GM and BRRR.

A little housekeeping upfront. We’ve rolled out a premium tier of membership for the newsletter. For just $2/month or $9.99/yr you’ll unlock live trade alerts, full access to our portfolio, and access to our private Facebook group.

To be clear, the core commentary, news, memes and AI art will always be free. If you’re interested in the upgrade, head over to our upgrade page to learn more.

With that covered, we’ll move on to the day’s news and our commentary.

Last night, China kicked off the week's price reporting by posting y/y deflation. The CCP reported negative CPI and PPI for the first time since 2020 at -0.4% and -4.4% respectively.

Because deflation is unacceptable to central banks and world leaders, markets now expect China to start easing financial conditions via stimulus or central bank balance sheet expansion to create pressure on prices to trickle higher. In response, equities and other asset prices trickled higher in the overnight session.

As an asset particularly responsive to economic stimulus and easing conditions, Bitcoin has performed well this week.

While Bitcoin is up this morning thanks to the deflation report out of China, it also reacted positively to ratings agency Moody’s downgrading 10 regional banks. Bitcoin famously surged in the face of the banking contagion that defined Q1, and looks like it’s ready to move further should the banking sector falter further.

After posting 12 consecutive days of low volatility (less than 1% up or down) bitcoin rose by nearly 3% over the last 24 hours and sits at $29,925 at time of print.

Today’s newsletter is brought to you by The Rundown AI. Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The Rundown AI Join 250k+ reading AI news and learning about AI tools every week. The Rundown does an outstanding job surfacing the most important breakthroughs from this powerful technology. Here’s your link to subscribe for free.

Macro News

China CPI Volunteers as US Inflation Wingman

US markets point to a mixed appetite for risk on Wednesday, as the initial recovery from Tuesday’s sell off has sputtered. Sentiment initially received a lift after China reported an official -0.4% CPI print, entering deflationary territory for the first time in over two years.

Meanwhile in Europe, equities are staging a robust rebound from the prior day's sharp selloff, led by Italian banks. The Italian government partially reversed course on a proposed windfall tax on lenders that had sparked an intense backlash.

Other global equity markets also signal a risk-on mood. The euro is climbing against the dollar, copper prices are rebounding after declines, and the 10-year US Treasury yield has risen back to around 4.03% ahead of a closely-followed $38 billion 10-year note auction later today. That auction will test investor appetite for US debt amid rising budget deficits.

In commodities, oil continues its ascent with WTI gaining over $1 per barrel to approach 2023 highs on supply concerns. Rice prices in Asia have spiked to the highest levels since 2008 on low stockpiles.

China Deflation May Help Fed: China's descent into deflation for the first time since 2020 could help restrain US core goods inflation if it leads to lower import prices. JPMorgan strategists suggest this scenario would be welcome if US consumer demand rotates back toward goods and away from services.

Mortgage Apps Down, Disney Earnings Today: Today's economic data highlights include mortgage applications, which declined 3.1% last week after sliding 3.0% in the prior week. Housing market indicators are being closely watched given Fed tightening. Earnings season continues with Disney's fiscal Q3 results due after the closing bell.

10-Year Auction Tests Demand: The 10-year Treasury note auction may provide clues on investor demand for US debt given ballooning budget deficits. Tuesday's well-received 3-year note auction saw yields come in below pre-auction levels, signaling healthy appetite. But larger refunding auctions this week will further test sentiment.

Crypto & Banking News

Moody's Downer Gives Bitcoin Upper

Cryptocurrency prices have risen as investors looked to digital assets amid a downgrade of major U.S. banks by Moody's. Bitcoin rose nearly 3% to $29,785 while ether gained over 2% to $1,762.

The gains came after Moody's lowered credit ratings for several smaller and mid-sized U.S. banks and put larger banks like BNY Mellon and Northern Trust on review for potential downgrades.

The moves echoed banking sector turmoil earlier this year that boosted interest in cryptocurrencies as an alternative system. The gains indicate crypto may be decoupling from stocks as investors see it as less correlated to traditional finance.

Bitcoin breaks out of narrow range: Bitcoin was stuck trading between $29,000-$30,000 for past 2 weeks before Moody's news sparked rally, signaling renewed interest after prolonged period of limited price action.

Ethereum leads altcoins higher: Ether gained over 2% to $1,762, outperforming Bitcoin's 2.9% rise. Other major altcoins like Solana's SOL token also saw sizable 7%+ gains showing broad optimism across crypto markets beyond just Bitcoin.

Crypto mining stocks rally: Mining equities like Marathon Digital and Riot Blockchain gained over 4% each furthering investor confidence in crypto economics despite market turmoil.

Moody’s New Ratings

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will Bitcoin outperform the Nasdaq over the next 10 years?

AI Art of The Day

Premium Subscribers Section

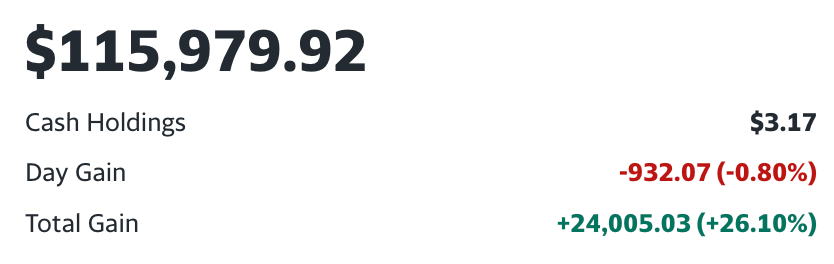

We took the cash we had in reserve to purchase another asset, and alerted our premium subscribers this morning.

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Upgrade to see holdings & trades

Trades

BUY 0.2315 $BTC @ $29,990

Bitcoin’s been resilient given market conditions and newsflow. We think it’s a clear buy & hold in the short-medium term with ETF, halving, and banking stress narratives picking up steam.

Watchlist

$ASML: They make the machines that make AI machines

$META: Sleeper in AI race and ad biz is proving resilient

$OPRA: Growing web-browsing solution

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.