TheBRRR’s Thoughts

GM.

Kamala Harris beat expectations in last night’s debate by executing on a coherent strategy. Her team prepared coherent talking points and she delivered them with more poise than we’ve seen from her in years.

Trump on the other hand, showed up without any fresh ammo. He didn’t raise any new data points, anecdotes or tripes to throw Kamala off of her game. Many of her most dishonest claims went unchecked by Trump, and the moderators certainly did him no favors - they fact checked and interrupted him countless times but left Kamala alone.

Stocks shrugged. Crypto sneezed.

Betting markets started to price in improved odds of a Kamala win (48% - >51%) , but we’re right back to 50-50 as we publish this.

At 8:30 AM, August’s CPI report hit the tape and markets also broadly shrugged, as the Nasdaq is completely unchanged since Tuesday’s close.

The odds of a 50 bps rate cut at next Wednesday’s FOMC meeting did fall from 34% yesterday to 15% today, while the odds of a 25 bps cut surged to 85%.

Core Inflation Comes In Slightly Hot

WHAT HAPPENED:

Headline CPI: +0.2% MoM (as expected), holding at 2.5% YoY—the slowest pace since early 2021.

Core CPI: +0.3% MoM, hotter than the +0.2% expected, pushing the YoY rate to 3.2%. This uptick in core inflation surprised the market and raises concerns about inflation being stickier than hoped

WHY IT MATTERS:

Fed’s Path Forward:

25bps Cut Likely: The market has now almost entirely priced in a 25bps cut at the September 18th FOMC meeting. The surprise mild rise in core inflation effectively rules out a 50bps cut

Inflation Stickiness: The slightly higher core inflation indicates that underlying price pressures, especially in shelter and services, are not easing as quickly as expected. This complicates the Fed's roadmap and may result in a slower cutting cycle than markets initially anticipated.

Sector-Specific Trends:

Shelter Costs: Still a major driver of core inflation, with shelter prices rising 0.5% MoM in August, accelerating from July’s 0.4%. Shelter inflation is up 5.2% YoY but has cooled significantly from its peak

Used Cars and Airfare: Price declines in used cars moderated, while airfares ticked up due to seasonal effects.

MARKET REACTION:

Equities Mixed: Stocks traded with caution as the uptick in core inflation raised questions about how aggressive the Fed might be with future cuts. Volatility was elevated, with bond yields rising in anticipation of tighter monetary policy

Bond Markets: Investors are adjusting expectations, no longer pricing in the potential for a jumbo 50bps cut. Traders expect the yield curve to steepen, reflecting slower, smaller rate cuts ahead.

WHAT TO WATCH:

September 18th Fed Meeting: Expect a 25bps rate cut, but the core CPI’s persistence means that markets will scrutinize Powell’s post-meeting comments for signs of the Fed’s future path. Will the sticky inflation lead to a more cautious stance on further cuts?

Labor Data: With inflation not cooling as fast as hoped, attention will shift back to the jobs market and wage growth, which will be critical in determining the Fed's next steps.

Presidential Debate Reaction: Betting Markets Flinch

Trump-Harris Debate: Substance and Market Response

WHAT HAPPENED:

The Trump-Harris debate centered on key issues like the economy, immigration, abortion, and foreign policy.

Notable moments included Harris pressing Trump on his economic policies and Trump accusing Harris of being weak on immigration. Despite the exchanges, no major breakthroughs emerged for either side.

Trump was roundly criticized for a lack of substance and substantiation of his claims, while Harris was perceived as well-prepared.

Both candidates played fast-and-loose with the truth, with Trump making unsubstantiated claims about pet abductions by Haitian immigrants in Ohio while Harris repeated the widely debunked claim that Trump said white nationalists were very fine people.

WHY IT MATTERS:

Betting Markets: Markets showed little reaction; Trump's odds dropped only from 52% to 50%, suggesting no clear winner or momentum shift.

Economic Focus: Both candidates hammered on economic recovery, though Trump's policies were more focused on deregulation, while Harris emphasized labor rights and middle-class support.

The debate had no effect on stock market indexes, while crypto sold off as Trump stumbled.

BOTTOM LINE:

Despite the heated debate, markets are still pricing in a tight race, and the debate didn't provide significant new catalysts for either candidate. Expect more volatility as election day approaches but no immediate impact from this debate alone.

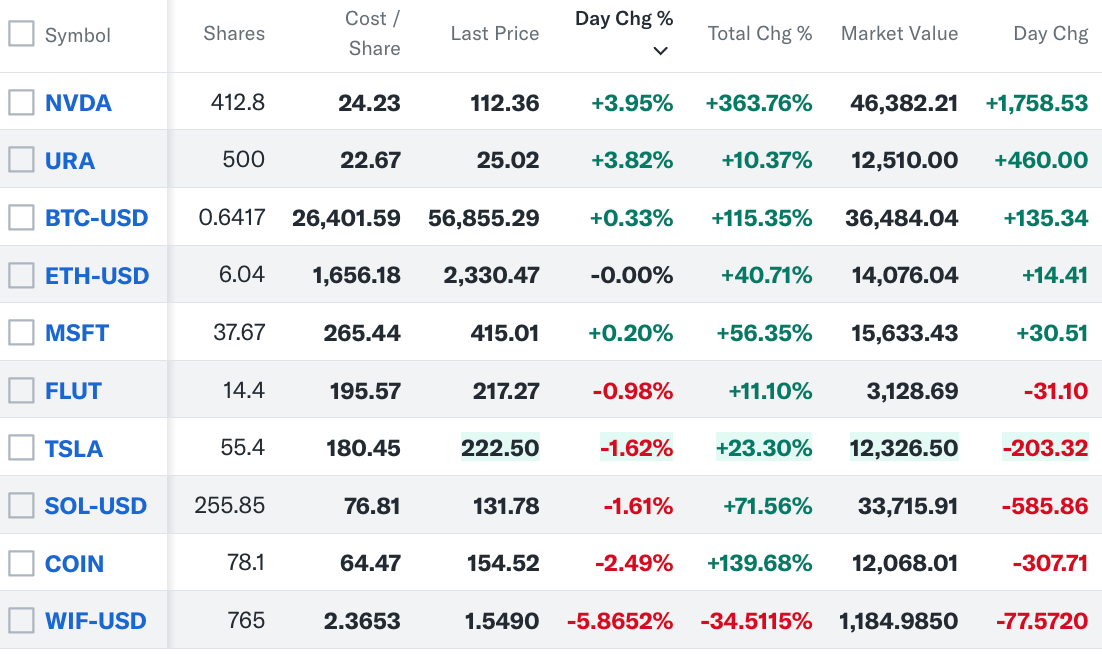

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll