Deflation? First housing decline since ‘12.

GM and BRRR.

In macro news, easing inflation (3.8% Y/Y vs 4.4% Y/Y thru April) could be a boon for the overall stock market, making risk assets like tech stocks more attractive, following yesterday’s report on core PCE, a number closely watched by the Federal Reserve. Lower gas prices and slower-rising food costs are the culprits, or heroes, depending on which side of the inflation debate you're on.

There’s big news in the world of crypto this morning as comments from the SEC in regard to BlackRock’s spot Bitcoin ETF have been leaked to the WSJ. The comments have cast a shadow over BlackRock (BLK) and Coinbase Global (COIN). However, it's not all doom and gloom, as BlackRock will make minor adjustments and resubmit.

When we last polled The BRRR audience about the ETF, 100% voted they thought the ETF would get approved. In light of today’s news, has your opinion changed?

Do you think BlackRock's Bitcoin ETF is approved by the end of the year?

AI: The Money Robots

Netherlands Tightens Chip Export Rules

BRRR watchlist company ASML is facing a setback with new export restrictions announced by its home country, the Netherlands. The under-the-radar giant may face a hit to topline revenue. Despite the news, the stock is unchanged, as the market doesn’t quite buy the scare.

The export restrictions on advanced semiconductor equipment arrive amid U.S. pressure to cut China off from key chipmaking tools.

Companies in the Netherlands will need to apply for a license to export certain advanced semiconductor manufacturing equipment overseas.

ASML makes machinery that is required to produce the most advanced chips; read about why we love the company in our previous post here.

Publicly-traded companies mentioned: ASML (ASML)

Our take: Between bullish and bearish for ASML, as the new export restrictions could potentially limit its market reach and impact its revenue.

Crypto: Digital Gold Rush

SEC Says Spot Bitcoin ETF Filings Are Inadequate

The Securities and Exchange Commission (SEC) has deemed recent applications for spot bitcoin exchange-traded funds (ETFs) “inadequate”.

The SEC informed exchanges Nasdaq and Cboe Global Markets, which filed the applications on behalf of asset managers including BlackRock and Fidelity Investments, that the filings aren't sufficiently clear and comprehensive.

The SEC told the exchanges that it returned the filings because they didn’t name the spot bitcoin exchange with which they are expected to have a “surveillance-sharing agreement” or provide enough information about the details of those surveillance arrangements. Asset managers can update the language and refile.

A wave of traditional and crypto asset managers followed in BlackRock’s footsteps after they filed. Fidelity Investments, Cathie Wood’s Ark Investment Management, Invesco, WisdomTree, Bitwise Asset Management, and Valkyrie all reactivated or amended their applications for a spot bitcoin ETF in recent days.

Publicly-traded companies mentioned: BlackRock (BLK), Fidelity (Private), Coinbase Global (COIN)

Our take: The SEC's stance is bearish for BlackRock (BLK) and Coinbase Global (COIN) and bitcoin (BTC) as it creates uncertainty around the approval of their spot Bitcoin ETFs, but the SEC’s comments leave the door open for BlackRock to make clarifications and resubmit their application. We remain bullish overall on crypto for the long haul.

AI ART OF THE DAY

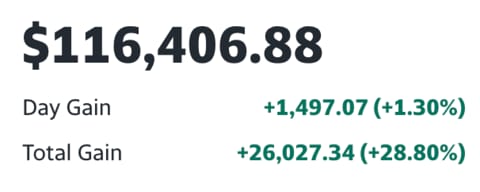

The BRRR’s Portfolio

Big Tech = Up Only

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.