TheBRRR’s Thoughts

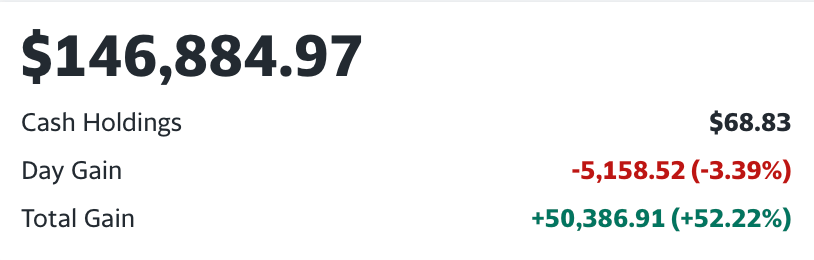

GM! We took a breather for the holidays but are energized for the new year. The newsletter’s portfolio had a banner year (+55% since March inception) and we’re locked in for continued growth and intelligent risk management.

Bitcoin takes center stage over the next week with ETF approval deadlines converging between Monday, January 8th and Wednesday January 10th and volatility is expected.

Despite the markets broadly expecting SEC approval, it’s an event that could see 5-10% moves in the matter of minutes as leveraged traders on both sides are wiped out.

Crypto markets are jittery today, catalyzed by a report from a no-name analyst predicting the SEC will reject the ETFs. The story cratered bitcoin from $45k to $40.5k before recovering to $43k.

The report suggests the ETFs do not meet “critical requirements”, but does not specify what the requirements are. Instead he cites that SEC Chair Gensler doesn’t like crypto and thinks it needs more oversight.

Here’s a link to the report if you’d like to read it yourself.

Macro News

December Jobs Data: More Ammo For Rate Cuts

WHAT HAPPENED:

Job Openings Dropped: November data from the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) shows job openings fell to 8.79 million. This is slightly below the Dow Jones estimate (8.8 million) and marks the lowest since March 2021.

Worker Demand Declines: The demand for workers is at its lowest in over two and a half years. Openings decreased by 62,000; however, the vacancy rate remained steady at 5.3%.

Changes in Hiring and Layoffs: Hiring dropped by 363,000, reducing the rate to 3.5%. Layoffs also fell by 116,000, but the layoff rate stayed at 1%.

Job Opening to Worker Ratio: The ratio of job openings to available workers decreased to 1.4 to 1, down from the 2 to 1 level prevalent in 2022.

WHY IT MATTERS:

Federal Reserve’s Response: The Fed monitors JOLTS data for signs of labor market slack. This easing in the labor market, after the tight situation post-Covid, might influence their decision on interest rates. The Fed hinted at a potential gradual reduction in rates if inflation continues to decline.

Economic Indicators: The ISM Manufacturing report for December indicated a slight improvement but still showed contraction (47.4 reading). The employment sub-index, however, increased, suggesting mixed signals about the economic outlook.

Inflation and Policy Implications: The JOLTS report indicating a cooling demand for labor could be seen as a sign of a slowing economy, which typically prompts central banks to consider lowering interest rates to stimulate economic activity.

Tech News

Tesla Beats 2023 Delivery Estimates, Stock Muted

WHAT HAPPENED:

Tesla's Record Deliveries: Tesla (TSLA) reported delivering 484,507 vehicles in Q4 and 1.81 million in 2023, surpassing its target of 1.8 million.

Wall Street's Muted Reaction: Despite exceeding delivery expectations, Wall Street analysts have maintained their price targets and ratings on TSLA, reflecting a cautious outlook.

Analysts' Focus: Analysts are more concerned with Q4 auto gross margins, vehicle pricing, and Tesla's performance in the face of EV demand concerns in 2024.

Margin Concerns: Bernstein analyst Toni Sacconaghi highlighted potential margin declines due to price cuts and discounting, forecasting lower margins and volumes for Tesla in 2024.

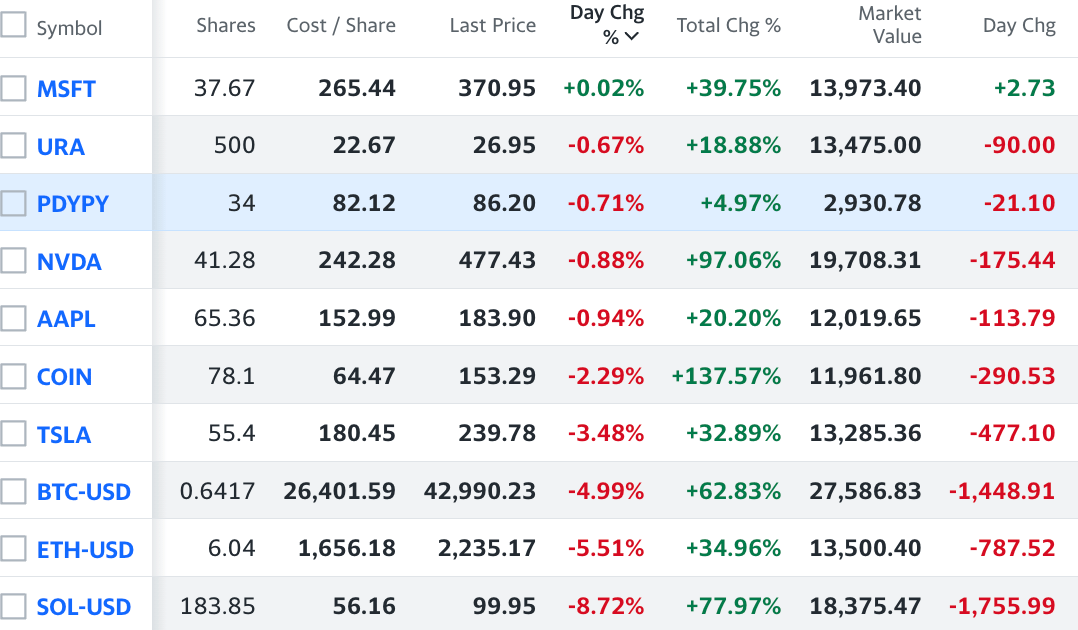

Tesla's Stock Movement: TSLA stock declined, falling 3.5% to 239.75, moving below the 21-day moving average.

WHY IT MATTERS:

Competition and Market Dynamics: While Tesla hit record numbers, it faces increasing competition, notably from China's BYD, which surpassed Tesla in battery electric vehicle sales in Q4. In the U.S., Rivian also reported strong production and delivery numbers.

Tesla's Business Strategy: Tesla's aggressive pricing and discounting strategies in 2023, to maintain sales momentum, have impacted its auto gross margins, which have significantly decreased from their peak in Q4 2021.

Elon Musk's Vision: Despite Tesla's automotive success, CEO Elon Musk emphasizes that Tesla is more an AI/robotics company, which might influence future business strategies and investor perspectives.

Poll of the Day

Of the following assets, which is your favorite investment over the next 12 months?

The MSFT votes are piling in. Is this voting process secure?

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 35% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 30+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.