TheBRRR’s Thoughts

GM.

The March US CPI data is in and it’s a little worse than expectations.

US CPI RISES 3.5% Y/Y; EST. 3.4%

US MARCH CORE CPI RISES 3.8% Y/Y%; EST. 3.7%

In reaction, the S&P 500, Nasdaq, and bitcoin are all down ~1.4% in early trading.

At 2pm today, the minutes from the March 19th FOMC meeting are published and could provide helpful context and color from the Fed.

This CPI report marks 3 consecutive months of inflation coming in hotter than expectations, and has lead to a rise in interest rate expectations. To start the year the market expected 7 interest rate cuts, but it now only expects 2 or 3.

Despite the hot inflation data this year, risk assets have continued their surge with the tech-heavy Nasdaq up 10% while bitcoin has surged by 53%.

We think that this reflects an under-appreciated reality -

Given high structural inflation with median wages not rising to keep up with rising prices, investors continue to go out on the risk-curve to attempt to generate real (inflation-adjusted) returns.

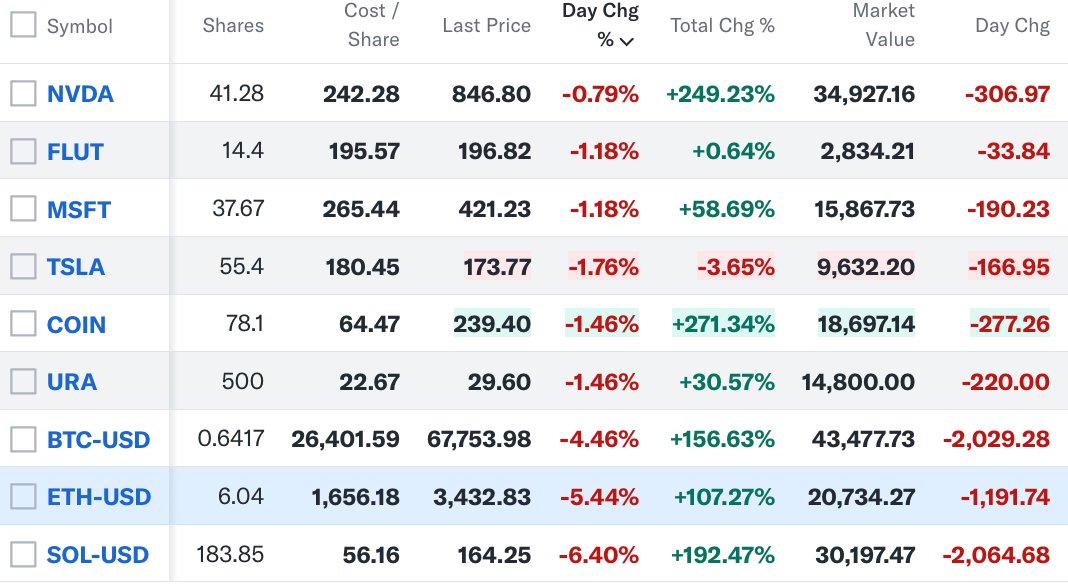

We still have a bullish bias and will look to early signs of a bottom/reversal to deploy the spare cash in the BRRR’s portfolio this week.

Work lesser & drive 10x more impact using AI

HIGHLY RECOMMENDED: A Power-packed workshop (worth $199) for FREE and learn 20+ AI tools to become 10x more efficient at your work.

👉 Become an AI Genius in 3 hours. Register here (FREE for First 100) 🎁

In this workshop you will learn how to:

✅ Simplify your work and life using AI

✅ Do research & analyze data in seconds using AI tools

✅ Automate repetitive tasks & save 10+ hours every week

✅ Build stunning presentations & create content at lightning speed

CPI Lands Hot, Stoking Sticky Inflation Fears

WHAT HAPPENED:

CPI Surprise: The Consumer Price Index (CPI) for March 2024 came in hotter than anticipated, marking a 0.4% month-over-month increase, mirroring its peak since August 2023. This uptick pushes the year-over-year increase to 3.5%.

Energy and Shelter Lead: Driving the surge were significant rises in energy and shelter costs, with energy reversing its previous deflationary trend. Core CPI also exceeded expectations, climbing 0.4% month-over-month, and nudging the annual increase to 3.8%.

Notable Increases: March saw the shelter index rise alongside gasoline, collectively contributing to over half of the month’s CPI increase. The energy index ascended by 1.1%, while food edged up by 0.1%.

Underlying Dynamics: Despite a general deflation in goods costs on a year-over-year basis, services costs, particularly for shelter and medical care, are re-accelerating. The SuperCore measure, which excludes shelter, leapt 0.7% month-over-month, hitting a 5.0% annual increase, its highest since April 2023.

WHY IT MATTERS:

Fed's Dilemma: This inflationary pressure complicates the Federal Reserve's position, potentially derailing plans for a June rate cut. With the CPI reporting above expectations for a third consecutive month, it weakens the case for immediate easing of monetary policy.

Economic Outlook: Persistent inflation signals continued cost of living frustrations for Americans, influencing future Fed decisions. This report may force the Fed to maintain higher interest rates longer than anticipated, affecting borrowing costs across the economy.

Political and Market Impact: Amidst debates on "Bidenomics" and its effect on inflation, the CPI data sparks discussions on the administration’s economic policies and their impact on price levels.

Taiwan Semiconductor’s Revenue Surges, Captures Key US Incentive Package

WHAT HAPPENED:

TSMC's Q1 Beats Expectations: TSMC, the titan of Taiwan's semiconductor scene, posted a 16.5% increase in Q1 revenue, reaching T$592.64 billion ($18.54 billion). This leap outpaced market forecasts and nudged the company's stock to new heights, largely thanks to the burgeoning demand for AI applications.

Market Cap and Stock Performance: Valued at a whopping $662 billion market cap, TSMC's shares have experienced a 37% surge this year, significantly outperforming the broader market's 16% gain, even as the company's shares dipped slightly by 0.5% on the announcement day.

U.S. CHIPS Act Windfall: In a strategic move to diversify its manufacturing base, TSMC has secured $6.6 billion in incentives under the U.S. CHIPS and Science Act, aiming to bolster domestic chip production and reduce reliance on foreign chip manufacturing amid geopolitical tensions and supply chain vulnerabilities.

WHY IT MATTERS:

AI Demand Driving Growth: The AI explosion not only exemplifies the shift towards more sophisticated computing needs but also positions TSMC as a pivotal player in the global tech ecosystem. The demand for AI applications is reshaping the semiconductor landscape, with TSMC at the helm.

Strategic Expansion in the U.S.: TSMC's significant investment in Arizona, totaling $65 billion for three fabrication units, underscores a strategic pivot towards mitigating risks associated with geopolitical tensions and supply chain disruptions. This move is pivotal for TSMC's global strategy, potentially altering the semiconductor supply chain's geography.

Investor Confidence: The Q1 revenue surge and the CHIPS Act incentives signal robust investor confidence in TSMC's growth trajectory and its strategic positioning within the global semiconductor industry. The company's ability to outperform market expectations amid the traditionally slower first half indicates strong operational resilience and market demand.

Long-Term Industry Implications: TSMC's expansion and the U.S. government's financial backing highlight the critical role of semiconductors in national security and economic stability. This dynamic may lead to a reshaping of global semiconductor manufacturing capacities, with significant implications for investors monitoring the tech and AI sectors.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll