GM and BRRR, we have an exciting news day for you all.

Once again we turn our gaze to the Federal Reserve's ever-fragile chairman, Jerome Powell, as the transcript of his monetary policy testimony to Congress has been released.

The market rally has paused ahead of Powell's testimony, reflecting the nerves of investors who've heard the same tune before. Powell's message? A stubborn commitment to hiking interest rates despite the inherent risks to the economy.

The alleged battle against inflation, according to Powell, is far from over.

Despite the scary macro picture, crypto is decoupling on a rush of institutional adoption headlines. Bitcoin has surged from $25k to $29k over the last 6 days as institutions like Invesco have piled in behind BlackRock with additional ETF filings.

And finally, we’re highlighting an under-the-radar company in the AI space that supplies nearly all of the machines used by Nvidia to manufacture processors. At over $200m per machine with over 5,000 components sourced from all over the world, $ASML has quite a moat around its business.

Let’s get after it.

AI: The Money Robots

ASML Deep Dive

Background and Operations: ASML Holding is a Dutch multinational corporation that develops and manufactures photolithography systems, primarily for the semiconductor industry. These systems are essential in the production of integrated circuits or chips. ASML's technology involves the use of light to print tiny patterns onto silicon, a process fundamental to chipmaking.

Critical Player: ASML's technology is so advanced that without their lithography machines, products as ubiquitous as Apple's iPhones or as sophisticated as the Nvidia chips that power ChatGPT would be impossible.

Competitive Advantage and Business Moat: ASML's competitive advantage lies in its unique position as the world's only manufacturer of EUV lithography systems, a technology that is crucial for producing the most advanced chips. The company's technological expertise, combined with significant barriers to entry such as high capital costs and complex manufacturing processes, creates a substantial business moat.

Key Innovator: The company's innovations have ensured that transistors have continued to shrink, making chips more powerful and keeping Moore’s Law alive.

Financial Strength and Market Position: ASML reported net sales of €5.96 billion in Q1 2023, a 15% increase from the same period in the previous year. ASML's market cap of about €275 billion makes it Europe's most valuable tech company.

Strong Earnings & Profit Growth: The company's profits have more than doubled over the past five years, with a corresponding 300% rise in its share price since mid-2018. The company's earnings have been consistently strong, with a gross margin of 51.5% in Q1 2023.

Future Prospects: ASML is betting on a doubling in the size of the semiconductor market in the coming years: from $600 billion today to up to $1.3 trillion by 2030. It has a $40 billion backlog of orders to prove demand is still resilient and plans to invest more than €4 billion in R&D by 2025 to sustain its pace of innovation.

Read more, Also more.

Publicly-traded companies mentioned: ASML

Our take: Bullish for $ASML. They’ve shown nothing but operational excellence and foresight.

Crypto: Digital Gold Rush

The Institutions Are Here

The SEC's Unending Love for Red Tape: Despite numerous attempts by ETF issuers like VanEck, ProShares, Invesco, Valkyrie, and ARK to launch spot bitcoin ETFs, the SEC has been playing hard to get. Their reason? The unregulated nature of the crypto space and its potential for fraud. Yet, it seems they have no problem with bitcoin futures ETFs or the Grayscale Bitcoin Trust (GBTC), which has been a rollercoaster ride for investors due to its trust structure.

BlackRock's Bold Move or Fool's Errand? In a surprising twist, BlackRock, the world's largest asset manager, has decided to throw its hat into the bitcoin ETF ring. With over 30 failed bitcoin ETF filings in the past, one has to wonder if BlackRock knows something we don't, or if they're just keen on joining the SEC's rejection party. The fact that they're planning to use Coinbase as their bitcoin custodian, a company currently being sued by the SEC, adds an extra layer of intrigue (and absurdity) to the situation.

The Crypto Chess Game: While BlackRock's filing doesn't technically stand out from previous ones, there's a conspiracy theory floating around that suggests BlackRock might be playing mediator in the Coinbase/SEC battle. If the SEC gains regulatory oversight of crypto exchanges, it could pave the way for a bitcoin ETF approval. Meanwhile, Fidelity is also eyeing the bitcoin ETF race and could potentially acquire Grayscale to become a major player in the crypto ETF space.

Crypto assets mentioned: BTC

Our take: Bullish for BTC, as it’s hit escape velocity

AI ART OF THE DAY

BlackRock CEO Larry Fink is the captain now.

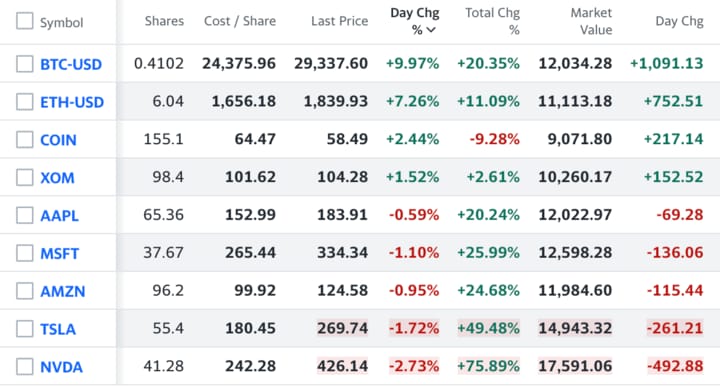

The BRRR’s Portfolio

Cruising along here. We like the new names on the watchlist, but not at the expense of what’s in the portfolio already.

On Watchlist:

$ASML: AI Supply Chain

$AI: Enterprise AI software

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.