Inflation experts

GM and BRRR.

Markets were again mixed on Tuesday, as traders await this morning’s CPI report and this afternoon’s FOMC minutes to telegraph the Fed’s next policy move. The street expects to see 5.1% inflation y/y in the CPI - we hold our breath for 5.1% or lower to spark a resumption of this year’s rally in risk assets.

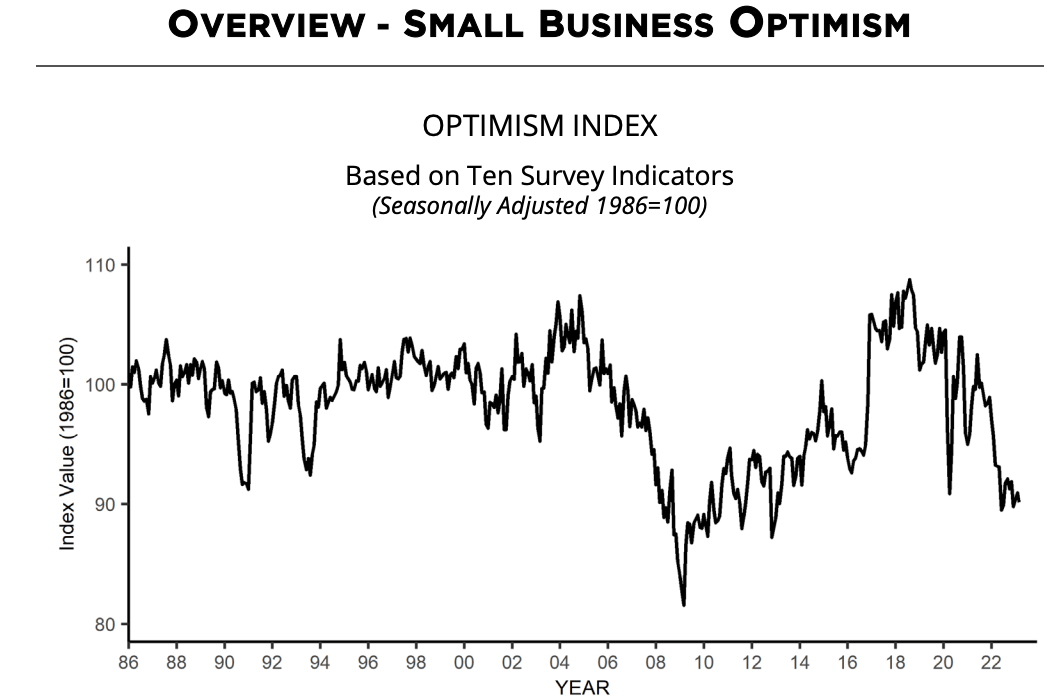

In other news, small businesses are struggling to obtain loans and expand, with a recent NBIC poll revealing a record low 2% of them seeing it as a good time to do so. Aggregate small business optimism has crashed below the COVID lows to levels not seen since the 00’s Great Recession (chart below).

We’ll return with the next prediction contest poll tomorrow.

Here’s what we brrr’d today:

CPI Preview

Record Low Credit For Small Businesses

IMF Warns of Hard Landing

CPI Preview

CPI Significance: CPI report impacts the Fed's interest rate decisions, affecting the broader economy, as market participants scrutinize the data for inflation trends and economic health indicators.

Consensus expectations: Predicting a drop in headline inflation from 6.0% to 5.1% Y/Y and a modest core gauge increase from 5.5% to 5.6%; slowdown to 0.2% M/M at the headline level, core CPI dipping to 0.4% from 0.5%.

Key focus items: Goldman's economist projects 0.5% increase in used car prices, 0.2% increase in new car prices, 2% decline in airfares, and elevated but decelerating shelter inflation (rent +0.73%, OER +0.65%).

Market reactions: Hot CPI reading could cause uncertainty regarding the Fed's next move, potentially leading to a 2% drop in the S&P if YoY CPI is above 6%; rates side analysis reveals average net sell-off in the front end of the curve.

Equity trading desk observations: Increased demand for low multiple/value retail ahead of CPI print, with Consumer Staples as the largest buy sector, signaling more defensive positioning among market participants.

Record Low Credit For Small Businesses

Credit crunch crash phase: Over the last two weeks of March, a record $105 billion in commercial bank loans and leases were sold, discharged, or transferred from bank balance sheets, signaling the credit crunch entering the crash phase and impacting small bank real estate loans.

Small business pessimism: NFIB's Small Business Optimism report showed a drop from 90.9 to 90.1, marking 15 consecutive months below the 49-year average of 98, with 24% of owners reporting inflation as their most significant business problem and 47% expecting worse conditions in the next six months.

Credit access worsens: In March, 9% of frequent borrowers reported financing was harder to obtain compared to three months earlier, the most since December 2012, and the 4-point monthly drop was the largest collapse in credit availability in over 20 years.

Tougher credit conditions expected: The same share of borrowers anticipates more stringent credit conditions in the next three months, matching the highest level in a decade, confirming that the credit crisis is only beginning for small businesses.

Dilemma for policymakers: Credit difficulties rank below inflation and labor quality as the most significant problem for small businesses, leaving Biden and the central bank in a challenging position - focusing on inflation could lead to growth collapse, while rebooting credit growth could result in a fresh inflation surge.

IMF downgrades Global Economic Growth - because inflation, bank collapses, obv.

Downgraded global growth forecast: The International Monetary Fund (IMF) has downgraded its global economic growth forecast for 2023 to 2.8%, citing high inflation, rising interest rates, and uncertainties caused by the collapse of two major US banks.

Increased global inflation prediction: The IMF predicts 7% global inflation for 2023, higher than its previous estimate of 6.6%, and warns that persistently high inflation may force central banks to keep raising interest rates, which could potentially destabilize banks that rely on historically low rates.

Hard landing risks heightened: The fund highlights increased risks of a "hard landing," especially in the world's wealthiest countries, which could lead to a recession and pose risks to global financial stability.

Rethinking monetary policy: The IMF's Global Financial Stability Report recommends policymakers consider adjusting the stance of monetary policy to support financial stability, possibly rethinking the pace of interest rate hikes intended to cool inflation.

Mixed regional outlooks: While the IMF issued modest upgrades for the US and European economies, it downgraded growth prospects for India, Latin America, the Middle East, Sub-Saharan Africa, and less-developed European countries. It also predicts Ukraine's war-torn economy will shrink by 3%.

AI ART OF THE DAY

too real

The BRRR’s Portfolio

Mixed day for the portfolio. Coinbase’s 6% gain helped shelter us from the tech beatdown.

Here’s your referral link to qualify for the Prediction Contest $100 Prize 👇

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.