GM and BRRR.

China continues to capture our attention this week, as the country continues to deal with the ramifications of its wealth-destroying “COVID-Zero” and brash regulatory crackdown of recent years.

Whether the CCP was scaring away local tech companies with hefty fines, disincentivizing real-estate investing, or outright banning net-positive industries like for-profit private tutoring, the economy has been damaged by a menagerie of self-inflicted wounds.

The Chinese consumer has pulled back spending dramatically, and local economists are calling for “helicopter money”, interest rate cuts, and deficit spending to spark activity.

Because China hasn’t committed to the stimulus but grumblings of its necessity have grown, global markets remain fearful and have begun to “risk-off” as we await clarity.

Individual stocks and assets matter less in times of uncertainty and turbulence, so our coverage reflects the broader economic landscape more than ever today.

The market fundamentals have changed - and we’ve changed our near-term view on where markets are headed. We just made a trade to reflect this minutes ago, and you’ll want to upgrade to our premium tier for $2/month to see the details of the move.

Today’s newsletter is brought to you by The Rundown AI. Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The Rundown AI Join 250k+ reading AI news and learning about AI tools every week. The Rundown does an outstanding job surfacing the most important breakthroughs from this powerful technology. Here’s your link to subscribe for free.

World News

China's Economy: All Bark, No Bite in 2023

China's hopes for an economic rebound after years of lockdowns have given way to a somber reality of falling growth and gathering storms. Retail sales, industrial output, investment - all key indicators softened in July, with Q2 GDP growth crawling near zero at 0.4%, down from 1.3%.

Behind the abrupt slowdown lies a property market sinking deeper despite scattered lifeboats of easing. Home prices have dropped for 12 straight months, while property investment in July was 5.7% lower than last year.

With real estate estimated to account for 25-30% of GDP, persistent housing woes spell heavier weather ahead. Already, youth unemployment has surged over 20% so officials have stopped releasing the data, while overall joblessness nears tech-bust levels at 5.4%.

Even more worrying, China's total debt now exceeds 300% of GDP - the highest of any major economy outside Japan. While state control likely prevents a Lehman-style crash, each yuan of new debt generates less and less growth.

By the numbers:

Housing Investment Plunge: Property investment dropped 12.3% in July, down for a fifth straight month. Housing sales plunged 28.6% in July, indicating weak demand.

Industrial Deceleration: Industrial output slowed to 3.8% growth in July, down from 3.9% in June and 4.0% in May. This extends a trend of decelerating industrial activity since the start of 2022.

Retail Slump: Retail sales grew by only 2.7% in July, much lower than the forecast of 5.0%, pointing to cautious consumer sentiment.

Small Business Decimation: Non-state firms produce 60% of GDP and 80% of jobs, but 1 in 10 now face bankruptcy after the pandemic.

Youth Disenchantment: Among those aged 16-24, nearly 1 in 5 is unemployed and disillusioned, further eroding consumer demand.

Macro News

Fitch to Banks: Your Credit Score is Tanking

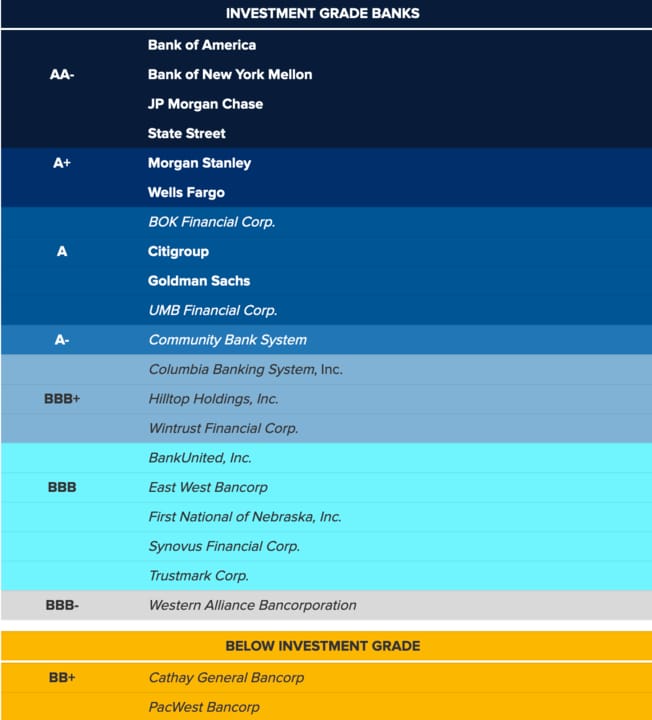

Fitch Ratings recently downgraded the U.S. banking industry's health score from AA to AA-, warning another downgrade to A+ could trigger sweeping rating cuts at dozens of banks.

Fitch says if the industry score drops to A+, ratings for top banks like JPMorgan and Bank of America would likely be cut to A+, forcing Fitch to reevaluate all banks it covers. Lower ratings could push weaker banks closer to junk status.

Key factors that could spur further downgrades include higher interest rates from the Fed compressing bank profits, and loan defaults rising beyond normal levels. The impact of broad bank downgrades is uncertain but could mean banks pay more to issue bonds, get locked out of debt markets or trigger adverse contract provisions.

Path of Interest Rates Poses Risks: The trajectory of interest rates set by the Federal Reserve is unclear. If rates stay elevated for longer than expected, it would put significant pressure on bank profit margins and could prompt Fitch to cut industry ratings further.

Loan Default Concern: Fitch has warned if loan defaults rise beyond levels considered historically normal, exceeding normalized loss levels could spur industry downgrades. Defaults often climb when rates rise.

Potential Impacts Hard to Gauge: The effects of widespread bank downgrades are uncertain but could include banks having to pay more to issue bonds, some getting locked out of debt markets entirely, and adverse provisions being triggered in lending agreements or complex contracts.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will Bitcoin outperform the Nasdaq over the next 10 years?

AI Art of The Day

No bears allowed in China

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Trades

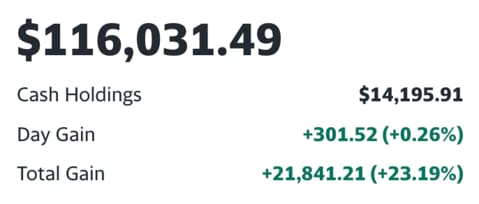

We just sold our AMZN position to derisk and lock in a 36% gain since March 15. We’ll likely redeploy the money in the coming days/weeks as the bottom of this selloff begins to form.

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Wednesday 8/9/23 9am: BUY 0.2315 $BTC @ $29,990

Watchlist

$ASML: They make the machines that make AI machines

$META: Sleeper in AI race and ad biz is proving resilient

$OPRA: Growing web-browsing solution

$PLTR: AI for government intelligence

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.