GM and BRRR. Headlining macro news today is a move out of China. The CCP’s finance ministry has attempted to provide some relief to its ailing economy through an unexpected cut in its benchmark lending rates. The one-year Loan Prime Rate (LPR) was reduced by 20 basis points to 3.70% from 3.90%, and the five-year LPR was trimmed by 10 basis points to 4.60% from 4.70%. While the move was intended to stimulate the economy by reducing borrowing costs for businesses and individuals.

With China cutting and the US pausing, it appears we’ve reached the apex of the hiking cycle as the economy has sufficiently slowed.

Today' we’re covering a new AI stock on our radar and some bullish regulatory news out of the Ripple case that bodes well for Web3 and Ethereum.

Let’s get after it.

AI: The Money Robots

C3.ai’s Big Moves in 2023

C3.ai is an enterprise AI software provider that’s made significant market gains in 2023 with a whopping 328% return year-to-date. Despite this performance, the company has been under scrutiny for sluggish growth, high customer concentration, accounting fraud allegations, and a sky-high valuation. It’s currently trading at 18 times sales with just a 5.6% revenue growth, making investors wonder if the AI hype is keeping this stock afloat.

The company has made a strategic shift from a subscription-based model to a consumption-based one. Despite causing a dip in growth in fiscal 2023, this shift seems to be paying off with expectations of higher growth rates in the second half of the current fiscal year as the model gains momentum. The ease of a pay-as-you-go model has led to a 59% increase in customer agreements compared to the prev year.

C3’s growth seems to be gaining momentum despite past underperformance. It’s forecasting a 9% increase in revenue this quarter compared to the same period last year, with analysts predicting sustained growth in the following fiscal years and profitability on a non-GAAP basis by 2025.

With its new business model, C3 has entered the second phase of its transition, in which it aims to gain traction with new customer deals. The third phase, expected to commence after a year, anticipates a sharp rise in revenue growth as many customers are predicted to adopt the consumption model. The goal? To tap into a staggering $791 billion addressable market in the AI software sphere by 2026.

Read more

Publicly-traded companies mentioned: C3.ai (AI)

Our take: Cautiously Bullish for $AI. The valuation has gotten rich this year, but they appear well positioned as a leader in b2b AI software integration.

Crypto: Digital Gold Rush

2018 SEC: “Ether is not a security” per Newly Released Docs

Hinman Papers: Ether's Superhero Origin Story: The release of the Hinman papers last week amid the SEC's ongoing case against Ripple has given a shot in the arm to ether (ETH). According to a research report by JPMorgan, this document dump can potentially inspire a shift towards more decentralization in the crypto landscape. These emails, linked to a 2018 speech by former Director of Corporation Finance William Hinman, revealed that the SEC didn't see ether as a security back then, which is almost as groundbreaking as finding out your grandpa used to be a secret superhero.

A Regulatory Gap, or a Loophole?: The SEC recognized in Hinman's speech that tokens on a "sufficiently decentralized network are no longer securities", pointing to a regulatory gap. This acknowledgment essentially puts ether and other decentralized crypto assets in an "other category", making them a weird kind of unregulated unicorn in the current crypto zoo.

Potential New Regulatory Approach: This could influence the ongoing efforts by the U.S. Congress to regulate the crypto industry. The most straightforward route? Treat ether just like bitcoin, categorize it as a commodity, and let the Commodity Futures Trading Commission take care of it. Another possibility is creating an entirely new category for ether and other decentralized cryptos, helping them dodge the "security" tag. This new designation could be something along the lines of "really special non-securities that are still quite important", but we'll leave the naming to the lawmakers.

Racing Towards Decentralization: The release of the Hinman papers might kick off a sprint among major cryptocurrencies to become more decentralized and appear more like ether. According to JPMorgan, this will be akin to a makeover for these cryptocurrencies - think of it as cryptos queuing up for the "Ether Look" at the salon. The more decentralized a cryptocurrency is, the better its chances of avoiding the "security" label, or the need for an unwanted regulatory haircut.

Crypto assets mentioned: ETH

Our take: Bullish for ETH, as it’s hit escape velocity

The BRRR's Wrap-up: The Sound of Money Printing

And that's a wrap for today. As the global economic plays its pingpong game of rate cuts and pauses, the investment landscape hums along - AI is making waves (and robots), while crypto might just be ready for a big move courtesy of BlackRock’s ETF and positive regulatory news courtesy of the Hinman papers.

AI ART OF THE DAY

Grumblings that Gensler may be fired soon, as even supporters dislike his approach to crypto enforcement. Members of the house introduced a bill about it.

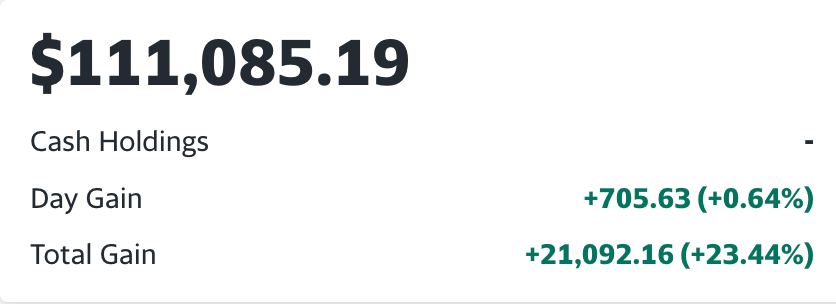

The BRRR’s Portfolio

Cruising along here. We like the new names on the watchlist, but not at the expense of what’s in the portfolio already.

On Watchlist:

$AI: Enterprise AI software

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.