TheBRRR’s Thoughts

Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

Nvidia and Bitcoin continue to crush as anchors in the BRRR portfolio. Both have smashed records this week, confirming the future is decentralized, and tech-driven assets are unstoppable.

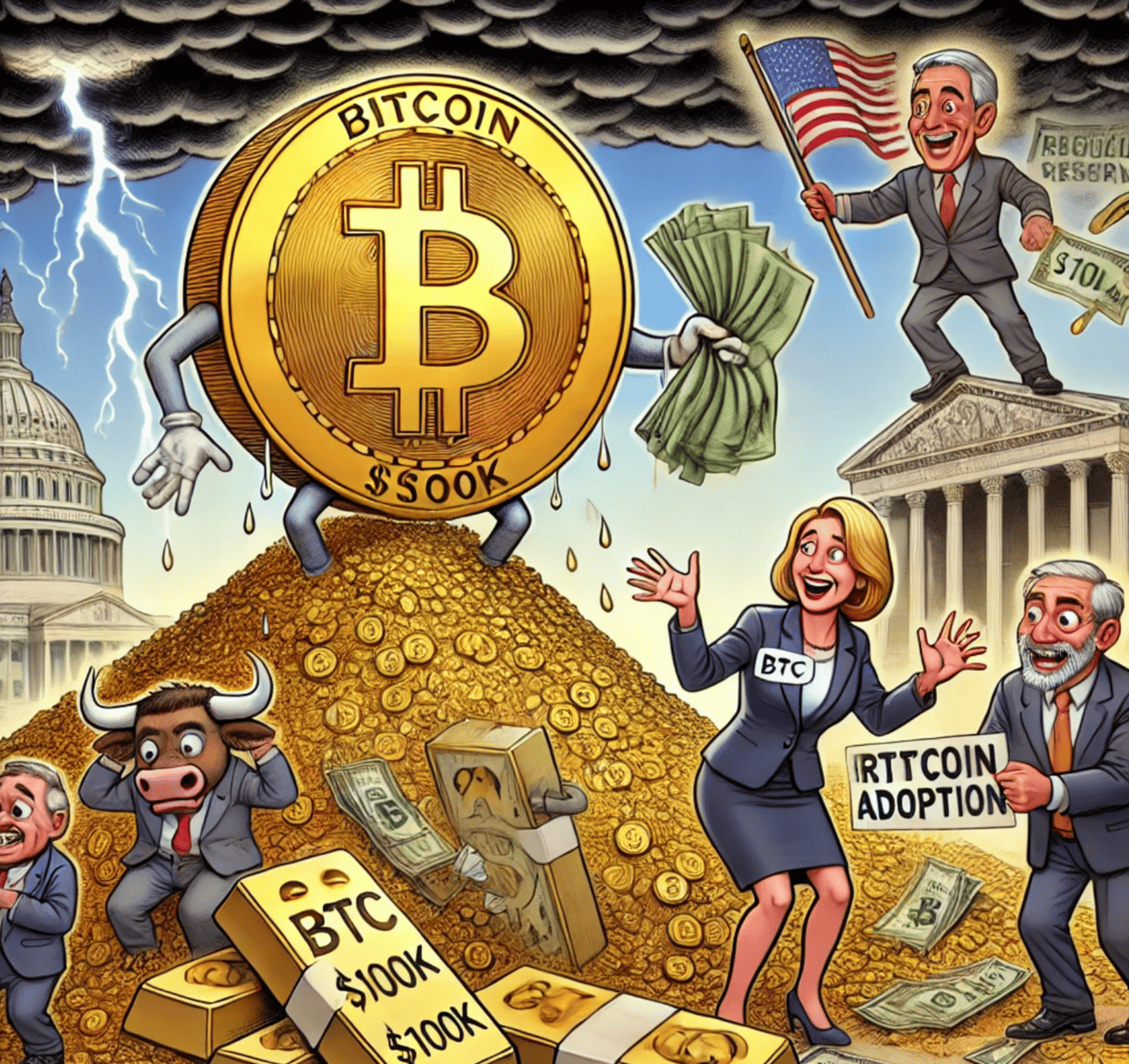

Bitcoin’s Surge

Bitcoin is flirting with $100K, up 40% since Election Day. The rally was supercharged by Trump’s win and the push for the Bitcoin Reserve Act, which could flip U.S. gold reserves into BTC. Institutional demand is on fire—Bitcoin ETFs saw $5B in inflows post-election.

Meanwhile, Bitcoin is now outperforming gold on all timeframes, with its market cap nearing $2 trillion. This isn’t just a price run; it’s a structural shift. States like Pennsylvania are exploring BTC treasuries, and the U.S. government already holds $21B in crypto.

Nvidia’s Dominance

Nvidia crushed Q3 with $35.08B in revenue, up 94% YoY. AI demand is off the charts, driving a 112% increase in data center revenue. Shares opened up 5%, reflecting their iron grip on AI hardware.

The new Blackwell GPUs are in such high demand that Nvidia can’t make them fast enough. While some see supply constraints as a problem, we see a bullish entry point. AI isn’t just here—it’s reshaping the global economy, and Nvidia is cashing in.

The Big Picture

Bitcoin and Nvidia represent a seismic shift. Both thrive in a world moving away from centralized systems. Bitcoin is digital gold for a decentralized future. Nvidia is the AI arms dealer fueling this revolution. Together, they define the BRRR thesis: bet on innovation, not stagnation.

What to Look For

Bitcoin: The rally isn’t done. The Reserve Act and ETF demand could push BTC to $150K+.

Nvidia: Watch for dips caused by supply delays—these are buying opportunities.

Policy: Keep an eye on Washington. Pro-crypto moves could ignite further institutional adoption.

NVDA Delivers 94% Y/Y Growth, Stock Holds Strong After Earnings

Synopsis:

Nvidia reported a staggering 94% year-over-year revenue growth in Q3, reaching $35.08 billion, surpassing Wall Street expectations. Despite this, concerns linger as growth rates decelerate, and supply constraints for the next-generation Blackwell GPUs may limit short-term sales. Nvidia’s dominance in AI chip production, driven by exploding demand for GPUs powering advanced models like ChatGPT, continues to fuel optimism. However, analysts warn that the "insane" growth expectations may be unsustainable, introducing risks to its over-earning streak.

The Details:

Revenue: $35.08 billion (+94% YoY, +17% QoQ); above forecasted $33.16 billion.

Earnings Per Share: $0.81 (adjusted); beat expectations.

Data Center Revenue: $30.8 billion (+112% YoY).

Gaming Revenue: $3.3 billion (+15% YoY, +14% QoQ).

Automotive Revenue: $449 million (+72% YoY).

Gross Margins: Non-GAAP at 75%, expected to dip slightly with Blackwell’s ramp-up.

Shareholder Returns: $11.2 billion in buybacks and dividends.

Q4 Outlook: Revenue projected at $37.5 billion (+70% YoY) with a margin range of 73%-73.5%.

Market Reaction:

Nvidia shares opened +5% higher but tempered by supply challenges for Blackwell GPUs.

Other chipmakers gained: AMD +1.4%, Intel +0.3%, Micron +2.2%.

Concerns:

Growth Deceleration: Q3’s 94% YoY revenue growth trails Q2’s 122%.

Supply Constraints: Blackwell GPUs face delays due to production capacity limits.

Competition & Regulation: Risks from export controls (China) and ongoing regulator scrutiny.

Over-Earning Concerns: Analysts fear Nvidia’s growth trajectory may not be sustainable as expectations skyrocket.

Why It Matters:

Nvidia’s results underscore its dominance in AI hardware, but the challenges ahead—supply constraints, geopolitical risks, and slowing growth—create uncertainty. Traders should note:

Upside Potential: Demand for GPUs like Blackwell and AI dominance reinforces long-term bullish sentiment.

Short-Term Risks: Supply chain bottlenecks and regulatory pressures may dampen earnings momentum.

Market Impact: Continued pressure on competitors (AMD, Intel) signals Nvidia’s grip on AI infrastructure.

Bitcoin Nears $100K With US Policy & Institutions Driving Narrative

Synopsis:

Bitcoin is on a tear, nearing $100,000 and challenging its all-time high against gold. The U.S. election, resulting in a Trump presidency and Republican-majority Senate, has energized the crypto market, propelling Bitcoin up 40% since Election Day. Momentum builds around pro-crypto policies like Senator Cynthia Lummis’ Bitcoin Reserve Act, which could position the U.S. as a global crypto leader. Institutional adoption accelerates as Bitcoin ETFs see record inflows and Bitcoin’s market cap edges closer to $2 trillion.

The Details:

Bitcoin Price Surge:

Bitcoin hit $98,000, marking a 40% post-election rally and nearing its record ratio against gold (37:1).

Bitcoin ETFs attracted $5 billion in inflows post-election, with further demand expected in Q1.

U.S. government Bitcoin holdings valued at $21 billion, primarily seized from criminal cases.

Legislative Momentum:

Bitcoin Reserve Act, led by Sen. Cynthia Lummis, proposes converting U.S. gold certificates to Bitcoin, aiming for 2025 adoption.

State initiatives like Pennsylvania’s Bitcoin Treasury Act signal growing institutional and political interest.

Pro-crypto appointments under Trump’s administration could pave the way for broader adoption.

Institutional Moves:

Companies emulating MicroStrategy’s Bitcoin strategy could amplify adoption.

Jersey City’s pension fund prepares to allocate into Bitcoin ETFs despite market volatility.

Gold Comparison:

Bitcoin outperformed gold with a 55% gain since 2021, compared to gold’s 46% rise.

BTC’s market cap now rivals $1.94 trillion, with full price discovery mode imminent if $98,500 is breached.

Why It Matters:

Bitcoin’s momentum isn’t just a price story—it reflects a seismic shift in market dynamics:

Policy Tailwinds: Pro-crypto leadership under Trump may cement Bitcoin as a national asset.

Institutional Legitimacy: ETFs and strategic reserves could push Bitcoin toward broader financial mainstreaming.

Global Positioning: U.S. adoption could force competitors like the EU and China to react, making crypto a geopolitical asset.

Key Bullet Points:

BTC nears $100K, with a 40% post-election rally.

Bitcoin Reserve Act aims to position BTC as a U.S. savings tool.

ETF inflows hit $5B, signaling growing institutional demand.

U.S. government crypto holdings now worth $21B.

Bitcoin to gold ratio nearing all-time high (37:1).

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

Monday November 4 2024: We haven’t updated the portfolio below, but we’re buying AI memecoin GOAT at its current $520m valuation as the fastest horse in a broad crypto rally post-election.

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll