TheBRRR’s Thoughts

GM, the hot ball of money that initially entered bitcoin is moving around the crypto ecosystem as traders seek high beta plays.

This phenomenon of bitcoin surging first followed by “alt season” has been observed in each of bitcoin’s major runs of the past.

One of the biggest winners have been Solana, formerly known as SBF’s favorite chain, as it has risen from the ashes post-FTX with a flurry of network activity and a sharp price rise ($21 → $72) since October 15th.

We actually recommended it in a dedicated email announcement on November 28th with Solana at $56 to premium subs.

We’re covering Solana in depth today, along with a story about the collapsing Japanese Yen.

Editor’s Note: We’ve released V1 of our technical analysis chatbot. Premium subscribers can see the link in the premium section at the bottom of the email. I released a preview of what it can do in this post, where I ask it to analyze the daily and hourly bitcoin charts.

Macro News

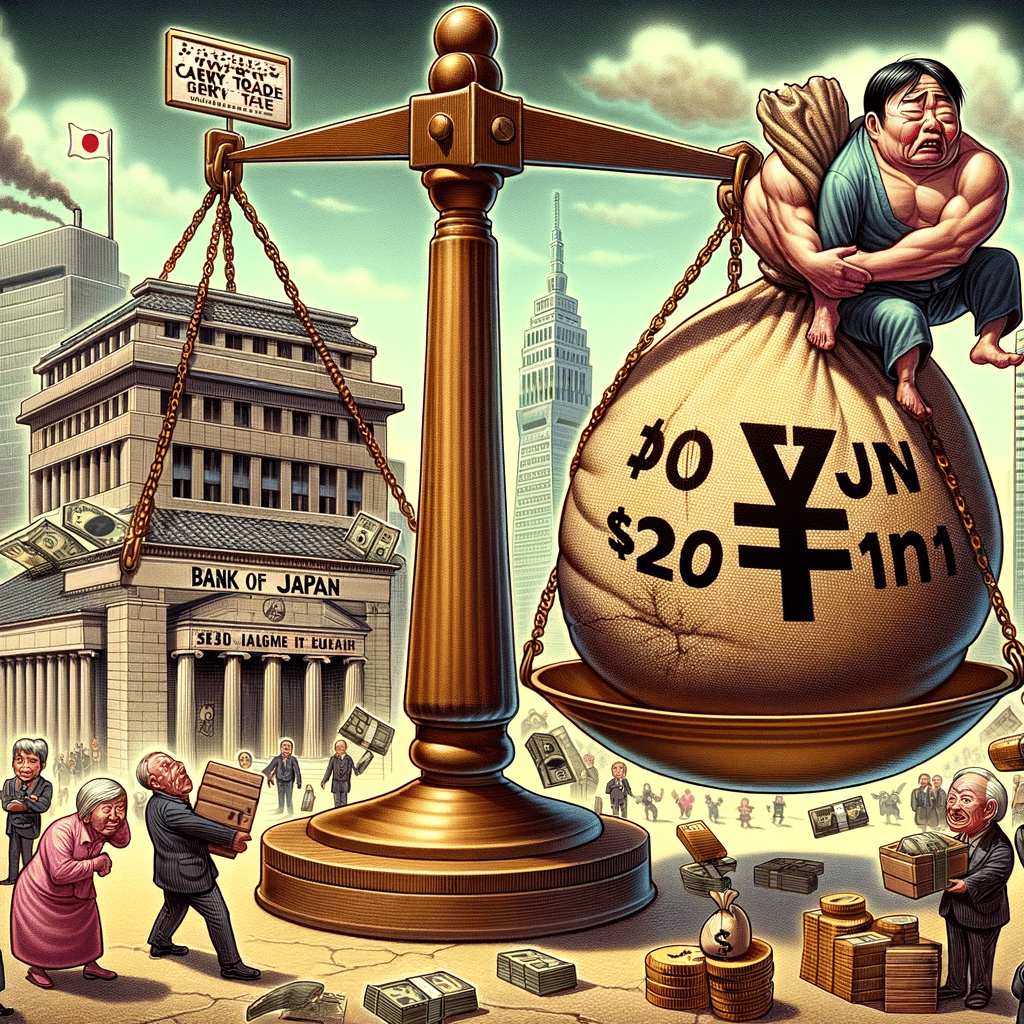

Japan Printing & Dumping Yen

WHAT HAPPENED:

Japan's government is involved in a massive $20 trillion carry trade, essentially funding foreign assets and loans by borrowing yen at low costs.

