TheBRRR’s Thoughts

While legacy markets are mostly flat, bitcoin’s up 7% since our Friday newsletter - breaking above $50k for the first time since 2021.

On Friday we pointed out that bitcoin “often steals the show for days or weeks at a time” when the momentum is driven from external capital flows, like we’re currently seeing with the ETFs.

Other crypto assets are also gaining, but bitcoin remains one of the top performers.

The inflows from the Blackrock and Fidelity ETFs have been relentless, and bitcoin seems poised to retest its all-time high of $69k in the coming months.

Microsoft Cloud's AI Charge: Catching Up To Amazon’s AWS

WHAT HAPPENED:

Eclipsing AWS: Microsoft's Azure is rapidly closing in on Amazon Web Services, buoyed by a significant AI push and a fruitful partnership with OpenAI. Once half the size of AWS, Azure now commands about three-quarters of AWS's market share.

Impressive Growth: Azure's revenue soared by 30% this quarter, starkly outpacing AWS's 13% growth, highlighting Microsoft's aggressive expansion and effective strategy.

AI as a Catalyst: A notable chunk of Azure's growth is attributed to its AI ventures, especially the integration of GPT-4, which significantly contributed to a jump in Azure's cloud services revenue.

WHY IT MATTERS:

Shifting Dynamics: Microsoft's swift ascent in the cloud hierarchy, powered by AI, signifies a potential shift in cloud dominance, challenging AWS's long-standing lead.

Strategic Mastery: Leveraging AI not only showcases Microsoft's innovation but also represents a strategic masterstroke in attracting a new wave of tech-driven companies seeking cutting-edge AI capabilities for their cloud infrastructure.

Economic Impact: Azure's growth trajectory is a key profit engine for Microsoft, bolstering its financials and market valuation, and solidifying its position as a tech titan with significant influence over future tech landscapes.

Looking Ahead: With Azure's momentum and the growing importance of AI in cloud services, Microsoft is poised to redefine cloud market leadership, making it a battleground of technology, strategy, and innovation.

Escalating Real Estate Challenges for US Regional Banks: A Data-Driven Analysis

WHAT HAPPENED:

Exposure Deepens: New York Community Bancorp's (NYCB) recent earnings have put a spotlight on the vulnerability of regional banks to commercial real estate (CRE) loans. This sector's distress is not isolated, as small banks account for nearly 70% of all CRE loans outstanding, a significant concentration that signals broader systemic risks.

Market Jitters: The backdrop of this concern is the memory of Silicon Valley Bank's collapse in Spring 2023, which sent shockwaves through the banking sector. NYCB's shares took a steep dive of about 60% following its earnings release, echoing fears of a domino effect among regional banks.

WHY IT MATTERS:

Interest Rate Sensitivity: The persistent high-interest rate environment exacerbates the pressure on CRE loans. According to Apollo, this situation places banks in a precarious position as they navigate the dual challenges of rate sensitivity and loan defaults.

Rising Delinquency Rates: Fitch forecasts CMBS delinquency rates to climb to 8.1% in 2024, up from lower rates in previous years. This uptick is particularly concerning for commercial multifamily properties, which are expected to see delinquencies increase to 1.3% in 2024 from 0.62% in 2023.

NYCB's Unique Position: Over half of NYCB's multifamily loan portfolio is tied to properties in New York State, many under rent regulation. The default rate for New York’s rent-stabilized housing jumped from 0.32% in April 2020 to 4.93% in December 2023, reflecting the compounded pressures of the pandemic and regulatory changes.

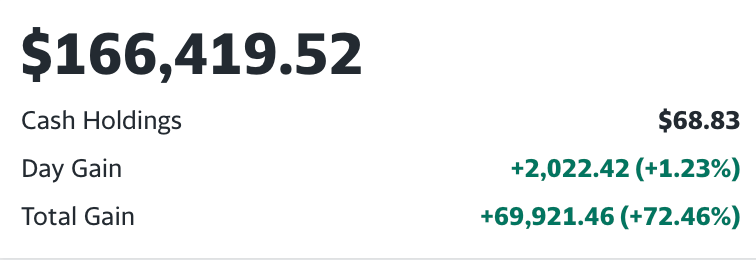

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 90+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll