Early Halloween party

TheBRRR’s GM

There was no major escalation in the Middle East over the weekend - that’s the good news.

The bad news is that assets are nearly all trading lower this morning against the dollar - stocks, commodities, bonds, collectibles - they’re all broadly down from Friday’s close.

There is one asset class holding up uncharacteristically well - crypto.

Bitcoin and Ether are both up 3-4% and a handful of altcoins are up by 10% or more since Friday.

We can retrofit a justification for the surge, whether ETF approval, global chaos, or simply supply/demand imbalance - take your pick.

The asset class has been left for dead since the FTX collapse, but bitcoin is up 75% from the Nov 2022 low and is trying to break through $32k for the third time this year. It last traded above $32k in May of 2022.

I think it breaks through and tests $38k sooner rather than later.

Today we’re doing a deepdive on the crypto move and previewing Microsoft’s Q3 earnings report due out tomorrow.

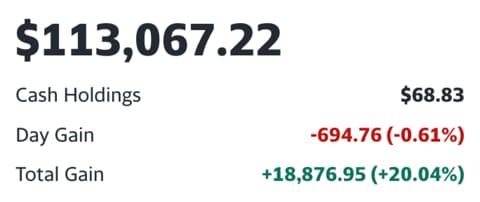

No changes to the portfolio, but it's holding up quite well overall, still up 22% since inception in late March.

Market News

MSFT Earnings Rally: Beat Expectations in Sight

Microsoft (NASDAQ: MSFT), the tech giant led by CEO Satya Nadella, is known for its diversified portfolio, effective management, and strong financials. The company boasts a loyal customer base, recurring revenue streams, and solid margins, fortified by a robust moat.

Even if earnings fall short, long-term investors might find an attractive entry point. Despite a 36% stock price increase, analysis suggests a 23% upside, showcasing its value proposition.

However, risks include fierce cloud competition, economic downturns, and the uncertainty surrounding a ~$28 billion tax bill from the IRS, though Microsoft is actively appealing.

Microsoft, under strong leadership, offers stability amid uncertainties. Its valuation signals potential returns, backed by its market position, adept management, and cash flow, albeit with inherent challenges and risks.

Alignment with Shareholders: CEO Satya Nadella's substantial stock ownership and compensation in stock and options demonstrate his alignment with shareholders' interests, instilling confidence in investors.

Financial Fortitude and Moat: Microsoft's financial strength is underscored by a solid balance sheet, robust liquidity, and conservative leverage. The company's return on invested capital (ROIC) averages an impressive 29% over a five-year period. Microsoft is fortified by a network effect, cost advantage, and high switching costs, creating a formidable barrier to potential competitors.

Segmental Opportunities: Microsoft's revenue is divided into three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Intelligent Cloud segment, powered by Azure, has experienced rapid growth, reflecting the ongoing shift to cloud computing in the enterprise sector.

2022 Figures

$100 Reader Giveaway

The AI Tool Report highlights fantastic AI tools. We’re giving away $100 to a reader that subscribes to the AI Tool Report and tells us about their favorite AI Tool they learn about as a subscriber.

To participate, subscribe below and email us about the best thing you’ve learned from them by November 15th. Only 1 submission so far - you’ve got great odds to win. 👇

Learn About AI

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Macro News

Bitcoin and Friends on a Bullish Bender

Bitcoin’s price has seen a notable recovery since September 11th of this year, with a swift ascent from below $25,000 to nearly $31,000, marking a 24% increase.

Altcoins like BSV, LINK, SOL, and AAVE have followed suit, each recording approximately 30% growth in the past week.

This swing in the crypto market has sparked discussions on whether this is the beginning of an upswing or a potential downturn.

Shifting Momentum: The recent rise of Bitcoin to almost $31,000 goes beyond initial projections, challenging the bearish outlook held and hinting at a potentially stronger bullish momentum than initially anticipated.

Altcoins Showing Growth: Altcoins such as LINK, SOL, AAVE, and BSV have not just followed Bitcoin’s lead but have surpassed it in terms of growth percentage, showcasing a substantial breakout from their previous ranges and indicating their readiness to embark on more pronounced uptrends.

Market Sentiment in Flux: Despite the prevalent bullish trends, there remains a layer of uncertainty regarding the market’s future direction, leaving investors and analysts pondering whether this is indeed the start of a sustained bull market or simply a fleeting relief rally before another bearish phase kicks in.

Today’s Reader Poll

Readers were slightly bearish on bitcoin on Friday, as prices hovered around $29,500. We’ll leave the poll open another day.

Where will Bitcoin close for the month of October?

Below are results from Friday’s poll, that asked for your expectations of Bitcoin’s price through the end of October. Signs point to ending higher than expected…

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

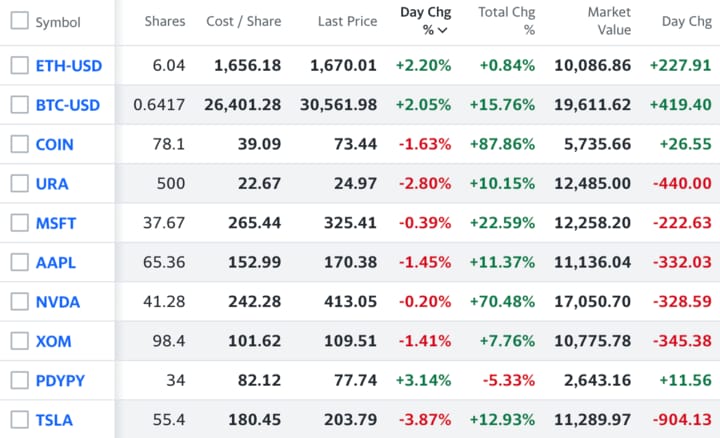

-We added Flutter Entertainment ($PDYPY) to our portfolio, after its stabilization over the past few weeks amidst the ever-growing sports betting industry. NFL season is in full-swing, and more competitors seek to enter the arena.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Friday 10/13 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.