TheBRRR’s Thoughts

GM.

Markets (and The BRRR portfolio) continue walking higher in the aftermath of last week’s Fed Pivot. The Nasdaq is back above 2021’s all-time high for the first time as money managers bid previous winners up to close out their books for the year.

Today we’re covering Apple’s decision to halt Watch during their best sales quarter of the year and the crypto industry’s collaborative lobbying effort - loading up a superpac with 78M in dry powder to fight Elizabeth Warren and her fellow dinosaurs.

Crypto News

Jay Powell's Comments on US Interest Rates - A Brief for 'The BRRR' Newsletter

WHAT HAPPENED:

Major Crypto PAC Funding: Cryptocurrency giants Ripple, Coinbase, and Andreessen Horowitz (a16z) have spearheaded a collective pledge of $78 million to the Fairshake political action committee (PAC) for the 2024 U.S. elections.

This initiative is supported by other prominent figures in the crypto space, including Brian Armstrong, the Winklevoss twins, Circle, Kraken, and Fred Wilson.

WHY IT MATTERS:

Crypto Industry's Response to Regulatory Pressures: Amid intense scrutiny from federal regulators like the SEC, this substantial funding aims to back candidates advocating crypto-friendly policies.

Strategic Political Engagement for Crypto's Future: The industry's substantial investment in these PACs is a strategic move to influence policy direction in Washington. With the SEC recently rejecting Coinbase's petition for bespoke crypto rules, the industry sees the 2024 elections as pivotal for shaping a more favorable regulatory landscape.

Potential for Shaping U.S. Crypto Policy: With the next U.S. presidential election approaching, there's a growing call within the crypto sector for clearer and more specific regulatory frameworks.

Political candidates across the spectrum, including Republicans Vivek Ramaswamy and Asa Hutchinson and Democrat Dean Phillips, have advocated for reining in the SEC's powers and establishing explicit rules for the crypto industry.

Crypto News

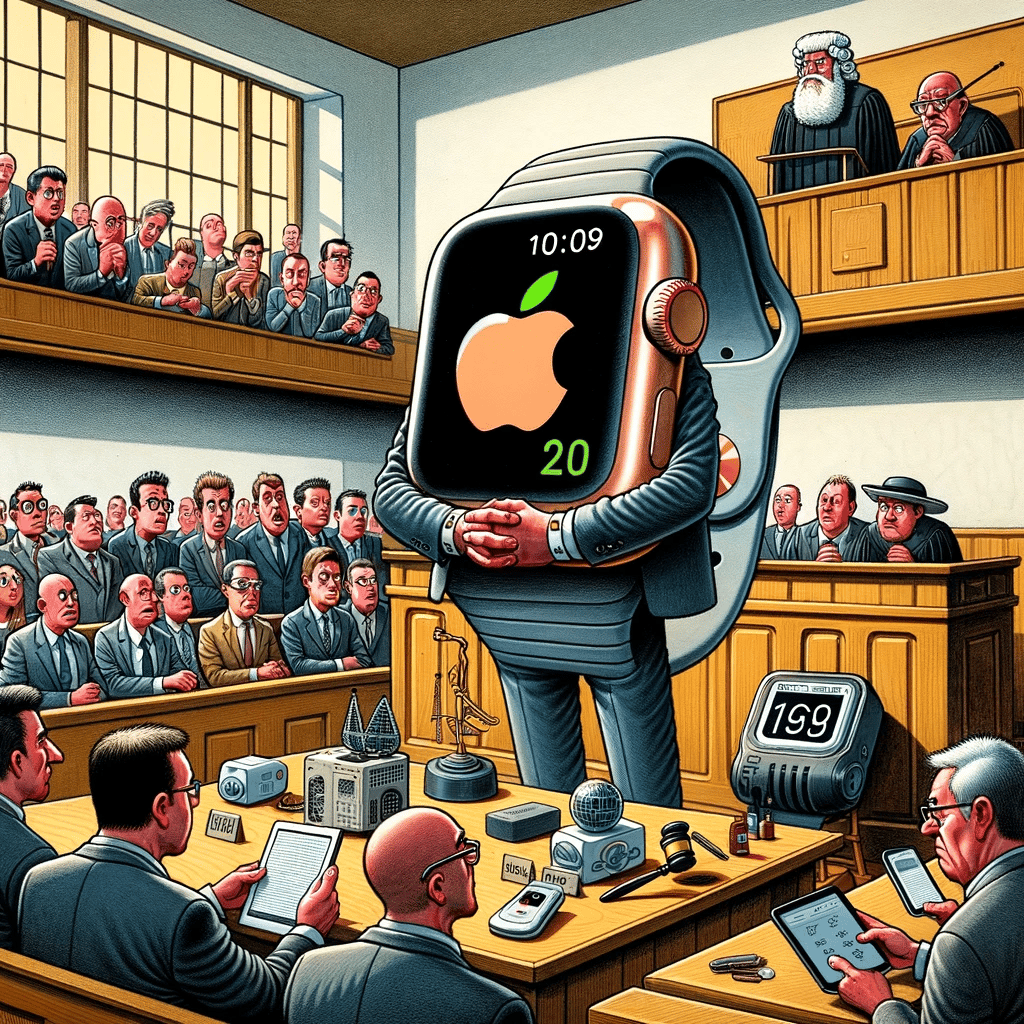

Apple Halts Watch Sales Amidst Patent Dispute

WHAT HAPPENED:

Apple Watch Sales Halt: Apple suspends sales of Apple Watch Series 9 and Ultra 2 in the US, starting December 21 online, and post-December 24 in stores, due to a patent dispute with Masimo over the SpO2 sensor.

Health Monitoring: SpO2 sensors measure blood oxygen saturation, crucial for monitoring respiratory and cardiovascular health.

WHY IT MATTERS: Investor's Perspective

Recent AAPL Stock Data:

As of Dec 18, AAPL closed at $195.65, with recent fluctuations observed between $192.32 (Dec 6) and $198.11 (Dec 14).

Apple Watch's Market Significance:

Q1 2023: Despite a 5% decline in overall revenue, Apple reported a record number of first-time buyers for the Apple Watch in Q1 2023. However, sales in the Wearables, Home, and Accessories category, which includes the Apple Watch, were down 8% year-on-year.

Q4 2023: Apple's overall revenue was $89.5 billion, beating expectations. The quarter included initial sales for the Apple Watch Series 9 and Ultra 2. Revenue for wearables was $9.3 billion.

Global Market Impact: In 2022, Apple Watch accounted for 34.1% of all smartwatch shipments and 60% of the market's revenue globally. Apple's shipments increased by 17% compared to 2021, accounting for about 60% of the global smartwatch market revenue.

Impact of Sales Halt:

Revenue Risk: The halt, especially during the holiday season, could significantly impact Apple's revenue from its Wearables segment.

Stock Response: Investors should closely monitor AAPL stock for potential volatility in response to this news.

Competitive Dynamics: The temporary absence of these popular models may provide an opportunity for competitors to capture market share.

Long-Term Implications: How Apple navigates this legal challenge could influence its strategy for future product development and intellectual property management.

Poll of the Day

Of the following assets, which is your favorite investment over the next 12 months?

The MSFT votes are piling in. Is this voting process secure?

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 35% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 30+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.