GM and BRRR.

Global tensions have negatively affected chip stocks, leading to investor nervousness and underperformance of the Nasdaq compared to the S&P 500 and Dow. The energy sector is the strongest while technology is the weakest among the S&P 500's 11 major sectors.

Traders give a 92% chance of a quarter rate hike, and investors are concerned about a potential standoff over the U.S. debt ceiling. Bed Bath & Beyond's bankruptcy has caused shares to fall 34%.

Meanwhile, a recent poll of 83 central banks found that over two-thirds thought their peers would increase their gold holdings in 2023, citing geopolitical risks. Gold is seen as an effective hedge against high inflation and becomes attractive due to instability in the world, causing many non-aligned central banks to reconsider where to hold international reserves.

Here’s what we brrr’d today:

Nasdaq plays second fiddle to S&P 500 and Dow, blames high-profile megacaps for lackluster performance

Central Banks Choose Gold Over Bitcoin: "It's Just More Real," They Say

Prediction Contest #5

Make sure to get your prediction in before Tuesday’s announcement!

Microsoft reports earnings on Tuesday, April 25. How will they do?

Chip Stocks Flounder as Global Tensions Rise, Leaving Investors Nervous

Nasdaq underperforms S&P 500 and Dow: High-profile megacaps weigh down the market, Tesla shares fall on spending concerns

Microsoft and Tesla among biggest drags on S&P 500: Investors worry about whether rally in tech stocks can continue amid gloomy economic outlook. Energy sector strongest, technology weakest among S&P 500's 11 major sectors

77% of S&P 500 companies beat Q1 estimates: Refinitiv IBES data shows 90 companies have reported Q1 results so far, with earnings forecasts improving marginally

Traders give 92% chance quarter-rate hike: Mixed economic data released last week cement bets of a 25-basis-point rate hike by the Federal Reserve in May. Investors concerned about potential standoff over U.S. debt ceiling.

Bed Bath & Beyond bankruptcy: Now in the penny stock department, shares fall 34%.

Regional banks down: Ahead of quarterly report, Regional bank's shares have sunk 88% this year, triggered by the U.S. banking crisis.

Gold is the New Black: Central Bankers Embrace Shiny Metal

Central Banks Increasing Gold Holdings: A recent annual poll of 83 central banks, which manage a combined $7tn in foreign exchange assets, found that over two-thirds of respondents thought their peers would increase their gold holdings in 2023. Bullion tends to become more attractive in times of instability, and demand has soared over the past year.

Geopolitical Risk a Top Concern: The HSBC Reserve Management Trends Survey found that most reserve managers surveyed rated geopolitical risk as one of their most important concerns. More than 40% of respondents listed it as one of their top risk factors, compared with 23% in last year’s poll. Around a third of those polled had changed, or were planning, the assets they purchase owing to tensions such as Russia’s invasion of Ukraine and worsening US-China relations.

Gold Effective Hedge Against Inflation: Gold was also seen as an effective hedge against high inflation — the number one concern of more than 70% of those polled. The price of bullion is now close to an all-time nominal high, following the surge in inflation over the course of 2022.

Non-Aligned Central Banks Buying: World Gold Council figures show many purchases made over the past year have been by central banks in countries that are not aligned with the west. John Reade, chief market strategist at the World Gold Council, said the sanctions against Russia’s central bank had “caused many non-aligned central banks to reconsider where they should hold their international reserves”.

Renminbi On the Rise: The majority of those polled said the renminbi would become a larger share of international reserves over the rest of this decade. European Central Bank president Christine Lagarde warned in a speech last week that rifts between the US and China threatened the leading positions of the dollar and euro in global reserve management.

AI ART OF THE DAY

Janet Yellen prays people stop buying gold

TWEET OF THE DAY

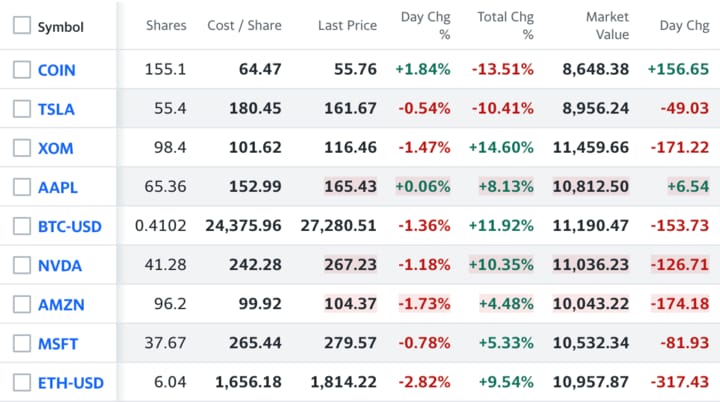

The BRRR’s Portfolio

HODL' on

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.