TheBRRR’s Thoughts

GM, will the Nasdaq finish its 19th consecutive money green? It’s down less than 1% so far, but there’s plenty of time for buybacks and short covering to drive us higher.

Scanning the news this morning we were drawn to a wild piece in the Wall Street Journal that details degeneracy at the Federal Deposit Insurance Corporation (FDIC).

Known exclusively for backstopping all US bank accounts up to $250,000, the “corporation” employs 5,500 people to collect insurance premiums from banks while monitoring compliance.

In the 1980s, the agency constructed its own 350-room hotel to host visiting employees and new hires for training exercises and events. The hotel, equipped with a rooftop patio and outdoor pool has earned a reputation for debauchery and scandal over time.

It’s a wildly entertaining writeup, but I find myself asking why the WSJ is exposing the FDIC in this manner?

Is it simply good journalism, or is it a well-timed hit-piece constructed to point the finger at an agency gone-rogue amidst a banking industry on the brink of failure?

Regional bank stocks have been widely dumped and devalued, as the flagship ETF index with ticker KRE down 30% YTD. Losses have even accelerated since the Federal Reserve bailed out the sector in March.

Macro News

FDIC Debauchery: Who Watches the Watchmen?

What's New:

Toxic Work Culture at FDIC: A Wall Street Journal investigation reveals a longstanding toxic environment within the Federal Deposit Insurance Corp., characterized by sexual harassment, sexism, and a heavy drinking culture.

FDIC Training Hotel Issues: The FDIC’s training hotel in Arlington, Virginia, is notorious as a party hub, leading to disruptive and inappropriate behavior like vomiting in elevators and urinating off the roof.

Ineffective Disciplinary Actions: Instead of firing, the FDIC often chooses to transfer offenders, an approach that fails to adequately address the underlying issues.

Why It Matters:

Exposé Reveals More Than Misconduct: The Wall Street Journal's exposé on the FDIC's toxic culture does more than uncover misconduct; it shifts focus from general banking sector problems to individual agency scandals.

Redirecting Focus to Individual Scandals: This investigative piece subtly moves attention from the broader challenges in the banking sector to the FDIC's internal issues.

Undermining FDIC Credibility: By highlighting these issues, the report not only diverts attention from complex financial industry challenges but also potentially damages the FDIC's credibility, possibly shifting blame for wider financial sector problems in the future.

Crypto News

Crypto Market: Bull Run Reloaded

What's New:

Pivotal Moment for Bitcoin: Bitcoin's price is near a critical level of $37,000, driven by high market optimism and expectations for an ETF approval in the U.S.

Speculators and High Funding Rates: There are elevated funding rates in the market, as speculators use leverage to bet on further price increases, paying a premium for exposure.

Rising Institutional Interest: The Grayscale Bitcoin Trust is demonstrating strong performance, and the CME’s Bitcoin Futures Exchange has experienced a surge in volume, indicating greater institutional interest in Bitcoin.

Why It Matters:

Signs of an Over-Leveraged Market: Bitcoin's funding rates are the highest since November 2021, suggesting the market may be over-leveraged and potentially leading to a price pullback.

Narrowing GBTC Discount: The surge in institutional interest has driven the Grayscale Bitcoin Trust's discount to net asset value down to 10.35%, the smallest since August 2021. The trust has submitted an application to convert into an ETF, with imminent approval expected.

Today’s Reader Poll

We want to know about your usage of GPT models in general (if any):

What do you primarily use GPT models for?

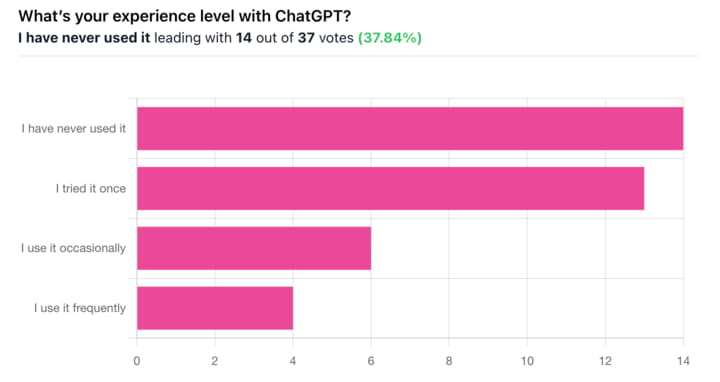

Friday’s poll gleaned out experience-level using ChatGPT (we chose it specifically given its longest market presence):

Subscriber “edward” mentioned his use case(s), which we have previously read became the norm during GPT’s first few months of rollout:

“I use it almost daily in my job - mainly for generating python code, fixing existing code or asking it questions that I would normally have used Google/Bing for in the past."

Those without experience using these LLMs remind us of the old adage:

“A bad workman blames his tools”

Even playing around/dipping one’s toes into these powerful tools can revolutionize your work approach.

AI Art of the Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

-Continued gains with the crypto exposure, as BTC and COIN making YTD highs

-Flutter is under pressure this morning after issuing disappointing guidance, but insists it’s still #1 in the US by marketshare. We’re unbothered and expect them to impress this fall and winter.

Latest Trades

Friday 10/13/23 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.