TheBRRR’s GM

Are stocks outrageously overextended? Are loads of regional banks and commercial real estate lenders secretly insolvent? Will inflation perk back up? Will oil prices surge as geopolitical tensions rise? Will the bond market destruction continue?

These provocative questions unfortunately all have merit as 2023 comes to a close over the next 10 weeks and we’re here to walk you through it all.

While we do expect volatility across asset classes to close the year, we feel strongly positioned.

Today we’re coving Tesla’s earnings bust & Cybertruck delivery estimates, bitcoin’s rise amidst ETF momentum, and Jay Powell’s linguistic high-wire act during an Economic Club of New York speech and interview.

Elon previously slept on the factory floor, will he do it again? He did go on a rant during the earnings call against remote work.

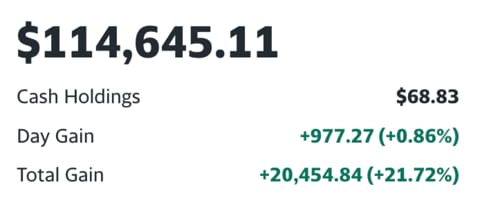

No changes to the portfolio, but it's holding up quite well overall, still up 22% since inception in late March.

Market News

Earnings Pothole: Cybertruck's Toll

Tesla's CEO Elon Musk highlighted significant hurdles in the production scale-up of its much-anticipated Cybertruck, affecting the company's profitability and contributing to a dip in third-quarter results.

The challenges stem from production complexities, aggressive pricing strategies to boost demand, and a harsh economic climate, casting doubt on the company's near-term financial health.

Despite these setbacks, Tesla reaffirms its ambitious delivery target for the year, although Musk acknowledged rapid growth is unsustainable in the long run.

Steep Profit Decline: Tesla's net income plummeted by 44% in the third quarter, a more pronounced decrease than anticipated by Wall Street, largely due to ongoing price reductions across its vehicle range. The average selling price dropped from $54,000 in Q3 2022 to around $44,000 in the same period in 2023, impacting the company's traditionally robust operating margin, which tumbled from 17.2% to 7.6%.

1M+ Reservations Amid Delays: Over a million reservations have been made for the Cybertruck, with plans for an annual production target of 250,000 units by 2025. However, Musk foresees a 12-18 month timeline before the Cybertruck significantly contributes to positive cash flow, mainly due to the vehicle's complex design and associated cost overruns.

EV Market Slows; Strategy Pivots: Tesla is betting on software, particularly autonomous driving technology, as a future profit generator. This amidst concerns over Tesla's capacity to maintain its historical growth trajectory, with Musk himself casting doubt on sustaining a 50% compound annual growth rate.

$100 Reader Giveaway

The AI Tool Report highlights fantastic AI tools. We’re giving away $100 to a reader that subscribes to the AI Tool Report and tells us about their favorite AI Tool they learn about as a subscriber.

To participate, subscribe below and email us about the best thing you’ve learned from them by November 15th. 👇

Learn About AI

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Crypto Climbs on ETF Whispers

Bitcoin's price has been on a surge, briefly reaching $30,000 on two occasions within a week.

The main driver for this rise is the growing optimism surrounding the approval of a spot Bitcoin ETF in the U.S. This speculation has been fueled by recent positive remarks from major institutions and notable individuals in the finance sector.

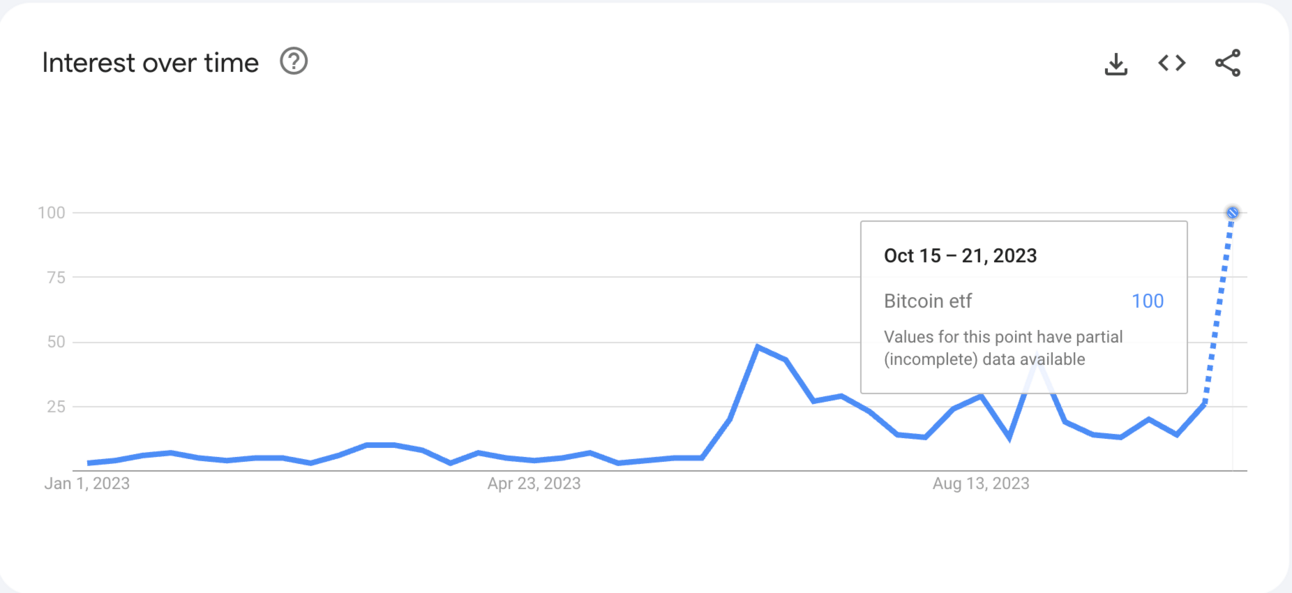

At the same time, the appeal of Bitcoin and other cryptocurrencies as safe havens amid global tensions and uncertainties has also been a contributing factor. Ether and several altcoins are experiencing similar uptrends, with heightened interest from retail investors evident in Google search trends.

ETF Approval Optimism: Speculation around the approval of the first spot Bitcoin ETF in the U.S. has been a significant factor pushing BTC prices higher. Influential firms and personalities, including JPMorgan and Mike Novogratz, have expressed confidence in a likely approval in the near future.

Flight to Crypto Safety: Bitcoin, often dubbed "digital gold", has been benefitting from its perception as a safe asset. Global tensions, especially in the Middle East, coupled with concerns regarding the U.S. banking system, have spurred interest in Bitcoin and gold. Prominent investors like Larry Fink and Paul Tudor Jones publicly endorsing this sentiment further bolsters this trend.

Growing Retail Interest: Data from Google Trends indicates an increasing retail curiosity about Bitcoin, especially the potential spot ETF. Searches for "spot bitcoin ETF" are reaching peak values, signaling heightened interest. The belief is that a spot ETF could significantly boost Bitcoin's liquidity and further its mainstream adoption.

Macro News

Powell Plots Delicate Dance

In a speech on Thursday, Federal Reserve Chair Jerome Powell discussed the state of the U.S. economy and the potential need for further interest rate hikes. He said the economy's continued strength and tight labor markets may require tougher borrowing conditions to control inflation.

However, rising market interest rates could reduce the need for action by the Fed itself. Powell walked a careful line, leaving open the possibility of more hikes but emphasizing emerging risks and the need to proceed carefully.

Walking the Tightrope: Powell threaded the needle between hawkish and dovish positions. He validated inflation concerns but also gave credence to recession worries. His remarks maintained flexibility as data unfolds.

The Art of Communication: Powell's speech highlighted the art of central bank messaging. He affirmed the Fed's resolve on inflation while introducing notes of prudent caution. Finessed communication provides latitude to respond to changing conditions.

Tuning a Complex Symphony: The Fed must orchestrate numerous uncertainties. Powell conducted a symphony of inflation risks, labor market resilience, the lagged impact of tightening, market dynamics, and risks like geopolitics. Ongoing fine-tuning is imperative.

Today’s Reader Poll

For today’s poll, we want to hear your thoughts on Bitcoin’s price possibilities:

Where will Bitcoin close for the month of October?

Below are results from Wednesday’s poll, where we asked for predictions on Tesla’s finishing stock price for the week; answers showed an even split. Ultimately, it looks like Elon’s earnings call and Cybertruck worries took charge (or depleted them, rather)…

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

-We added Flutter Entertainment ($PDYPY) to our portfolio, after its stabilization over the past few weeks amidst the ever-growing sports betting industry. NFL season is in full-swing, and more competitors seek to enter the arena.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Friday 10/13 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.