GM and BRRR.

Not to say we told you so, but we did put out a smoke signal on Wednesday, writing:

“Given the broad mega rally in tech since Q1 ended, many believe that tech earnings need to handily beat expectations in order to prevent a selloff this summer.”

Tesla and Netflix narrowly beat expectations, and both stocks plunged by 8% or more. It’s a little ominous for the tech sector, as more earnings reports surface in the coming days and weeks.

Today we’re extending our coverage of the looming “category 5 hurricane” in the commercial real estate sector and adding some context to the Tesla and Netflix stories.

We’d love to cover crypto again, but it’s been uncharacteristically boring lately so we’ll spare you the details. Have a great weekend everyone.

Today’s email is brought to you by the TLDR Newsletter. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The TLDR Newsletter: Want to understand the most important trends and stories in tech in 5 minutes or less? TLDR has amassed over 1m subscribers because that’s exactly what they deliver. Here’s your link to subscribe for free.

Still reading: The AI Tool Report for specific ways to leverage AI for productivity.

CRE Hurricane Coming

Fed's Hikes: Sternlicht's 'Interest'ing Nightmare

Billionaire investor Barry Sternlicht, of Starwood Capital Group, warns of a looming crisis in the US commercial real estate (CRE) market, likening it to a "Category 5 hurricane." Sternlicht attributes the downturn to the Federal Reserve's aggressive interest rate hikes over the past sixteen months, which have led to tighter credit conditions and increased difficulty for landlords to refinance existing buildings. He also highlights a massive debt maturity wall of CRE loans, totaling $2.5 trillion over the next five years, which could lead to a significant number of bank failures and forced asset sales. Sternlicht sees potential investment opportunities in this crisis, particularly in distressed real estate debt.

Federal Reserve's Role in CRE Downturn: Sternlicht points out that the current CRE downturn was sparked by the Federal Reserve's aggressive interest rate hikes over the past sixteen months, aimed at taming inflation. This is unlike past downturns, which were typically due to reckless speculation.

Massive Debt Maturity Wall: According to Morgan Stanley, there is a massive debt maturity wall of CRE loans that totals $500 billion in 2024 and $2.5 trillion over the next five years. This could lead to a significant number of bank failures and forced asset sales, potentially creating a "second RTC" event, referring to the Resolution Trust Corp. that liquidated assets of failing savings and loan associations three decades ago.

Investment Opportunities in Distressed Real Estate Debt: Despite the looming crisis, Sternlicht sees potential investment opportunities in distressed real estate debt. He suggests that banks may be willing to restructure loans and cut debts in half to avoid taking back assets. He also sees potential in the residential real estate market, given the increasing scarcity of single-family home units due to high interest rates depressing construction. Sternlicht also suggests that investing in public REITs could be a good move for savvy investors.

Tech Earnings Trickle In

Tesla and Netflix Fall Despite Beating Earnings Expectations

Earnings reports revealed a mixed bag of results for Tesla and Netflix in Q2. Tesla exceeded Wall Street's expectations with earnings of $0.91 per share, surpassing the estimated $0.79, with better-than-expected revenue and less bad margins than anticipated. However, shares still sank 9.7% in Thursday trading. Relatedly, Netflix saw a drop of 8.4% following mixed Q2 earnings. Despite an EPS of $3.29, which beat the consensus of $2.84, revenue missed expectations. Netflix's new subscriber additions did manage to exceed expectations, with 5.9 million paid net subscribers joining in Q2.

Tesla's Earnings:

Counterintuive Reaction: The decrease in Tesla's shares by 9.7% was triggered despite a strong earnings report. Analysts noted that the reported gross margins, excluding regulatory credits, were better than feared, at 18.2% in Q2, higher than the estimated 16.9%.

Pricing Power: While the recent price cuts on Tesla's electric vehicles led to a dip in gross margins, they helped the company to significantly boost its customer base. In particular, Wedbush noted these cuts were a 'homerun success' in China, Europe, and the US, likening Tesla's strategy to Apple's approach in 2008/2009.

Netflix's Earnings:

Mixed Data: Despite missing the revenue consensus, Netflix successfully expanded its paid sharing feature to over 100 countries. This expansion contributed to 80% of its total revenue and resulted in the addition of 5.9 million paid net subscribers in Q2, exceeding expectations.

Analyst Upgrade: Following the report, Evercore ISI upgraded its rating and lifted the price target for Netflix to $550. The firm advised investors to buy Netflix shares on the current pullback, suggesting that the drop in shares is more an expectations correction rather than a fundamental one.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Tesla's down about 10% from its high earlier this week and sits at $260 per share. What comes first?

AI Art of The Day

Tesla falls. Will it get worse?

The BRRR’s Portfolio Update

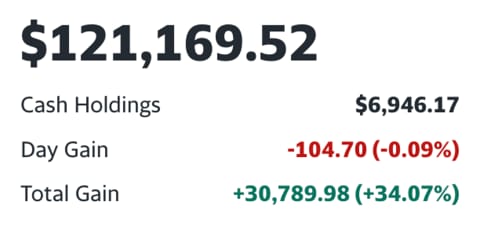

Tesla’s plunge stings, but we’re still up 45% on the position and 34% overall since March.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.

T