR’s Portfolio

Supercharged by Tesla, helped by Big Tech; can’t really complain with near 20% total gain. Maybe it’ll beat inflation 😅

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.