TheBRRR’s Thoughts

GM.

Welcome to a news-heavy week with a deluge of major tech earnings and central banker statements due out.

With Microsoft, Apple, Google, Meta and Amazon lined up to report, we expect that this week will set the tone for the technology sector over the next 3 months.

All 5 companies have impressed analysts with austerity/cost-cutting measures while maintaining or growing revenue over the last 18 months and we broadly expect this to continue.

We are particularly curious to see how Apple reports, as there have been recent reports of weak iPhone demand as the improvements have become more marginal so consumers don’t have the same desire to upgrade to the latest model as frequently as they once did.

Goldman Analyst: March Cuts Still On The Table

Goldman Sachs Central Bank Rate Cut Forecast Synopsis:

What Happened:

Goldman Sachs suggests possible rate cuts by the Federal Reserve, European Central Bank, and Bank of England as early as March, driven by declining inflation indicators and cooling labor markets. The Fed's core PCE inflation is below the 2% target, and the ECB is showing a dovish pivot, with the BoE also likely to follow suit amid inflation control progress.

Inflation Indicators: Core PCE, the Fed's preferred inflation gauge, dipped to 0.17% MoM, bringing the YoY rate to 2.9%, the first sub-3% since 2021. The 6-month annualized core PCE is now at 1.86%, below the 2% target.

Labor Market Signals: Indications of a cooling labor market are emerging. Data such as the household survey, JOLTS, and ISM Services employment suggest a slowdown, aligning with one side of the Fed's dual mandate.

Policy Implications: Given these metrics, Goldman suggests the Fed might cut rates in March, a significant shift from the hawkish tone previously maintained. The potential for a 25bp cut, as opposed to larger increments, is indicated.

ECB’s Recent Meeting Tone: The ECB's latest meeting was more dovish than anticipated, signaling a readiness to pivot. President Lagarde acknowledged weaker economic data and a disinflationary trend.

Why It Matters:

Shift in Monetary Policy: This comprehensive analysis by Goldman Sachs underscores a global central banking pivot towards potential rate cuts, a departure from previous hawkish stances. For investors, this suggests a more accommodative monetary environment could support risk assets, especially if central banks like the Fed and ECB ease their policies.

The BRRR’s Take: Goldman sees what we see - central bankers running out of excuses to keep interest rates high and narrative cover to cut rates to help regional banks currently drowning in underwater bonds and toxic assets.

Money. Printer. Go. BRRR.

Big Tech Earnings Report Preview

5 Tech giants report earnings this week, a combined $10 trillion in market cap representing 25% of the S&P 500. Here are the key drivers and expectations for each company.

Meta Platforms Q4 2024: Analysts anticipate a significant increase with an expected EPS of $4.84, up 61.3% year-over-year, and revenues forecasted at $38.93 billion, a 21% increase. The growth in 'Revenue- Advertising' is projected at $37.88 billion, demonstrating a 21.2% rise. These projections suggest a strong rebound in the advertising market, with Meta leading the way, leveraging its AI technology. The focus is on the company's performance in advertising and its strategic use of AI following a year marked by restructuring and efficiency improvements

Microsoft Q4 2024: Microsoft anticipates strong earnings with a projected EPS of $2.55 and revenue of $55.47 billion. Growth drivers include robust Azure cloud services and Office 365 transition. The company has consistently surpassed earnings and revenue estimates in recent quarters. AI, particularly ChatGPT, presents new growth opportunities.

Apple Q4 2024: Apple's Q4 report shows a slight revenue dip to $89.5 billion, but a 13% increase in EPS to $1.46. Key highlights include record iPhone sales and high Services revenue. Apple's focus on its Mac lineup, especially the M3 chip-powered devices, has driven new customer acquisition. Despite recent revenue declines, Services remain a growth area.

Alphabet Q4 2024: Alphabet is expected to post an EPS of $1.20 with revenue at $75.62 billion. The spotlight is on Google Search ads and AI advancements following the rise of ChatGPT. Challenges include advertising pullbacks and currency headwinds. Analysts will focus on Alphabet's strategies in search, advertising, and AI.

Amazon Q4 2024: Amazon's Q4 earnings are projected to set a record with $137.6 billion in revenue, up 10% year-over-year. However, EPS is expected to decrease to $3.70 from $14.09 previously. Growth is driven by AWS and Advertising, but challenges include labor shortages and supply chain issues. Amazon's strategies in cloud computing and same-day delivery will be key areas of focus.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 70+% since we bought and should continue to run. 🔥

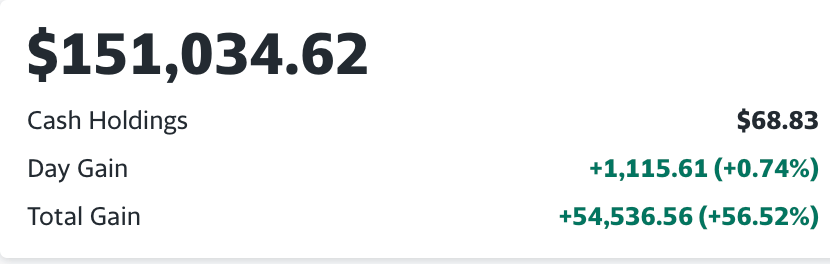

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.