The debt represents an enormous trade invested abroad at high interest rates, funded by short-term, low-rate borrowing in yen.

There's growing speculation about the Bank of Japan (BOJ) possibly exiting its ultra-loose monetary policy, which is a critical factor in this scenario.

WHY IT MATTERS:

Potential Risks of Tightening Policy: If the BOJ tightens policy, it could trigger significant financial changes. A rate hike means the government would have to start paying higher interest on its massive debt, leading to the unwinding of this carry trade's profitability.

Impact on Government and Households:

The government's balance sheet, savings, and household assets could be significantly impacted.

Older and wealthier households might suffer a fall in their asset values and pension entitlements.

Currency Fluctuations and Global Implications:

The yen, traditionally a favorite for carry trades due to Japan's low interest rates, could appreciate if domestic rates rise.

This could lead to a decrease in the value of both foreign and domestic assets.

If Japan unwinds these trades, it could have ripple effects globally, as investors around the world might also start to unwind hundreds of billions of dollars from similar trades.

Japan's Unique Position:

The government has been able to maintain its debt at over 200% of GDP, partly funded by overnight cash, without the usual repercussions thanks to the BOJ's negative rates policy.

Uncertain Future:

With sustained inflation, the pressure mounts on the BOJ to normalize its monetary policy.

This normalization could end the carry trade, leading to higher interest payments, reduced government bond values, and a decline in asset values in a higher interest rate environment.

In summary, Japan's $20 trillion carry trade is a delicate balance that hinges on the BOJ's monetary policy, with potential widespread effects on the government's financial health and the assets of households, both in Japan and globally.

Crypto News

Solana’s Emerging Ecosystem

Solana's ecosystem has witnessed substantial growth and diversification, driven by several key developments:

Meme Coins - More Than Just Memes:

$BONK: Originally a playful meme coin that airdropped heavily to existing Solana development teams and projects, $BONK has evolved into a more substantial project resonating with both meme enthusiasts and Solana users. The token has surged over 1000% this month and into the top 100 of all crypto assets, sitting wit a $500m market cap.

Significant Airdrops Fueling Growth:

JTO Airdrop: Jito's airdrop of 90 million tokens was initially valued at a staggering $540.9 million, significantly boosting Solana’s ecosystem. Despite a subsequent price drop, the airdrop remains impactful with a market capitalization of around $211 million.

Pyth Network Airdrop: A data oracle competing with Chainlink, the Pyth Network distributed 250 million tokens with an initial value of $77 million, now worth $107 million, further stimulating the ecosystem's growth.

Impressive DEX (Decentralized Exchange) Volume:

Volume Data: Solana's DEX volume hit about $240.5 million, surpassing Polygon's $137.5 million.

Transaction Comparison: Solana recorded 19.5 million daily transactions, significantly higher than Ethereum’s 1.05 million, demonstrating Solana's growing dominance in transaction activity.

WHY IT MATTERS:

These developments are crucial for several reasons:

Diversification and Engagement: The evolution of meme coins like $BONK into more substantial projects, combined with large-scale airdrops, highlights the diversification and increased user engagement in Solana's ecosystem.

Financial Impact: The massive valuation of airdrops, notably the JTO and Pyth Network tokens, injects significant capital and liquidity into the ecosystem, fostering growth and innovation.

Competitive Edge: The substantial DEX volume and higher transaction numbers position Solana as a formidable competitor to Ethereum, suggesting a shift in the DeFi landscape towards greater inclusivity and innovation.

Poll of the Day

Of the following assets, which is your favorite investment over the next 12 months?

Staggering results so far, with BTC and MSFT tied for the lead:

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 13% since.

Trades, Watchlist & Live Portfolio

(paywall only)

(March 15, 2023 inception)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 8% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.