US PPI and CPI - we’ve peaked

GM and BRRR.

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

Happy Friday. Today we’ve decided to zoom out and focus on some longer-term inflation charts and trends surfaced by macro investor, tech and crypto bull Raoul Pal.

Raoul concludes that much of the data the Fed uses to make interest rate decisions is lagged and backward-looking, and that there is mounting evidence that uncontrolled inflation is in the rearview window.

If that’s the case, we’ll continue to see CPI and PPI data surprise to the down side in the coming months, and the Fed will be able to gradually ease financial conditions without fear of inflation spiking back up again.

Here’s what we brrr’d today:

Deflating Delights: From China to Brazil, Countries Embrace the Deflation Trend

AI or Die Trying: Investors FOMO Over the Next Big Revolution

Deflating Delights: From China to Brazil, Countries Embrace the Deflation Trend

Global Deflationary Trend: Inflation surprises globally have turned negative, with declining inflationary pressures and falling prices observed in various countries, including China, Brazil, Norway, and Spain (see chart at top of email and the China PPI chart below)

Symmetrical Inflation Cycles: Extreme inflation cycles, characterized by sharp rises and falls, are highlighted by the base effect. The elevator-up trend is now transitioning to an elevator-down pattern, emphasizing the symmetrical nature of inflation cycles.

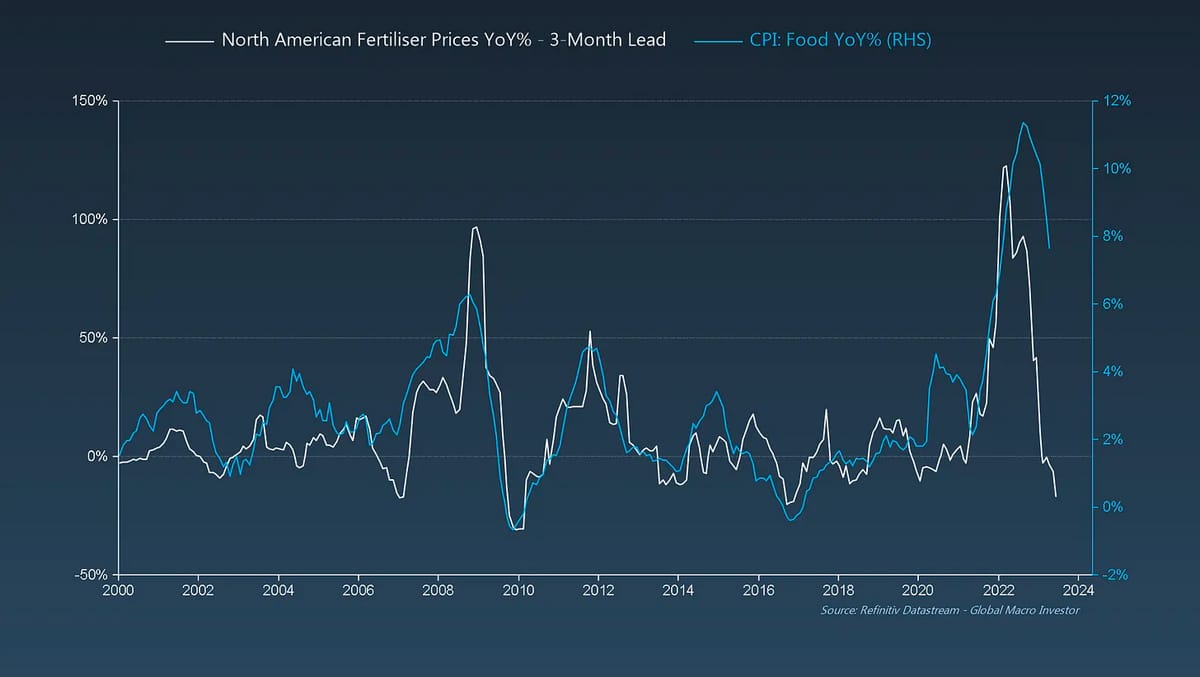

Lagging Inflation Factors: Factors such as housing prices, food prices, and wages, previously considered "sticky" inflation areas, are projected to decline. CPI: Shelter, which lags house prices by eighteen months, will soon peak and work lower into 2025 (see chart below).

Negative Inflation Surprise Cycle The normalization of supply chains has triggered a negative inflation surprise cycle globally. Inflation surprises have turned negative for the first time since November 2020, indicating a downward trajectory.

Fertilizer prices drop first - then food

China PPI already deflationary

AI or Die Trying: Investors FOMO Over the Next Big Revolution

FOMO Market Surge: The relative cost of upside equity protection outpaces tail-risk insurance as traders chase market gains. FOMO-driven trading pushes the market higher, fueled by a narrow band of mega-cap tech stocks. The S&P climbs while the Nasdaq races ahead.

Price is Key: In a year marked by easy arguments for a lower equity market, price remains the ultimate driver. Paying attention to price-based measures devoid of bias or transient trends is crucial. The Coppock Signal, a reliable long-term bottom indicator, triggered in March, signaling positive prospects for equities.

AI and FOMO: A new AI revolution provides a powerful tailwind, triggering FOMO-driven behavior as investors fear missing out on a potential new bull market. The demand for chasing the market higher intensifies, creating an emotive force that can lead to speculative behavior.

Skewed Options Market: Put skew reaches 18-month highs, indicating higher costs for hedging tail-risk in the S&P. However, call skew rises even more, reflecting increased demand for chasing the market higher. Breaching the significant resistance level of 4,200 could unleash further market follow-through.

Medium-Term Positive Trend: While the market maintains a positive medium-term trend, caution is advised. Volatility spikes, low VIX levels compared to cross-asset and realized volatility, and the dominance of zero-day options trading contribute to market instability. Being long in the market may not be relaxing, but potholes can be navigated with careful consideration.

AI ART OF THE DAY

The BRRR’s Portfolio

NVDA and MSFT continue their surge as investors pile into perceived AI winners

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.