TheBRRR’s Thoughts

Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

The Week’s Macro Snapshot: AI Ascends, Crypto Roars, and Bitcoin Hits $100K

This week delivered seismic shifts in the worlds of tech, crypto, and macroeconomics. Bitcoin shattered the $100,000 barrier, fueled by a crypto-friendly political pivot under President-elect Trump. Meanwhile, OpenAI cemented its dominance, hitting a staggering 300 million weekly active users as it races to define the AI arms race. The libertarian ethos of free markets echoed across these developments, challenging centralization and regulation, and exposing lucrative opportunities for traders and investors unshackled by convention.

In macro trends, Sam Altman of OpenAI boldly forecasted the arrival of AGI within a year, promising economic transformation and white-collar disruptions with the rise of autonomous AI agents. Simultaneously, OpenAI’s meteoric rise coincided with geopolitical chess moves in tech, as Elon Musk’s xAI ramped up its challenge to Altman’s dominance. Amid this, the U.S. dollar slipped as markets anticipate policy shifts, further underscoring the shifting power dynamics in finance and innovation.

The future isn’t just coming—it’s here. Below, we dissect the week’s pivotal developments with actionable insights for the investor looking to thrive amidst rapid innovation and relentless volatility.

Bitcoin Crosses $100K: A Crypto Coup

Synopsis: Bitcoin surged past the psychological $100,000 mark, buoyed by the announcement of crypto-supporter Paul Atkins as the incoming SEC chair under President-elect Trump. This marks a turning point for digital assets, signaling a potential thaw in the regulatory freeze that’s long hindered crypto’s broader adoption.

The Details:

Bitcoin hit $100,000, its highest valuation ever, fueled by optimism over Atkins’ deregulatory stance.

Altcoins rallied on the news, with increased institutional flows expected as regulatory clarity improves.

Trump’s pick of Atkins highlights his broader strategy to make the U.S. a hub for financial and crypto innovation.

Why It Matters: Bitcoin’s rise reasserts its role as a hedge against fiat devaluation, particularly as the USD weakens. With a crypto-friendly administration incoming, expect volatility and upward momentum in the digital asset space. Look to institutional-grade products and ETFs for exposure.

AI Arms Race: OpenAI Hits 300M Users

Synopsis: OpenAI has solidified its dominance in the generative AI space, boasting 300 million weekly users and targeting 1 billion by 2025. With a $157 billion valuation and aggressive expansion plans, the Microsoft-backed company is positioning itself as the vanguard of an industry projected to surpass $1 trillion in annual revenue.

The Details:

User Growth: OpenAI added 50M active users in weeks, signaling insatiable demand for AI applications.

Strategic Moves: Recently hired Coinbase CMO Kate Rouch to spearhead user acquisition campaigns.

Market Disruption: OpenAI’s ChatGPT now competes directly with Google in search functionality.

Why It Matters: Generative AI is transforming industries, creating winners and losers at unprecedented speed. Watch for AI agent adoption as companies replace human labor in knowledge-intensive roles. Investors should consider exposure to AI infrastructure stocks like semiconductors and cloud platforms benefiting from this exponential growth.

Sam Altman’s Vision: AGI and Economic Upheaval

Synopsis: OpenAI’s CEO Sam Altman predicted that Artificial General Intelligence (AGI)—AI matching human cognitive ability—could arrive as soon as next year. While he downplayed immediate existential risks, Altman warned of significant economic disruption as AI agents transform the workforce.

The Details:

Altman foresees AGI by 2025, with job turnover accelerating faster than any prior industrial revolution.

Autonomous AI agents will redefine white-collar work, creating profound productivity gains while displacing traditional roles.

Why It Matters: The rapid onset of AGI may deliver asymmetric opportunities for companies at the cutting edge of AI adoption. Investors should monitor automation tech and enterprise AI deployment trends for potential early movers.

Crypto Regulation Reset: Paul Atkins’ Appointment

Synopsis: Trump’s selection of Paul Atkins as SEC chair marks a watershed moment for crypto. Atkins, a staunch advocate of free-market principles, represents a dramatic shift from the punitive enforcement-first regime under outgoing SEC Chair Gary Gensler.

The Details:

Atkins’ deregulatory ethos aligns with Trump’s pro-crypto agenda, aiming to attract innovation and capital.

The crypto industry, long battered by regulatory overreach, sees this as a green light for growth and adoption.

Why It Matters: Regulatory clarity could unleash a wave of innovation in decentralized finance and blockchain technology. Look to early-stage crypto projects and DeFi platforms for asymmetric growth potential.

DeFi: Shaping the Future of Finance

Explore how DeFi Technologies Inc. (CAD: DEFI & US: DEFTF) bridges traditional finance and the $3T digital asset market. With innovative strategies and global expansion, DeFi is redefining the investment landscape. Gain exposure to Bitcoin, Web3, and beyond with regulated, secure solutions.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

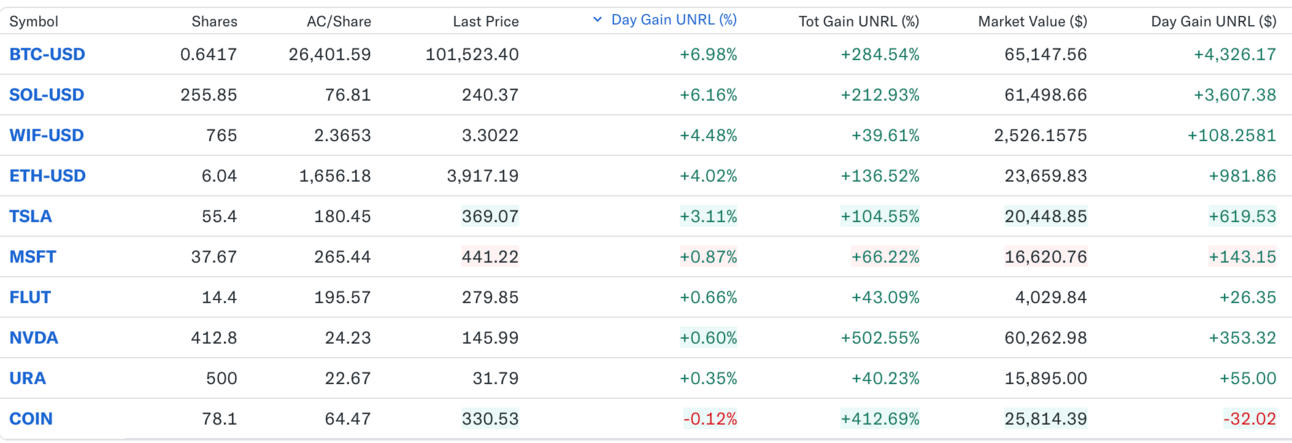

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

Monday November 4 2024: We haven’t updated the portfolio below, but we’re buying AI memecoin GOAT at its current $520m valuation as the fastest horse in a broad crypto rally post-election.

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll