TheBRRR’s Thoughts

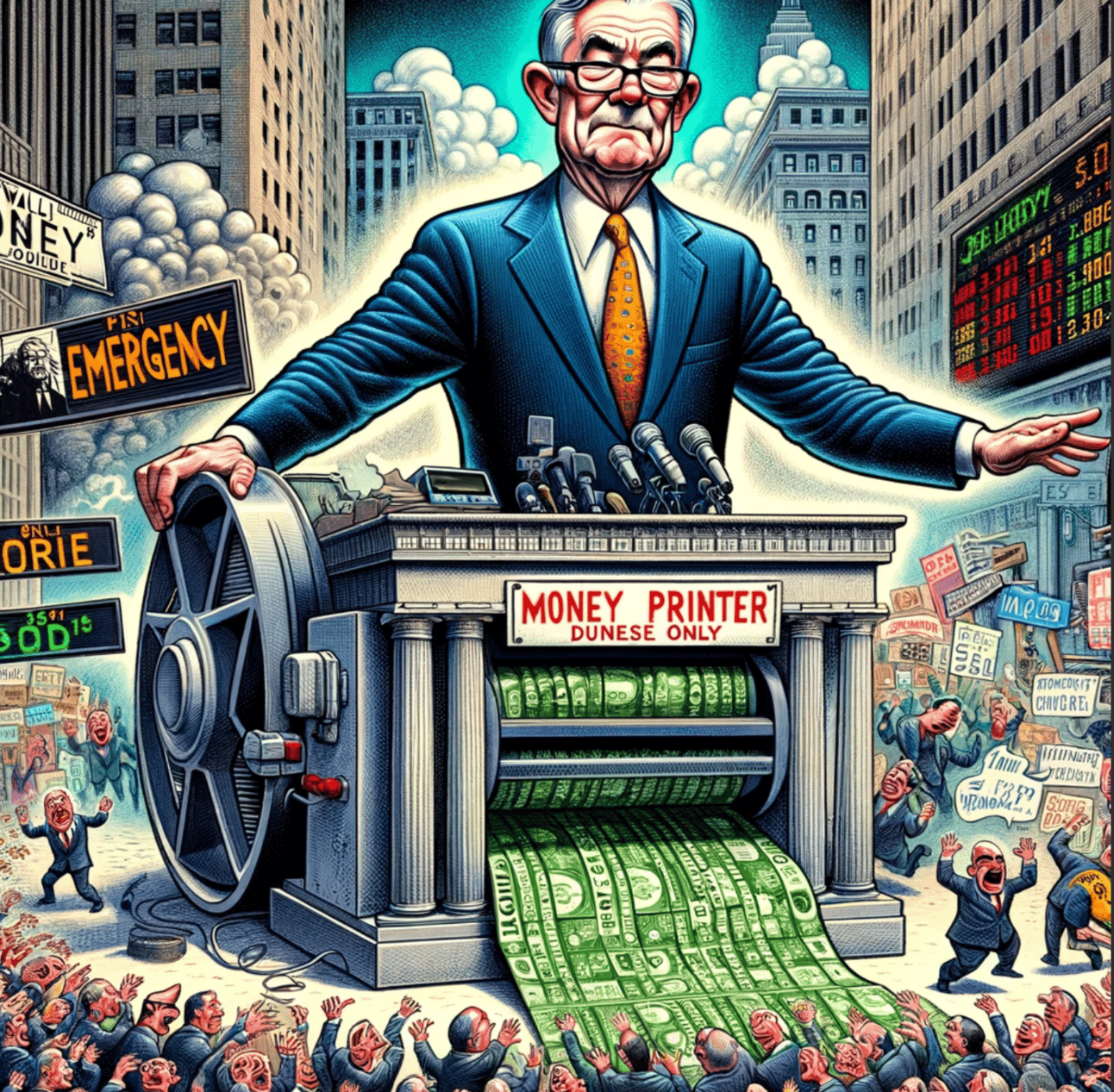

GM. Markets are jittery ahead of Jay Powell’s FOMC press conference later today.

The Fed will announce no change to interest rates, so market reaction will hinge on any notable shifts in sentiment during his speech or the Q&A.

They’ll likely acknowledge that inflation has been stickier than expected and that the job market remains robust, but the recent GDP weakness concerns them.

I still expect a rate cut before the election in November with relatively high certainty (~75%), while the markets are pricing the odds at around 48% according to CME data.

Tech is holding up better than crypto but both are trading down thanks to a strong dollar and mixed tech earnings, while gold and uranium are rallying.

The newsletter’s tech and crypto-heavy portfolio is up over 100% from launch last March despite an 18% correction over the last month.

FOMC Preview: Will Jay Powell’s Statement Tilt Dovish Or Hawkish?

WHAT HAPPENED:

The Federal Reserve's Federal Open Market Committee (FOMC) is expected to maintain the federal funds rate at 5.25-5.50% in today's meeting. This decision aligns with the persistent high inflation data and subdued GDP growth figures, suggesting a cautious approach by the central bank.

Recent FOMC minutes hint at a potential shift towards a less restrictive policy later this year, sparking trader interest in Federal Reserve Chair Jerome Powell's tone during the upcoming press conference. The focus will be on any dovish signals despite a generally hawkish consensus.

Financial markets have adjusted expectations significantly, with projected rate cuts reduced from seven to around one and a half for the remainder of the year, based on the March Personal Consumption Expenditures (PCE) report.

WHY IT MATTERS:

Monetary Policy Adjustments: There's a looming anticipation around adjustments in the Fed's balance sheet runoff. Most FOMC participants support reducing the Treasury runoff cap from $60 billion to $30 billion monthly, while maintaining the current pace for mortgage-backed securities (MBS).

Economic Projections: Despite a disappointing Q1 GDP growth of 1.6%, Morgan Stanley notes robust job gains and stable inflation metrics, influencing its forecast of three rate cuts in 2024. However, there's a consensus that inflation's recent progress has stalled, potentially delaying rate cuts until later in the year.

Market Implications: Financial markets and traders will closely watch Powell's press conference for any changes in tone or policy direction, which could significantly impact market sentiment and positioning.

Press Conference and Market Strategy:

Powell's Stance: Expected to emphasize a "higher for longer" policy stance in light of recent inflation data, suggesting that rates will remain elevated until there is more definitive progress towards the inflation target.

Trading Strategies: According to Goldman Sachs, considering the macroeconomic backdrop and Powell's recent remarks, markets should brace for a possible continuation of restrictive monetary policies. Hedging strategies might include long positions in US Megacap tech stocks, which are perceived as robust under a hawkish policy scenario due to strong balance sheets and high profitability.

Big Tech Q1 Earnings Were Strong, Reactions Were Mixed

WHAT HAPPENED:

Tech Earnings Overview: Last week, the first-quarter earnings season saw significant contributions from major tech firms, collectively dampening the potential for a second-quarter market sell-off. Notable companies that reported include:

Tesla underperformed on both earnings and revenue expectations. However, its stock rose nearly 20% following news of an upcoming affordable electric vehicle set for 2025.

Meta Platforms exceeded earnings projections but offered weak future revenue guidance and highlighted substantial spending on AI and mixed realities, which led to a decline in its stock.

Alphabet delivered a strong earnings report with a 15% increase in EPS, driven by robust YouTube ad revenue and Google Cloud performance, leading to the announcement of its first-ever dividend and $70 billion in share repurchases.

Microsoft reported better-than-expected results, particularly in its cloud segment, though it provided slightly softer revenue guidance for the upcoming quarter.

Amazon also topped expectations with significant contributions from its advertising and cloud computing sectors, showcasing a strategic emphasis on cost-efficiency and operational improvements.

AMD reported a slight beat on earnings expectations with its AI chip sales standing out, yet the company's in-line forecast led to a drop in its stock price.

WHY IT MATTERS:

Market Influence: The combined influence of these Big Tech companies significantly impacts global market sentiments and trends, particularly as their earnings reports can trigger widespread reactions across financial markets.

Investor Sentiment and Strategy:

The earnings results reflect a complex landscape where cost-cutting has played a critical role in surpassing profit expectations, rather than revenue growth. This trend raises concerns about the sustainability of profit margins if cost-cutting potentials are exhausted.

The mixed reactions to earnings reports highlight the varying investor confidence in tech companies' growth trajectories and their ability to manage expenses and innovate amidst economic uncertainties.

Shifts in earnings announcement dates, particularly those later than usual, could signal underlying issues that might affect investor strategies and market perceptions.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Notes

Wednesday April 17 2024: We bought more Solana and added Solana’s top memecoin WIF on the heels of a leverage wipeout dip after the WW3 scare.

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll