TheBRRR’s Thoughts

GM. Markets have bounced since Wednesday’s interest rate cut with crypto standing out with clear outperformance.

Within crypto, the further you go out on the risk curve the better the performance you see with memecoins leading the charge higher.

Granted, most memecoins and other altcoins have been destroyed over the last few months, the universality and the magnitude of the memecoin bounce indicates they’ll likely continue to outperform as central banks and treasury departments continue to inject liquidity into the global economy.

The chart below maps relevant crypto assets and the Nasdaq (QQQ) since the interest rate announcement on Wednesday afternoon.

Risk assets has broadly taken a pause over the last 12 hours as China’s central bank decided to leave its interest rates unchanged despite markets expecting a cut.

Central banks have dominated the market narrative this week, so we’ll close the week with coverage of the central bank announcements out of Japan and China that took place over night.

Have a great weekend.

Yen Plunges as Bank Of Japan Leaves Interest Rates Barely Above Zero

WHAT HAPPENED:

The Japanese yen plunged over 1% after BOJ Governor Ueda downplayed the urgency of future rate hikes, indicating that "upside risks to inflation are easing."

Ueda’s comments came after the BOJ kept its policy unchanged, with rates still hovering around 0.25%.

Traders had expected a more hawkish stance following Ueda's aggressive July tightening, but this softer approach points to a further delay in rate hikes, possibly until December or January 2025.

Japan’s CPI has dropped significantly, back to 2%, with more deflationary risks on the horizon as the yen's recent strength could push inflation—and wage growth—into negative territory.

WHY IT MATTERS:

Yen Sell-off: Traders are likely to continue shorting the yen, especially with the BOJ's dovish signals compared to other central banks now cutting rates.

Market Stability over Inflation: BOJ seems more focused on avoiding another stock market crash (like the $1.1 trillion wipeout post-July hike) than on controlling inflation, reinforcing their outlier status among central banks.

No October Hike: Ueda’s cautious tone significantly lowers the chances of an October rate hike. Economists now predict the BOJ might raise rates in December or even push into 2025.

Political Pressure: Japan’s upcoming LDP leadership election further complicates the BOJ’s ability to make bold moves, especially with potential frontrunner Sanae Takaichi favoring monetary easing (yen negative).

China Surprises Markets, Leaves Interest Rates Unchanged

WHAT HAPPENED:

China unexpectedly kept its benchmark lending rates unchanged despite the U.S. Federal Reserve's aggressive 50 basis point rate cut.

The People's Bank of China (PBOC) held the one-year Loan Prime Rate (LPR) at 3.35% and the five-year LPR at 3.85%, contrary to market expectations of a cut.

The move came as a surprise since the Fed's rate cut gave China more leeway to ease domestic monetary policy without causing a sharp decline in the yuan. Analysts had anticipated a reduction to counteract China’s economic slowdown(

In addition, China launched a ¥500 billion ($70 billion) re-loan program to boost small and medium-sized tech companies, aiming to fuel innovation amidst struggling economic sectors.

WHY IT MATTERS:

Yuan Stability vs. Economic Stimulus: The PBOC’s decision reflects the balancing act between keeping the yuan stable and boosting the economy.

Lowering rates could weaken the yuan further, which has already faced pressure. Beijing’s caution highlights a desire to avoid further currency devaluation.

China’s Struggling Economy: China’s economic data continues to disappoint—retail sales, industrial production, and urban investment have all fallen short of expectations.

Housing prices dropped at the fastest pace in nearly a decade, while unemployment continues to rise.

Many analysts believe that even with monetary easing, the real issue is weak consumer demand, which rate cuts alone may not resolve

What’s Next?

Markets still expect more stimulus from China later this year. There’s increasing pressure for the PBOC to act aggressively in the fourth quarter, potentially implementing larger rate cuts or further fiscal measures to stabilize growth.

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

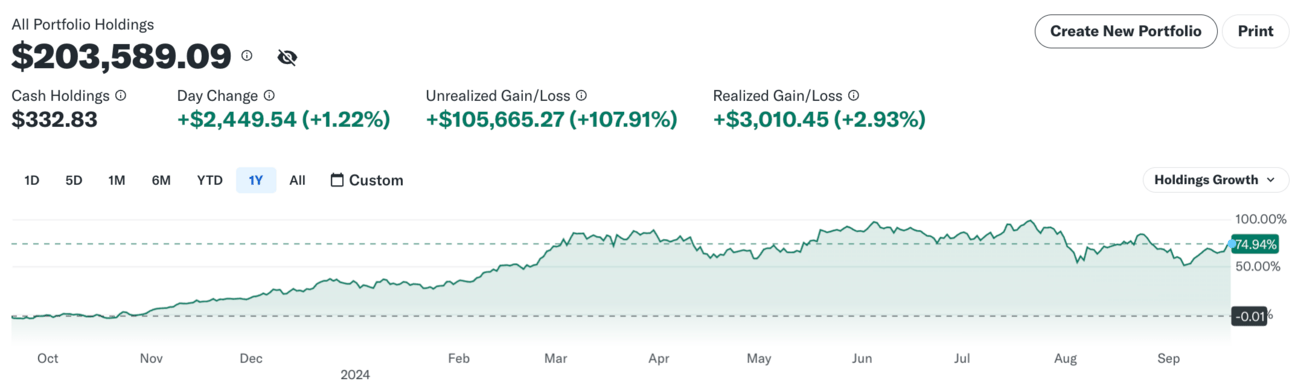

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll