TheBRRR’s Thoughts

GM.

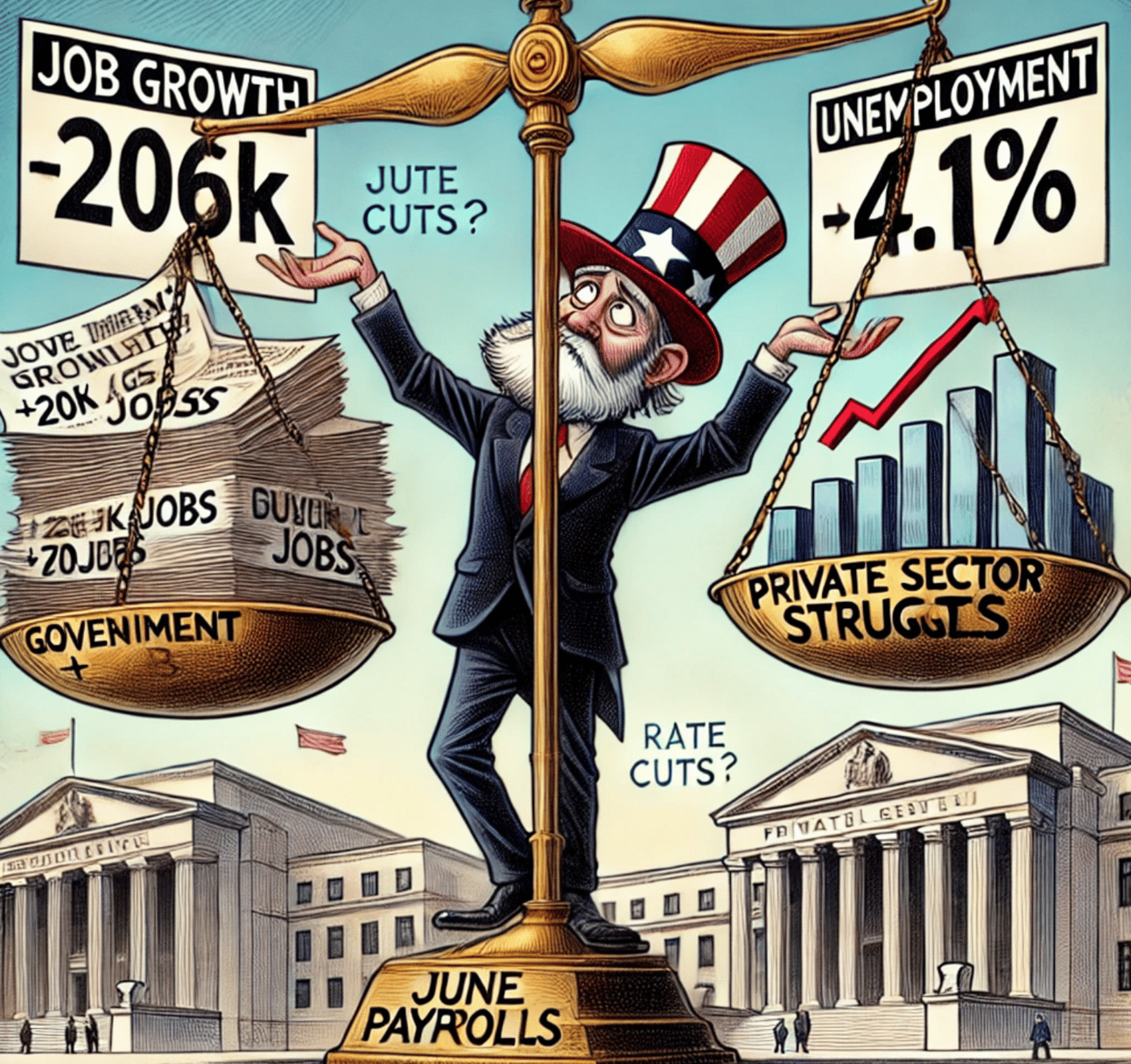

Economic indicators continued to tumble this morning as the unemployment rate ticked up to 4.1% while private sector payroll data came in dramatically below expectations.

Due to the deteriorating conditions and slowing inflation made evident over the last week, the odds of a September rate cut have risen from 64% to 75%.

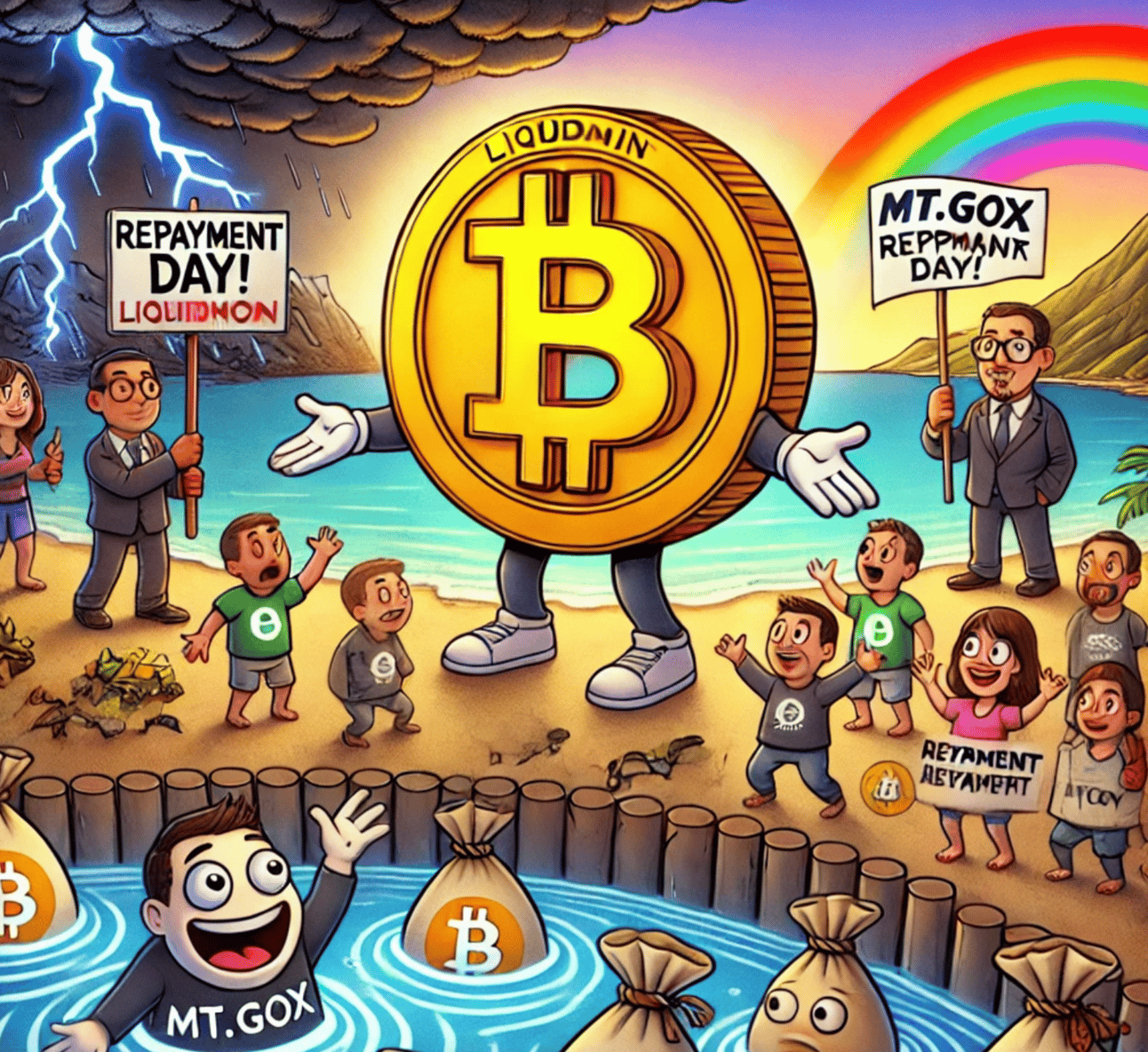

Equities continue to walk higher, but crypto assets have fallen hard as defunct crypto exchange Mt. Gox readies repayment of billions in bitcoin to early adopters after nearly a decade of legal wrangling.

The German government is also aggressively selling bitcoin they confiscated from an illegal streaming site, further driving price lower.

As these two supply unlocks play out, traders and speculators are frontrunning the selling, hoping to buy back lower or make money shorting as prices fall.

The selling will continue this summer and lower prices are expected, but we expect a strong rally to close the year as the Fed and Treasury inject liquidity and ease financial conditions.

The rubberband effect of shorts covering their positions and sellers rebuying should trigger a sharp move back higher when the selling has exhausted.

The inflation and employment data continues to support aggressive interest rate cuts this year, including what we learned in this morning’s data dump, as covered in today’s lead story.

Unemployment Rises to 4.1%, Flood Of Payroll Data Disappoints

WHAT HAPPENED

June Payrolls: The U.S. added 206K jobs in June, surpassing expectations of 190K and Goldman's forecast of 140K.

Downward Revisions: May's jobs were revised from 272K to 218K and April's from 165K to 108K, reducing job count by 111K.

Unemployment Rate: Increased to 4.1% from 4.0%, the highest since November 2021.

Job Sector Breakdown: Government jobs grew by 70K, Healthcare by 49K, Social Assistance by 34K, and Construction by 27K. Retail and temp-help services saw declines.

WHY IT MATTERS

Data Manipulation Concerns: Downward revisions inflate current figures, leading to future downward adjustments. This pattern raises concerns about data reliability.

Unemployment Spike: The rise in the unemployment rate signals a weakening labor market, conflicting with the narrative of a strong labor market.

Part-Time Job Growth: An increase of 50K in part-time jobs versus a decline of 28K in full-time jobs suggests underemployment issues.

Labor Force Participation: Increased to 62.6%, indicating more people are actively seeking jobs.

Wage Growth: Slowed to 3.9% YoY from 4.1%, which shows easing inflationary pressures.

IMPLICATIONS FOR RATE CUTS

Federal Reserve's Stance: The weakening job data strengthens the case for potential Fed rate cuts, possibly as early as September. The rise in unemployment and slower wage growth may prompt the Fed to consider easing monetary policy to support the economy.

Mt. Gox Moves $2.7B in Bitcoin Ahead of $9B Repayment Event

WHAT HAPPENED

Mt. Gox Moves Bitcoin: The defunct crypto exchange moved nearly 47,229 BTC (approx. $2.71 billion) to a new wallet.

Subsequent Transactions: The new wallet sent back 2,702 BTC to cold storage and then transferred 1,545 BTC to a Bitbank hot wallet.

Payout Preparation: This activity precedes a $9 billion repayment to creditors in Bitcoin, Bitcoin Cash, and fiat.

WHY IT MATTERS

Market Impact: This significant movement of BTC is expected to add substantial selling pressure, potentially lowering Bitcoin prices.

Price Fluctuations: Bitcoin has already seen a drop of 5.54% in 24 hours and 18.7% in the last 30 days.

Market Sentiment: The impending payout and movements from other entities like the German government exacerbate concerns of increased selling pressure and price volatility.

ANALYSIS

Selling Pressure: Analysts predict continued selling pressure as the market absorbs the additional supply from Mt. Gox and Germany.

Potential Bottom: Experts suggest that the end of these large-scale sales might mark a bottom for Bitcoin prices.

Investor Concerns: The market is already reacting with a significant drop in prices, triggering widespread liquidations and increasing volatility.

MARKET REACTION

Bitcoin Price: Fell to its lowest point in four months, hitting $53,550 amid heavy selling.

Liquidations: Over $600 million in long positions were liquidated, the largest single-day wipeout since mid-April.

Bear Market: The broader crypto market is officially in a bear run, with a combined market cap drop of over 11% in 48 hours.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll