Silicon Valley rn

GM and BRRR.

A flurry of earnings and economic data has hit the tape since our Wednesday email.

Earnings

Amazon earnings: BIG BEAT, stock up 9%

Apple earnings: BEAT, stock down 2.5%

Coinbase earnings: BEAT, stock flat

Q2 tech earnings have universally been stronger than headline expectations, but the Nasdaq is down slightly since the reports began. This suggests that the index (and many individual names) were priced for perfection with no new buyers to be found, so any level of profit-taking or risk-reduction resulted in weak price performance.

We called out the limited upside in our July 19th email.

Jobs Data

Unemployment: 3.5% vs 3.6% expected

July New Jobs Added: 187K vs 200K expected

Hourly Wages: Up 4.4% y/y vs 4.2% expected

This morning’s jobs data paints a fairly rosy picture of the state of the US economy with unemployment lower than expected and hourly wages better than expected.

This will build the Fed’s confidence to raise interest interest rates again, despite markets expecting them to pause and soon reverse course.

Market reaction has been fairly muted, with the indexing walking higher by less than 0.5% in early trading while the VIX (measure of expected volatility) is down by 3%.

The cooling VIX is instructive, although it is still up 20% since July 27th.

Today’s email is brought to you by the AI Tool Report. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report: Leverage AI for productivity. Leverage AI for creativity. Leverage AI so the robots don’t replace you. This newsletter brings the best AI Tools to your inbox. Here’s your link to subscribe for free.

Silicon Valley’s AI Chip Wars

Battle Royale for Nvidia's Hottest Chip

Access to Nvidia's powerful and expensive H100 GPUs for large language model training has become highly coveted in Silicon Valley, with major tech firms like Meta, Microsoft, and Google vying for limited supply. While startups look for efficiency improvements, for large-scale AI model training there seems to be no replacement for the H100 - making a powerful case for Nvidia’s ability to retain its large moat and unmatched pricing power.

Frenzy to Fuel AI's Appetite: Ravenous demand for H100s continues growing, with estimated needs of 50K-100K in the next 1-2 years from the likes of OpenAI, Anthropic, Meta and major cloud providers. At ~$35K per chip, this represents a $15B+ potential market servicing a slice of big tech alone.

Manufacturing and Components Fall Short: Even as Nvidia insists it is producing enough GPUs, supply chain issues around scarce components limit system-level production. New H100 DGX systems remain backordered, unavailable before late 2022 due to shortages.

Unequal Access Sparks Tensions: With the H100 conferring a competitive edge, allocation rumors cause controversy amid the talent/funding battles. Disparities in access may cement power relationships. Startups seek efficiency improvements as temporary alternatives.

Crypto News

Coinbase Beats Q2 Expectations Amid Crypto Slump, Lawsuit

Coinbase reported second quarter earnings that beat analyst expectations, despite ongoing challenges from the crypto bear market and regulatory scrutiny. The company posted adjusted revenue of $708 million and a loss per share of 42 cents, surpassing forecasts of $628 million in revenue and a 76 cent per share loss. Coinbase's stock price rose over 7% in after-hours trading following the better-than-expected results.

The earnings release comes as Coinbase faces a lawsuit from the SEC alleging it improperly listed securities. However, Coinbase remains confident in its legal position, with Chief Legal Officer Paul Grewal stating "We do think we can win." The company plans to file a motion to dismiss the lawsuit on Friday and is focused on pushing for regulatory clarity around cryptocurrencies.

While trading volume has declined amid low crypto volatility, Coinbase saw subscription revenue hold relatively steady at $335 million, down just 7% from last quarter. The company is optimistic about future growth drivers like a potential bitcoin ETF approval and bipartisan cryptocurrency legislation, which it believes could "enshrine consumer protections and an equitable market structure framework." However, analysts caution guidance may remain muted given persisting bearish crypto market conditions.

Legal Position: Coinbase to file motion to dismiss "unlawful" SEC lawsuit on Friday; Chief Legal Officer asserts "we do think we can win"

Q2 Financials: Adjusted revenue of $708M beats forecast of $628M; EPS loss of 42 cents surpasses expected 76 cent loss

Stock Price: Closed at $90.75 before earnings, then rose 7.4% to $97.50 after results

Lawsuit Context: SEC filed in July alleging Coinbase improperly listed securities from 2013-2021

Regulation Outlook: Cites bipartisan legislation progress; Committed to protecting crypto users

Growth Drivers: Upcoming bitcoin ETF decisions could broaden crypto's reach

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will Bitcoin outperform the Nasdaq over the next 10 years?

AI Art of The Day

Janet Yellen hoping for a soft landing so she can continue to dump bonds on the market.

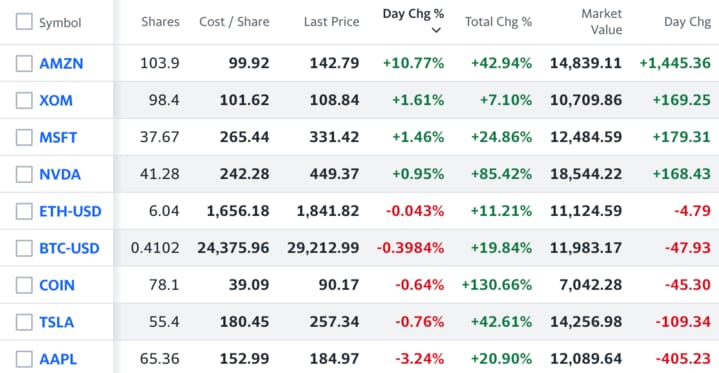

The BRRR’s Portfolio Update

Amazon single-handedly keeping the BRRR green today.

On Watchlist:

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$META: Sleeper in AI race and ad biz is proving resilient

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.