it’s all so tiresome

Editor’s Note: We’re shaking up the newsletter’s format today. This introduction will continue to be used as a safe space for us to poke fun at the Fed and macro news, but the subsequent sections will be focused on specific investment ideas related to AI and crypto. Let us know if you like it or hate it.

GM, free-market frens. Today, we're diving headfirst into the chaotic circus that is the global economy, where the clowns at the central banks continue to juggle our financial futures like brightly colored balls.

In the macroeconomic sphere, we've seen equities firming up and the Yen lagging post-BoJ, with metals getting a lift from Chinese stimulus. The Fed's Waller and Barkin are set to speak, and we can't wait to hear what new wisdom they'll bestow upon us.

Perhaps they'll explain why the Fed's Bostic violated the central bank's trading guidelines during the forbidden blackout period. Or maybe they'll shed some light on the Fed's Discount Window borrowing, which has increased from USD 3.1bln to USD 3.6bln. But who's counting?

Meanwhile, Adobe, an AI stock darling, is making waves in the market after its q2 earnings report. The company's shares rose more than 5% in after-hours trading following a 2% gain in the regular session.

In the crypto corner, BlackRock, the world's largest asset manager, has filed paperwork for a spot Bitcoin ETF. The SEC, which has rejected numerous attempts by other fund companies to launch a spot Bitcoin ETF, might find it harder to say no to BlackRock. After all, it's not every day that a company with over $10 trillion in assets under management comes knocking.

In this market, the only sure thing is that there are no sure things. Unless, of course, you count government blunders. Those are pretty much a given.

Adobe’s Blowout Quarter

In the AI stock arena, Adobe (ADBE) is stealing the show. The creative software specialist reported a 10% year-over-year increase in its quarterly revenue, with adjusted net income rising to $1.79 billion. That's a 13% increase from last year, translating to earnings of $3.91 per share. Not too shabby.

The company's digital media, creative software, and document cloud revenue all gained between 9% and 11% year over year. Adobe's updated financial estimates for the full 2023 fiscal year anticipate revenue of between $19.25 billion and $19.35 billion, with nearly three-quarters of that total coming from the digital media segment.

Earnings are expected to finish the year between $15.65 and $15.75 per share on an adjusted basis.

Adobe's CEO, Shantanu Narayen, is betting big on a "new era of generative AI." If he's right, Adobe could be on the cusp of a significant breakthrough. If he's wrong, well, let's just say that Adobe's stock price might need some creative editing of its own.

BlackRock Files To Create a New Bitcoin Trust ETF

In the world of crypto, BlackRock is making waves. The fund management giant has filed paperwork with the U.S. Securities and Exchange Commission (SEC) for the formation of a spot Bitcoin ETF.

Named the iShares Bitcoin Trust, the fund's assets will "consist primarily of bitcoin held by a custodian on behalf of the Trust," according to the filing. That custodian will be crypto exchange Coinbase, a company in dire need of good news after last week’s regulatory pounding.

The SEC has previously rejected attempts by other fund management companies to launch a spot Bitcoin ETF, but BlackRock might be a different story. With over $10 trillion in assets under management, BlackRock is not your average fund management company, so the SEC might find it too hard to say no to this behemoth.

The news of BlackRock's filing gave the price of Bitcoin a slight boost, pushing it just shy of $25,600.

Significantly, the approval of BlackRock’s trust would apply pressure Greyscale to improve its own Bitcoin Trust product by lowering fees or opening up redemptions. Greyscale’s GBTC currently trades at a significant discount to its net asset value.

AI ART OF THE DAY

BlackRock may not be the hero bitcoin wants, but it’s the one it got today

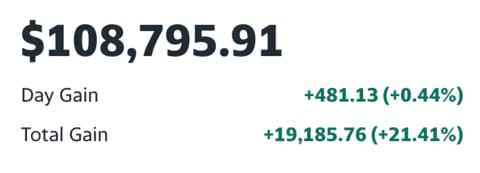

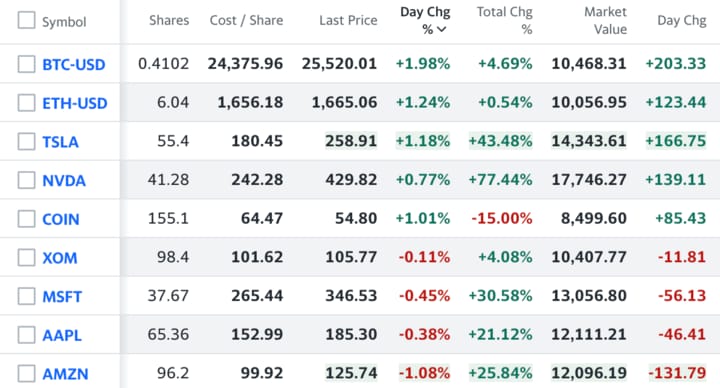

The BRRR’s Portfolio

We’re adding a couple of AI stocks to our watchlist for the BRRR today. We’re not buying them yet - just watching.

$AI: Enterprise AI software

$ADBE: Creativity & productivity software

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.