TheBRRR’s Thoughts

Risk asset have whipsawed around to close the week as geopolitical tensions have continued to spook markets.

The latest episode of this scripted back-and-forth between Iran and Israel featured Israel launching symbolic fireworks missiles that ultimately landed in Iran without causing any significant damage. This came as a response to Iran’s missiles that also exploded harmlessly - theirs in remote areas of Israel.

Iran has downplayed Israel’s latest response and seems content to allow the back-and-forth to end here.

Crypto markets reacted positively to the perceived conclusion of the exchange as bitcoin bounced from recent lows at $60,000 to $64,000 overnight, trimming its 7 day loss to 1.75%.

Equities have faired much more poorly both today and over the last 7 days, with the Nasdaq down by 1.3% today and 5.5% over the last 7.

We’ve been watching the charts intently this week and called bottoms in two crypto assets on Wednesday, alerting our premium subscribers.

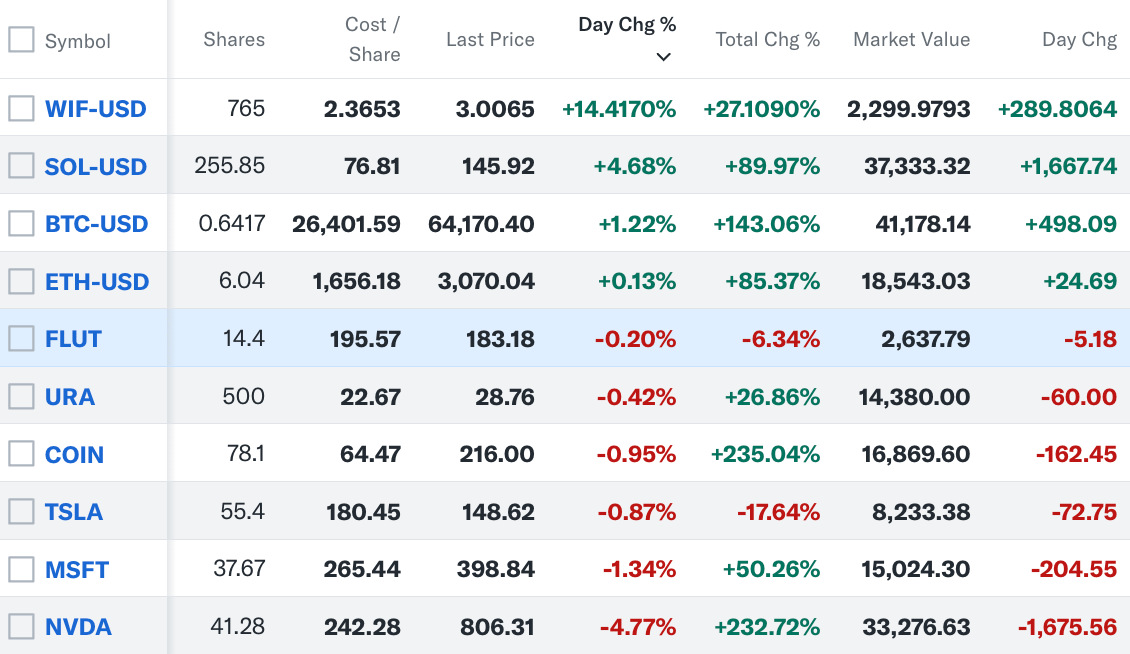

In an email titled “We’re Buying The Solana Dip” we added to the newsletter’s Solana position at $131 and added a small position in Solana’s largest memecoin dogwifhat as high-upside beta.

Since the price has already run 10% higher on Solana and 27% higher on the memecoin since the post was sent, we removed the paywall from the web version, accessible here.

I explain why I like Solana, and share a theory on why memecoins, and specifically Solana’s top memecoin, will continue to perform well as long as the bull market rages on.

Happy bitcoin halvening day to those that celebrate.

Have a great weekend!

Free SOC 2 Compliance Checklist from Vanta

Are you building a business? Achieving SOC 2 compliance can help you win bigger deals, enter new markets, and deepen trust with your customers — but it can also cost you real time and money.

Vanta automates up to 90% of the work for SOC 2 (along with other in-demand frameworks like ISO 27001, HIPAA, and GDPR), getting you audit-ready in weeks instead of months and saving you up to 85% of associated costs.

AI Darling Taiwan Semiconductor’s Weak Guidance Spooks Taiwanese Markets

WHAT HAPPENED

Overseas Investors Flee: Overseas investors pulled out $2.6 billion from Taiwanese tech on Friday, marking the most significant foreign selloff in over three years. This exodus was sparked by a downgrade in the growth outlook from Taiwan Semiconductor Manufacturing Co. (TSMC), along with broader global market weaknesses.

Impact on Taiwan's Markets: The sell-off led to a sharp 3.8% drop in Taiwan's tech-heavy stock index, its steepest decline since October 2022. The local currency, the Taiwan dollar, hit its lowest level since 2016.

TSMC Outlook Adjustment: TSMC, a pivotal figure in global chip manufacturing, scaled back its 2024 growth projections for the semiconductor market (excluding memory chips) to about 10% from previously higher estimates. The company cited ongoing macroeconomic and geopolitical uncertainties affecting consumer sentiment.

WHY IT MATTERS

Broader Economic Signals: The sizeable foreign withdrawal from Taiwan's stock market and the downward adjustment in TSMC's outlook are significant indicators of investor sentiment and broader economic trends. These moves reflect growing concerns over the sustainability of growth in the tech sector amid global economic headwinds.

Sector-Specific Repercussions: TSMC's revised forecasts are particularly noteworthy as they suggest a cooling in some areas of the chip market, even as the firm benefits from strong demand in the AI sector. This divergence highlights potential shifts in technology investment and development priorities.

Geopolitical Tensions: The outflows and market reactions also occur against a backdrop of heightened tensions in the Taiwan Strait, adding a layer of geopolitical risk to market dynamics and investment decisions in the region.

Expansion Plans Beyond Taiwan: TSMC is making a significant investment in the U.S., with $65 billion earmarked for three chip-making facilities in Arizona, highlighting its strategy to diversify manufacturing bases and potentially introduce advanced packaging technologies in the U.S. market.

Markets Dump As Israel Retaliates In Toothlesss, Performative Response

What Happened

Israel's Retaliatory Strike: Israel conducted airstrikes on Iranian territory, reportedly using unmanned aircraft. These strikes targeted locations including the 8th Tactical Airbase at Isfahan International Airport, which houses F-14 fighter aircraft.

Market Volatility: The initial news of the airstrikes caused panic selling in global markets, with futures dropping and oil prices spiking. However, as it became apparent that the Israeli response was more performative than escalatory, markets began to stabilize and rebound.

Media Reports and Responses:

Iranian media confirmed the Israeli airstrikes but downplayed the damage, stating no significant explosions occurred on the ground.

U.S. officials described the attacks as limited, suggesting a controlled approach by Israel.

Multiple reports indicated large explosions near Iranian nuclear sites and military facilities, although these were initially unconfirmed.

No-Fly Zone: Iran established a no-fly zone over its western region in response to the airstrikes.

Why It Matters

Geopolitical Implications: The exchange between Israel and Iran highlights ongoing tensions and the potential for escalation in the region. Despite the performative nature of the strike, the situation remains volatile with high stakes for regional security.

Market Sensitivity: The immediate market reactions reflect the global economy's sensitivity to Middle Eastern geopolitical events. Even perceived minor escalations can trigger significant market movements, impacting global financial stability.

Military and Strategic Posturing: The use of unmanned aircraft and precision strikes indicates a shift towards less risky forms of engagement, which could set precedents for future military actions in the region.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

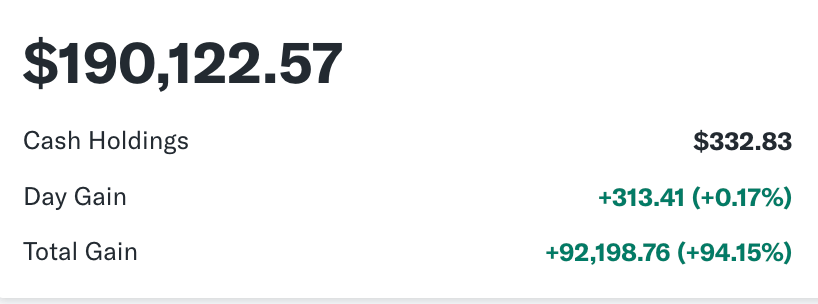

Portfolio

Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll