TheBRRR’s Thoughts

GM.

China’s gonna have to do better.

On Tuesday morning their National Development and Reform Commission failed to deliver specifics of their previously announced stimulus package and markets punished them for it.

China’s key stock indexes fell 7-10% on the day after rallying by 40% over the last few weeks.

US stocks and crypto have sustained recent strength despite continued geopolitical turmoil and inflation fears. Surging odds of a Trump victory have buoyed crypto prices, as have optimism around FTX’s finalized $16B repayment plan, as we cover today.

China Fails To Deliver Stimulus Details

Synopsis:

China’s latest high-profile economic meetings set a pro-growth tone but fell short of delivering the aggressive stimulus markets were hoping for.

The National Development and Reform Commission (NDRC) emphasized steady, incremental support for infrastructure and urbanization, while Premier Li Qiang stressed stabilizing growth and market expectations. Despite positive messaging, capital markets were disappointed by the lack of specific large-scale stimulus, with significant volatility in Chinese indices.

The Details:

The NDRC, alongside Premier Li Qiang, emphasized support for strategic infrastructure and domestic consumption while maintaining a long-term, measured policy approach.

Despite underwhelming headline growth in Q2 and Q3, officials refrained from unveiling major stimulus measures. They hinted at further countercyclical macroeconomic policy, targeting infrastructure, urban renewal, and support for struggling local governments.

Hong Kong’s Hang Seng Index saw a 9.41% drop, while China’s CSI300 gained 5.93% after initial spikes, signaling the markets’ mixed response.

The NDRC committed to completing 5,100 projects outlined in the 14th Five-Year Plan, issuing 100 billion yuan ($14.1 billion) in advance from the 2025 budget and pledging fiscal support for urban renewal and local development.

Why It Matters:

While China's tone is upbeat, the lack of concrete stimulus may prolong market uncertainty. The cautious approach reflects concerns about exhausting policy tools too quickly, especially with deflationary pressures looming.

Traders should watch for further policy easing targeting real estate and urbanization, but the absence of immediate stimulus means markets may stay volatile. Investors may want to focus on sectors like infrastructure and urban development, where incremental government spending is expected.

Key Points:

NDRC promises incremental infrastructure spending but no large-scale stimulus.

Hang Seng Index sinks 9.41%, reflecting disappointment over stimulus.

100 billion yuan advanced from 2025 budget for strategic projects.

Markets remain uncertain amid potential future policy easing.

FTX Finalizes $16B Customer Repayment Plan

Synopsis:

FTX, the once-dominant crypto exchange, is nearing the final stages of its bankruptcy process, with a court-approved plan to repay creditors. The estate has recovered up to $16.5 billion to settle claims, promising to repay 98% of customers, but in cash, not the original crypto they held.

While customers will receive at least 118% of their November 2022 account value, many are disappointed about missing out on the recent surge in crypto prices. The sentencing of top executives, including Sam Bankman-Fried’s 25-year term, closes a dark chapter in the crypto world.

The Details:

Repayment Plan Approved: Judge John Dorsey approved FTX's plan, with $14.7 to $16.5 billion available to repay creditors.

Cash Instead of Crypto: Creditors will receive cash equal to the value of their crypto holdings from November 2022, with interest, but many are upset about missing the crypto market's rebound.

Sentencing of Executives: Sam Bankman-Fried received 25 years, Caroline Ellison 2 years, and Ryan Salame 7.5 years for their roles in FTX's collapse. Sentencing for Nishad Singh and Gary Wang is still pending.

Customer Discontent: Despite receiving 118% of their original holdings, many customers are frustrated, as Bitcoin has surged from $16,000 in November 2022 to over $63,000 today.

Why It Matters:

The conclusion of the FTX saga brings relief to creditors, but the decision to return funds in cash leaves many feeling shortchanged due to the crypto market's resurgence. Traders and investors who had hoped to regain their crypto holdings will need to decide how to re-enter the market with the payouts.

Should a fraction of the repayment re-enter the market, we should see a tailwind of retail participation as the funds are dispersed.

Key Points:

FTX repays 98% of customers in cash, not crypto.

Executives sentenced, with Bankman-Fried serving 25 years.

Customers miss out on the recent crypto price surge, causing frustration.

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Premium Subscriber Section

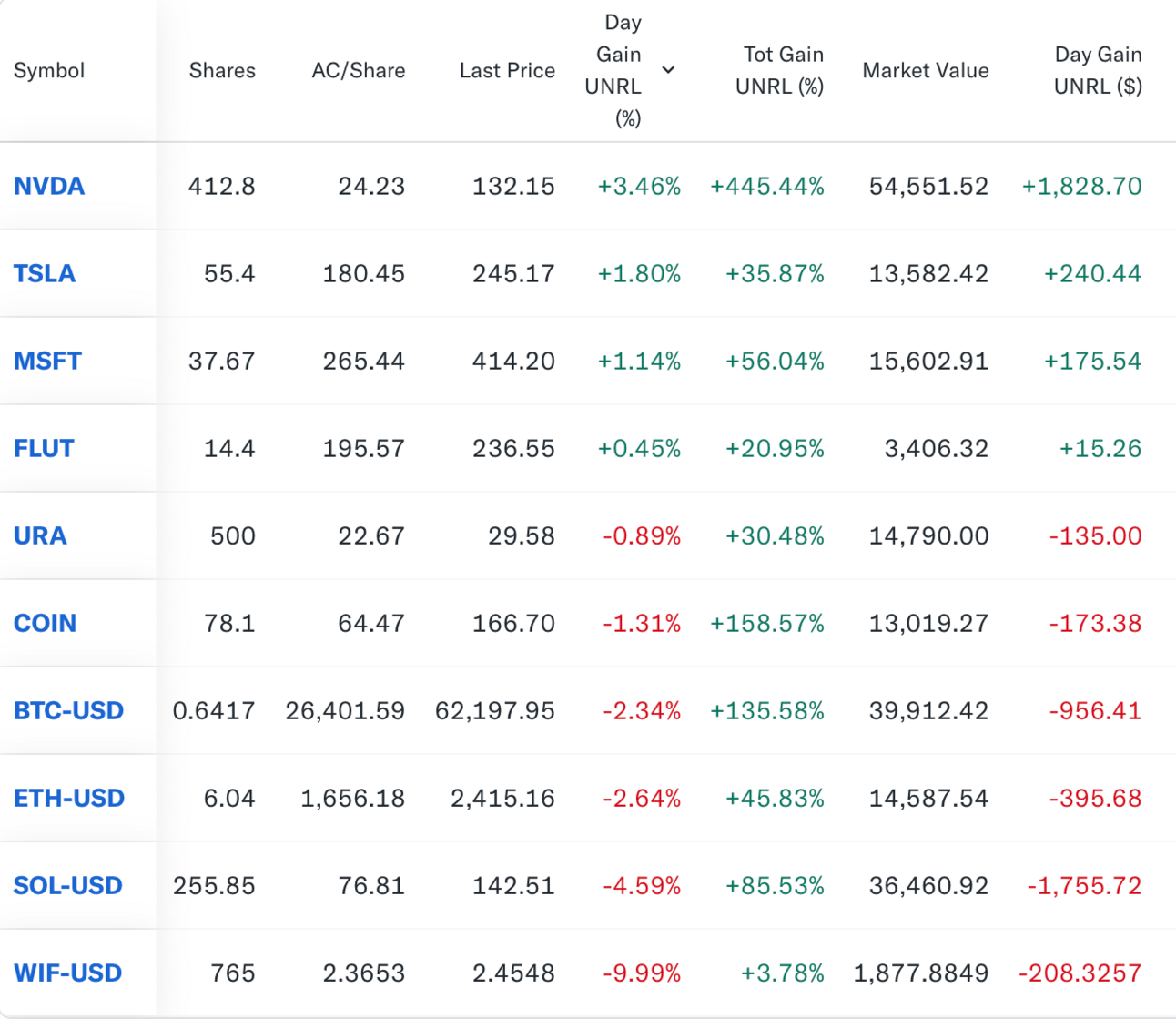

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll