Cathie Wood sad

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR.

A compromise deal to raise the debt ceiling for 2 years appears imminent. R's and D’s will cap spending on everything besides the military - because we can’t say no to everything besides war.

Assets are rallying across the board in response.

This continuation rally is in the face of a bad core inflation print reported this morning. The 4.4% y/y rise in core inflation could give the Fed second thoughts about their expected decision to leave interest rates unchanged for the first time at an FOMC meeting in years.

We think they’ll keep the path and leave rates as-is next month, but this does change the probability of their action slightly, on the margin.

We’ve got nice summaries of both news stories in today’s issue.

Have a great weekend everyone.

Here’s what we BRRR’d today:

Debt Ceiling Deal Appears Imminent

Fed Inflation Indicator Re-Accelerated in April

Debt Ceiling Deal Appears Imminent

Potential Debt Deal: As the U.S. approaches its estimated default date of June 5, House GOP and White House negotiators are close to an agreement to raise the debt limit and cap federal spending for two years, according to Bloomberg. The specifics are still being worked out, including the cap amount. As part of the emerging agreement, defense spending is expected to increase by 3% next year.

Key Deal Components: The proposed deal includes provisions to upgrade the nation's electric grid to support renewable energy, a Democrat priority, and expedite permits for fossil fuel projects, as demanded by Republicans. The deal also anticipates cutting $10 billion from an $80 billion increase for the IRS that was part of the Inflation Reduction Act, amid Republican concerns about a surge in audits.

Impact of Deal: The potential agreement would largely cap all spending except for defense. The House GOP's plan suggests a spending reduction of $130 billion for fiscal year 2024, approximately 0.5% of GDP. According to reports, the White House may cap FY24 nondefense discretionary spending at FY23 levels, reducing spending by about 0.1% of GDP. Hence, the federal spending reduction for FY24 could range from 0.1% to 0.5% of GDP.

Freedom Caucus Response: There is uncertainty over whether the House Freedom Caucus will accept the emerging deal. As the proposed agreement seems to fall short of the Republicans' initial request, which included raising the debt ceiling through March in exchange for 10 years of spending caps, the Freedom Caucus appears hesitant. They have sent a letter to Speaker Kevin McCarthy urging him to stand firm.

Fed Inflation Indicator Re-Accelerated in April

Rise in U.S. Prices and Inflation Rate: The cost of goods and services in the U.S. increased by 0.4% in April, indicating that the inflation rate remains within the 4% to 5% range. This situation is complicating the Federal Reserve's decisions regarding interest rate hikes. The increase in the personal consumption expenditures (PCE) index, the Fed's preferred measure of inflation, was slightly higher than Wall Street forecasted in April (4.4% vs 3.9% expected)

Shifts in Core PCE Index: Despite lower gasoline prices and slower food cost increases contributing to a decrease in the overall inflation rate, the core PCE index, which excludes food and energy, suggests that efforts to reduce inflation may have stalled, rising by 0.4% in the last month. This index is viewed by the Fed as the most reliable predictor of future inflation trends.

Implications for Federal Reserve Decisions: The current inflation situation poses significant challenges for senior Fed officials in determining actions for their upcoming June meeting. While there's an inclination to skip another rate increase in June to assess the impact of previous increases on the economy, the consistent rise in the PCE indexes might increase concerns.

AI ART OF THE DAY

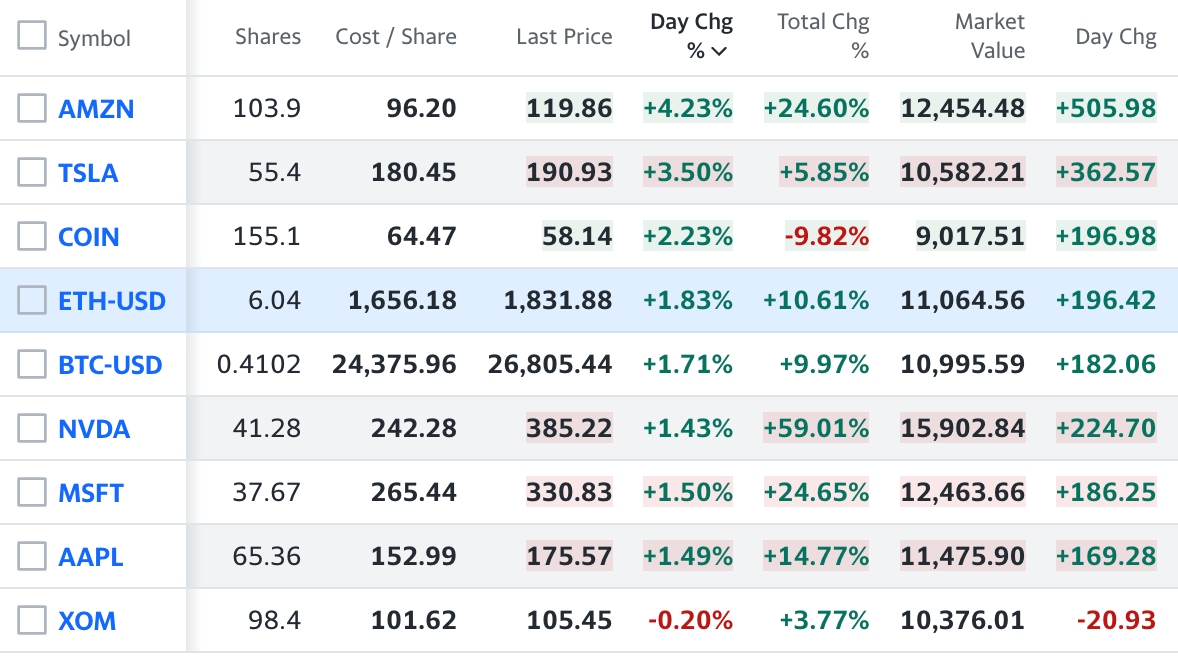

The BRRR’s Portfolio

Nvidia single-handedly saved the market this week. What debt ceiling?

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.