TheBRRR’s Thoughts

GM.

Markets are digesting Tuesday’s earnings reports from Microsoft, AMD and Google this morning. They’re dealing with some indigestion overall but Microsoft is proving resilient.

Microsoft beat expectations on both revenue and EPS and the stock is inching higher.

AMD missed across the board and fell 6%.

Google actually beat expectations, but missed on ad revenue specifically, and is down 5%.

The Nasdaq has shed about 1% since Tuesday’s close, but remains up 5% since the new year began.

Today we’ll hear from Fed Chief Jerome Powell. It’s widely expected the committee will leave interest rates unchanged, so market reaction will hinge on his language and tone.

The odds the Fed cuts rates at the Fed’s next meeting in March sits at 45%, but odds of a cut by the end of their May 1st meeting jump to 88%.

Where to you stand? Vote in the poll below.

When Will The Federal Reserve / FOMC Cut Interest Rates?

Previewing Today’s FOMC Meeting

WHAT HAPPENED:

The upcoming FOMC decision is anticipated to maintain the current interest rates at 5.25-5.50%.

A key focus is the expected shift in the Fed's statement, signaling an end to tightening bias and a lean towards future rate cuts.

No new Economic Projections ("Dot Plot") at this meeting; the market eyes Powell's guidance for future paths.

March meeting's outcome remains uncertain, with the Fed balancing declining inflation and a robust economy.

Rate cut expectations: Majority of economists and money markets foresee rate cuts starting Q2, potentially in May or June.

RATE EXPECTATIONS:

All 123 economists in a Reuters survey predict no rate change in the upcoming meeting.

2024 projections include a possibility of rate cuts totaling up to 100bps, as per most economists.

Market pricing reflects expectations of several rate cuts this year.

STATEMENT:

Possible dovish tweaks in the Fed's statement are anticipated, following December's adjustments.

Analysts suggest the statement may no longer indicate a likelihood of rate increases.

VOTER ROTATION:

A slight shift to a more hawkish voter composition in the FOMC, with new members rotating in.

However, the overall influence of this change is seen as limited.

POWELL'S STANCE:

Fed Chair Powell is expected to acknowledge potential rate cuts but avoid specifics, focusing on data dependency.

Powell might emphasize a gradual approach to policy easing and touch on balance sheet tapering discussions.

INFLATION & GROWTH INSIGHTS:

Core inflation (PCE) is at its lowest since early 2021, prompting discussions on rate cuts.

Debate revolves around the dichotomy of declining goods inflation and persistent services inflation.

Real GDP growth exceeds expectations, complicating the potential for aggressive rate cuts.

BALANCE SHEET CONSIDERATIONS:

No immediate decision expected on balance sheet runoff pace.

Discussions might revolve around slowing down the runoff process for an extended period.

WHY IT MATTERS:

The Fed's upcoming decisions and statements are crucial indicators of future monetary policy direction.

Balancing inflation control with economic growth and market stability is key.

Investors, economists, and policymakers closely monitor these developments for insights into the economic outlook.

Microsoft Strong Earnings

WHAT HAPPENED:

Significant Profit Growth: Microsoft reported a 33% increase in net income to $21.9 billion in the fiscal second quarter, marking its strongest quarterly expansion since September 2021.

Revenue Surge: The company recorded $62 billion in revenue, surpassing analysts' estimates and showing an 18% year-over-year increase.

Market Capitalization Milestone: Microsoft recently surpassed a $3 trillion market cap, fueled by AI-driven product enthusiasm.

KEY DRIVERS:

AI-Driven Cloud Services: Microsoft’s Azure cloud business grew by 30%, beating estimates of 27%. AI demand contributed 6 percentage points to Azure's growth, doubling from the previous quarter.

Activision Blizzard Acquisition: The recent acquisition of Activision Blizzard boosted Microsoft’s revenue by 4 percentage points.

COMPETITIVE LANDSCAPE:

Google Rivalry: Microsoft and Google are competing closely in the generative AI space. Google's AI contributions to its cloud division are growing, although specific financial details weren't disclosed.

AI Products and Investments: Microsoft's focus on AI-driven tools like Copilot, using technology akin to ChatGPT, is central to its strategy. This includes applying AI to Microsoft 365 apps like Word, Excel, and Teams.

ANALYSTS' VIEW:

Optimism for Copilot: Analysts expect businesses to adopt Copilot, which can perform tasks like summarizing transcripts and generating emails. This AI-powered upgrade is seen as a potential new revenue stream.

Technological Edge: Microsoft's AI products are regarded as more advanced than competitors’, offering tangible proof points beyond marketing claims.

CORPORATE STRATEGIES:

Cost Management: Following a period of significant layoffs, Microsoft continues to streamline operations, including reducing its gaming staff post-Activision acquisition.

Sales Forecast: For the current fiscal quarter, Microsoft anticipates sales between $60 billion and $61 billion, aligning with analysts' expectations.

CHALLENGES:

Mixed Success in AI: While Microsoft's AI-driven cloud services have been successful, its first AI-powered chatbot for Bing did not significantly challenge Google's search dominance.

Regulatory Scrutiny: Microsoft's investment in OpenAI, leading to a 49% stake in its profits, is under regulatory examination in the U.S. and U.K.

BRRR’s TAKE:

Microsoft's latest earnings reflect the significant impact of AI on its cloud business, with strong revenue and profit growth. The company's strategic focus on AI-driven products, despite some challenges, positions it strongly in the competitive tech landscape. We’re long.

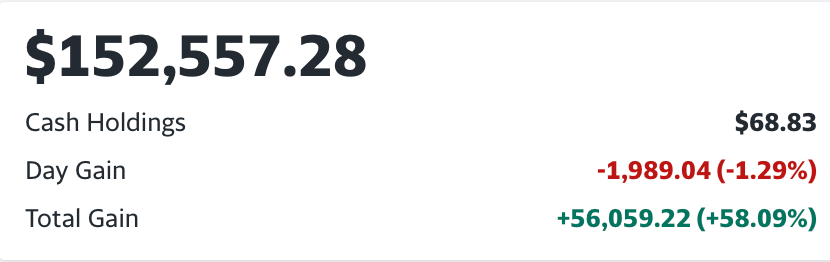

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 70+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll