TheBRRR’s Thoughts

The only major macroeconomic data released today was the Bureau of Labor Statistics seasonal revisions to CPI data for the last 6 months.

The revisions were minor overall - essentially revising inflation data mildly lower while smoothing out the month to month gyrations to present a more consistent trend.

TL;DR: a nothingburger. Proceed with a bullish bias for risk assets.

In tandem, and perhaps not unrelatedly, bitcoin ETFs are experiencing massive inflows with $400m reported yesterday.

Bitcoin surges driven by capital external to the crypto ecosystem tend to be highly reflexive.

As crypto-native capital and participants take notice of bitcoin’s outperformance, they often rotate out of their altcoin holdings and into bitcoin to catch and accelerate the move.

We’re seeing this today. In order to find a crypto asset up more over the last 24 hours than bitcoin is, you need to go down the market cap list to the #33 asset, a crypto-AI crossover project called Bittensor ($TAO).

Bitcoin often steals the show for days or weeks at a time before cooling off. When it does, the capital rotates back into altcoins and you see wild outperformance as traders chase risk.

We’re covering these two stories in depth below.

December Inflation Revised Lower

WHAT HAPPENED:

Stock Market Movements: On Friday morning stocks inched higher with the S&P 500 breaking above the 5,000 level for the first time, marking a significant psychological milestone. This comes after the government reported a lower-than-initially reported inflation rate for December.

Inflation Update: The December consumer price index (CPI) was revised down to a 0.2% increase from the initially reported 0.3%. Core inflation remained unchanged.

Overall Market Sentiment: Positive, driven by solid earnings season, easing inflation data, and a resilient economy.

WHY IT MATTERS:

Psychological Milestone: The S&P 500 crossing the 5,000 mark is not just a number but a significant psychological level for investors, indicating market confidence and the potential for future growth.

Inflation and Federal Reserve: The lower revised inflation figures for December provide more room for the Federal Reserve to potentially cut interest rates later this year, easing monetary policy concerns.

Market Outlook: The anticipation of Federal Reserve rate cuts, based on futures market pricing, suggests a positive outlook for the stock market, with traders expecting a steady rate in March followed by cuts starting in May.

Bitcoin ETFs Saw $403M In Net Inflows Thursday, Price Tops $47K

Today's Crypto Spotlight: Bitcoin ETFs Surge and Market Dynamics

Bitcoin ETFs Experience Monumental Inflows:

Record Inflows: Bitcoin ETFs witnessed their third-largest inflow day on record, with a massive $403 million pouring into spot Bitcoin ETFs. Blackrock’s iShares Bitcoin Trust (IBIT) alone accounted for over $200 million of these inflows, highlighting a significant shift in investor preference towards these investment vehicles.

Demand Indicator: These inflows have pushed the total net investment into spot Bitcoin ETFs to an impressive $2.23 billion since their launch, underlining strong demand for Bitcoin in the market.

Market Movements and Sentiment:

Bitcoin's Price Rally: Following these substantial inflows, Bitcoin's price soared, nearing the $48,000 mark and erasing previous 'sell the news' losses. This rally occurred as Bitcoin ETFs, including BlackRock's IBIT, Fidelity, ARK 21Shares, and Bitwise, absorbed significant capital, reducing the market supply of Bitcoin and sending a bullish signal to the market.

Institutional Interest: The significant net inflows and Bitcoin's price response underscore the growing institutional appetite for Bitcoin, suggesting a robust confidence in its long-term value proposition.

Halving Event on the Horizon: The upcoming Bitcoin halving, set to reduce the block reward from 6.25 BTC to 3.125 BTC, is anticipated to further tighten supply amidst growing demand, potentially driving Bitcoin's price to new highs. Historical precedents of bull runs following halving events support this expectation.

Premium Subscriber Section

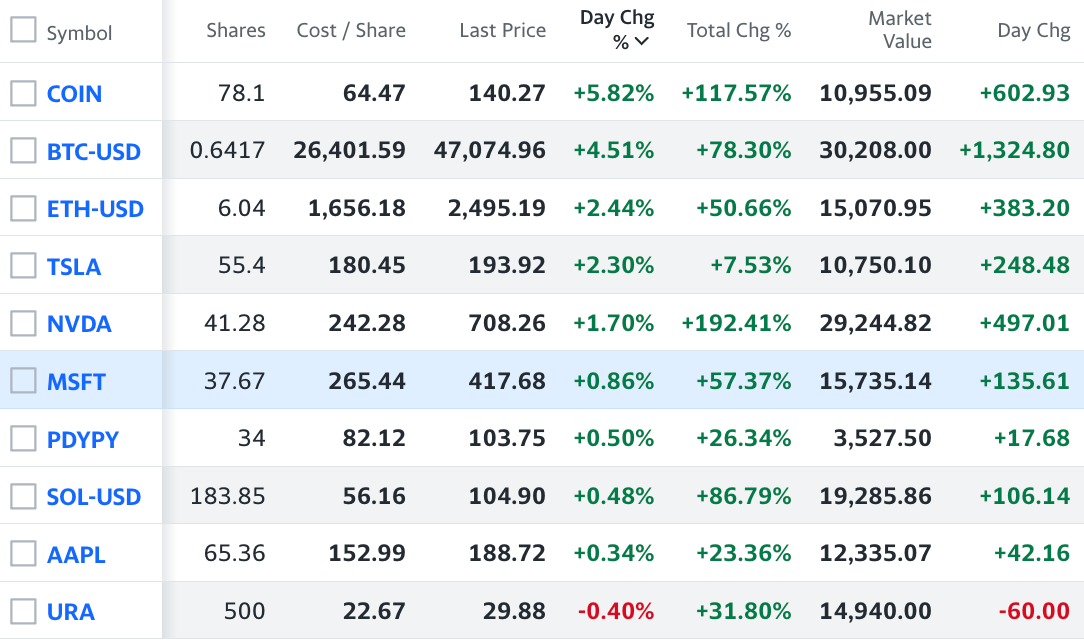

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 70+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll