TheBRRR’s Thoughts

GM. Fairly muted week for markets. The most significant piece of macroeconomic data was the weekly jobless claims, which came in higher than expected, and as high as any weekly claim in the last 9 months (Reuters).

Markets ticked higher on the report, but have had little reason to move much the rest of the week as volatility has all but crawled to a halt.

The summer still sets up well for rally in risk assets with corporate buybacks, slowing quantitative tightening and potential interest rate cuts all on the table headed into the election.

Today we’re covering a hot take on next week’s critical CPI report. Analysts are predicting that calculation changes to the shelter/housing component will lead to a dovish surprise.

We’re also covering supportive comments made by former President Donald Trump about crypto, contrasting his stance with the Biden admin’s hostility to the industry. Ever the populist, Trump tends to like whatever the other side dislikes as long as it provides a boost in the polls, but it’s still a positive development for the battle-tested industry. Here’s the video.

Could the 40m US citizens holding crypto swing the election? 1 in 5 voters think it’s a key issue this year, per DCG research published this week.

Trump Speaks To Crypto Investors At Event

What Happened:

During gatherings with NFT buyers and public statements, Trump has asserted his support for the crypto sector, promising to allow campaign donations in cryptocurrencies and to prevent crypto businesses from leaving the U.S. due to regulatory hostility.

Key Comments:

Trump stated, "I’m fine with it," emphasizing his approval for the crypto industry. He expressed a desire to ensure the industry is "good and solid" and encouraged crypto supporters to vote for him.

He addressed concerns about U.S. crypto firms leaving the country due to regulatory hostility, specifically criticizing Democrats and SEC Chair Gary Gensler for this perceived antagonism.

Trump contrasted his stance with that of President Joe Biden, whom he accused of lacking understanding about crypto. On the same day, Biden expressed intentions to veto a resolution that would repeal an SEC accounting policy (SAB 121), viewed as detrimental to crypto operations.

The issue of cryptocurrency regulation is expected to be a significant factor in the upcoming election, influencing voter decisions.

Why It Matters:

Political Influence on Crypto Markets:

Volatility and Speculation: Trump's comments have immediate impacts on market prices, highlighting how political endorsements can drive speculation and volatility in the crypto market.

Election Dynamics: Cryptocurrency policy is becoming a more prominent issue in U.S. elections, with candidates like Trump and RFK Jr. positioning themselves as pro-crypto. This could sway voters who prioritize digital currency and blockchain policy.

Regulatory Environment:

SEC Scrutiny and Regulation: The Biden administration and the SEC have been criticized for a heavy-handed regulatory approach towards crypto, termed "regulation by enforcement." Trump's pro-crypto stance contrasts sharply with the current administration’s policies, suggesting significant changes if he is re-elected.

Analyst: CPI Will Land Soft Because Of Adjusted Methodology

What Happened:

Standard Chartered and ZeroHedge predict a significant discrepancy in the upcoming Consumer Price Index (CPI) report, specifically in the Owner Equivalent Rent (OER) component. This prediction is based on the expectation that the Bureau of Labor Statistics (BLS) will adjust OER values, which have historically lagged behind real-time market rent data. This adjustment is anticipated to show a downturn in OER, contrary to current rising rent trends.

Analysis by Steven Englander: The chief FX strategist at Standard Chartered conducted a regression analysis on OER, which suggests a decrease in OER inflation in the coming months. This analysis predicts OER inflation at 0.29% month-over-month in Q2 2024, a drop from 0.48% in Q1.

Federal Reserve implications: A decrease in OER could significantly impact the core CPI, potentially lowering it from 0.3% to 0.2% month-over-month, thus influencing Federal Reserve policy decisions concerning interest rates.

Why It Matters:

Inflation Tracking and Response: The CPI is a critical economic indicator used by the Federal Reserve to make decisions about monetary policy. A "big miss" in CPI, as predicted, could shift expectations and lead to changes in interest rate policies.

Political Influence: With U.S. elections on the horizon, there is speculation about political pressures influencing economic reporting and decision-making, potentially to avoid dampening consumer sentiment.

Data Integrity and Economic Predictions:

Reliability of Economic Data: The lag in incorporating real-time data into official measures like the OER raises questions about the timeliness and accuracy of economic indicators that guide policy decisions.

Future Rent Trends and Economic Cycles: The anticipated adjustment in OER, while intended to reflect past rent drops, may not align with current rising rent trends, which could lead to misjudgments in economic policy and planning.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

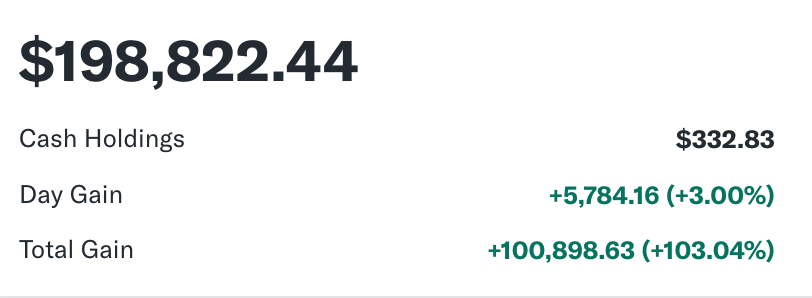

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana and added Solana’s top memecoin WIF on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll