TheBRRR’s Thoughts

Markets were mixed on a bizarre Friday.

The nonfarm payroll report came out before the market opened and sent stocks and crypto lower.

The report blew out all estimates, as 272k nonfarm payroll jobs were reported in May against estimates around 180k.

Unemployment unexpectedly ticked higher to 4.0%, confusing the narrative.

Stocks mounted a minor comeback with both the S&P500 and Nasdaq essentially unchanged on the day.

RoaringKitty went live on YouTube in a much-hyped return to drink a beer and talk about his Gamestock position.

Over 500,000 tuned in live to listen to the man famous for roasting short hedge funds in 2021, triggering billions in losses in a win for retail traders.

The market did not like what he had to say, and the stock fell 40%, although it remains 18% higher on the week.

The dollar index ripped higher against other currencies. This type of dollar action has sent crypto lower in recent weeks and today was no different.

It took a few hours after the report, but bitcoin eventually tumbled below $70,000 and it dragged the rest of the crypto market with it.

All eyes are to next week’s CPI report.

Incoherent Jobs Data Sends Dollar Higher; Risk Assets Chaotic

WHAT HAPPENED

The latest BLS jobs report for May 2024 reported a significant increase of 272,000 jobs, far exceeding the consensus forecast of 180,000. However, a deeper dive reveals substantial discrepancies between the establishment and household surveys, raising concerns about the reliability of these numbers and the true state of the U.S. labor market.

BREAKDOWN

Nonfarm Payrolls: The establishment survey reported an increase of 272,000 jobs in May, with 229,000 in the private sector, exceeding expectations and previous estimates. However, the household survey reported a loss of 408,000 jobs during the same period, resulting in a discrepancy of nearly 700,000 jobs (BLS.gov).

Unemployment Rate: The unemployment rate unexpectedly increased from 3.9% to 4.0%, despite the strong payroll numbers. This paradox is partly due to the conflicting results of the establishment and household surveys (BLS.gov).

Full-time vs. Part-time Jobs: The household survey indicated a loss of 625,000 full-time jobs, offset by a gain of 286,000 part-time jobs in May. Over the past year, the U.S. has lost 1.2 million full-time jobs while gaining 1.5 million part-time jobs, highlighting a troubling shift in the quality of employment.

Birth/Death Model Impact: The birth/death model added 231,000 jobs to the May payroll numbers, a significant portion of the reported job growth. Over the past year, this model has contributed 56% of all reported job gains, indicating potential overestimation and statistical manipulation (BLS.gov).

Foreign-born vs. Native-born Workers: The number of native-born workers decreased by 663,000 in May, while foreign-born workers increased by 414,000. This trend has persisted over several years, suggesting that job growth has primarily benefited foreign-born workers, many of whom may be undocumented.

ANALYSIS

Data Discrepancies: The significant gap between the establishment and household surveys raises serious questions about the accuracy of the reported job numbers. The reliance on the birth/death model for a substantial portion of job growth further complicates the picture and suggests that the headline figures may not fully reflect the true state of the labor market (BLS.gov).

Inflationary Pressures: Rising wages indicated by the establishment survey suggest ongoing inflationary pressures, potentially influencing Federal Reserve policy decisions. Given the strong headline job numbers, the Fed is less likely to cut rates in the near term, potentially leading to higher yields (BLS.gov) (J.P. Morgan | Official Website).

Political and Economic Implications: The data indicating that job growth has primarily benefited foreign-born workers could become a significant political issue, especially in the context of upcoming elections and ongoing debates about immigration policies. This trend may also influence voter sentiment and policy decisions.

WHY IT MATTERS

Economic Policy: Accurate job data is crucial for Federal Reserve decisions on interest rates and monetary policy. Overestimated job growth could lead to misguided policy decisions and affect economic stability.

Market Reactions: Strong headline numbers can drive market optimism, while the underlying weaknesses suggested by the household survey might align with more cautious sentiment surveys. This mixed data can influence market dynamics and investor strategies (BLS.gov) (J.P. Morgan | Official Website).

Public Trust: Consistent discrepancies and frequent revisions can erode public and investor trust in government economic data. Greater transparency and methodological improvements from the BLS could enhance the accuracy and reliability of job reports.

GME’s Roaring Kitty Stumbles In First Stream Since 2021

WHAT HAPPENED

Keith Gill, known as Roaring Kitty, held a highly anticipated YouTube livestream event at 12:00 PM ET to discuss his investment in GameStop (GME). The event followed a series of controversial moves by GameStop and Gill's own trading activities. Here’s a detailed breakdown of the chaotic day:

BREAKDOWN

Livestream Event: Announced on Thursday, sending GME shares soaring from around $26 to $66 in after-hours trading.

Delay and Confusion: Roaring Kitty was 25 minutes late to the livestream, causing GME shares to hit the low of the day. Over half a million viewers were tuned in, eagerly awaiting his comments.

Revelations:

Investment Thesis: Gill’s presentation lacked a convincing new investment thesis for GME. He reiterated his confidence in CEO Ryan Cohen's turnaround strategy, heavily betting with options expiring in two weeks.

Clarifications: Gill emphasized that he is not working with hedge funds and all trades are his own.

Positions: Revealed his positions, indicating a strong bet on GME's short-term recovery despite poor earnings and a new equity offering.

GameStop's Announcements:

At-the-Market Offering: GME announced it would sell 75 million shares of Class A common stock, managed by Jefferies as the sales agent. This news caused shares to plummet by 40% in premarket trading.

First-Quarter Earnings: Reported net sales of $881.80 million, a significant drop from $1.237 billion year-over-year, and a loss per share of 12 cents, missing Wall Street’s estimate of a 9-cent loss.

Stock Dilution: Earlier sales included 45 million shares for about $933.4 million, indicating CEO Ryan Cohen is leveraging Gill's influence to offload shares onto retail investors.

ANALYSIS

Market Reaction: The combination of disappointing earnings and the announcement of a massive share offering led to a significant crash in GME’s stock price, erasing the previous gains driven by Gill's announcements.

Investor Sentiment: Retail investors, particularly those following Roaring Kitty, faced substantial losses. The reliance on momentum and speculative trading around GME's volatile stock has resulted in heavy financial repercussions for many.

Regulatory Scrutiny: Reports suggest that E*Trade might take action against Gill, and securities regulators are investigating him for potential stock manipulation.

WHY IT MATTERS

Market Volatility: The events surrounding Roaring Kitty and GME highlight the extreme volatility and risks associated with meme stocks. Investors should be cautious of speculative trading based on online influencers.

Regulatory Concerns: The investigation into Gill's activities underscores the importance of regulatory oversight to protect retail investors from potential market manipulation.

Company Strategy: GME’s strategy of using market pumps to sell additional shares raises questions about the company’s long-term viability and commitment to its retail investor base.

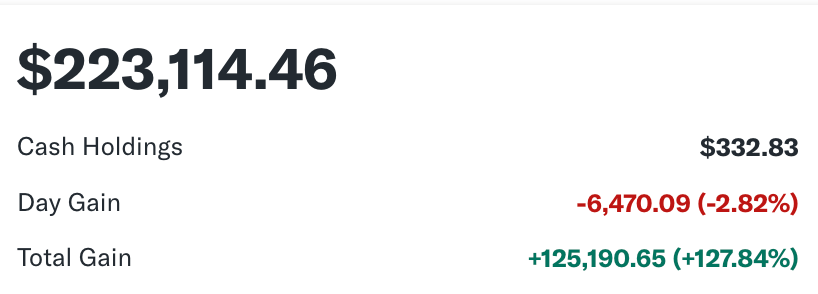

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll